![]() Sanjel is not four years old (refer to March 2020 press release below). The company just got a name change from Sanjel to Sanjel in 2016, after being sold to different companies (neither named Sanjel) because of massive debt. Sanjel is 18 years old; it was founded in 1982.

Sanjel is not four years old (refer to March 2020 press release below). The company just got a name change from Sanjel to Sanjel in 2016, after being sold to different companies (neither named Sanjel) because of massive debt. Sanjel is 18 years old; it was founded in 1982.

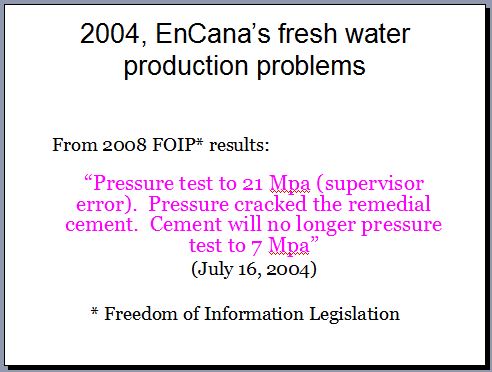

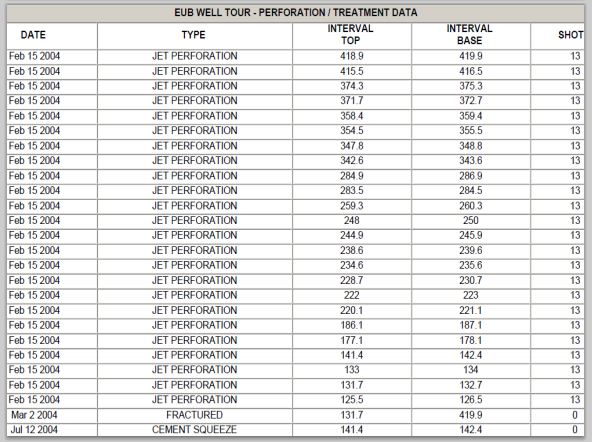

In 2004, Sanjel Corp tried remedial cementing and then cement squeezes on Encana’s gas wells frac’d into Rosebud’s drinking water aquifers.

First Encana illegally intentionally frac’d my community’s drinking water supply, releasing massive amounts of methane and ethane into it and who knows what drilling, cementing, perforating and frac additives. Next Encana frac’d our water again in error with cement and more undisclosed additives, making a bad mess worse.

Throughout Encana’s frac fiasco, the authorities – AER/Alberta Health/Alberta Environment, and companies – Encana/Sanjel/Trican, never warned the community. Encana and our authorities lied and covered it up.

Alberta Environment blamed B & B owner, Debbie Signer (single mom), for contaminating our aquifers and the rest of us water well owners for being dirty.

AER blamed bacteria and violated my charter rights trying to scare me silent (judged me a criminal – in writing – without a trial and without any evidence) and later used McCarthy Red Baiting trying to make me admit to crimes I had not committed.![]()

Slides from Ernst presentations. EUB became ERCB became AER.

Global Well Cementing Services Market with (Covid-19) Impact Analysis: Worldwide Key Industry Segments & Forecast, 2020-2025 by hiren, July 14, 2020, njmmanews

“The Well Cementing Services Market: Global Industry Analysis, Size, Share, Growth, Trends, and Forecasts 2016–2024 report has been added to Zion Market Research ‘s offering. The Well Cementing Services Market report assembles the fundamental summary of the global Well Cementing Services Market industry. The research report represents a comprehensive presumption of the market and encloses imperative future estimations, industry-authenticated figures, and facts of the global market. It predicts inclinations and augmentation statistics with emphasis on abilities & technologies, markets & industries along with the variable market trends. It reveals fact and across-the-board consideration over the global Well Cementing Services Market.

Request Free Sample Report of Well Cementing Services Market Report @ https://www.zionmarketresearch.com/sample/well-cementing-services-market

Our Free Complimentary Sample Report Accommodate a Brief Introduction of the research report, TOC, List of Tables and Figures, Competitive Landscape and Geographic Segmentation, Innovation and Future Developments Based on Research Methodology

Some of the Major Market Players Are:

Schlumberger Ltd., Halliburton, Gulf Energy Llc., Sanjel Corp., Nabors Industries Ltd., Tenaris, China Oilfield Services Ltd., Baker Hughes Inc., Calfrac Well Services Ltd., Condor Energy Services Ltd., Vallourec, Trican Well Service Ltd., and Top-Co.

The global Well Cementing Services Market report highlights growth factors of the main segments and sub-segments including market growth, drivers, projections, and framework of the present conditions of the market. It presents protective and pre-planned management of the market along with embracing classification, definition, chain structure, and applications. The report uses SWOT analysis for research of the global Well Cementing Services Market.

In-depth research of the Well Cementing Services Market is carried out to estimate the market. It engaged the cost, utilization, rate, import, price, gross margin, production, share and supply of the market. The research analysis uses various elements of the Well Cementing Services Market to evaluate the entire growth of the dominating players including their future scope. It demonstrates the positive effects standards raising revenue of the global Well Cementing Services Market. …

Download Free PDF Report Brochure @ https://www.zionmarketresearch.com/requestbrochure/well-cementing-services-market

The countries like America, Japan, China, North America, the Middle East, Africa, and Europe are involved in the global Well Cementing Services Market research report. The report highlights dominating players in the global market along with their highest share, growth, contact details, and sales. It displays the statistics of the global Well Cementing Services Market in the form of graphical representation.

The market report estimates the significant facts and figures for the Well Cementing Services Market. It offers a realistic orientation of the market that works as a useful guide for marketing, sales, analysts, executives, and consultants of the industry. It offers all the functional data in the form of tables making it convenient for the players in the market. The global Well Cementing Services Market research report covers the crucial data regarding the all competitors ruling the global Well Cementing Services Market.

To view TOC of this report is available upon request @ https://www.zionmarketresearch.com/toc/well-cementing-services-market …

The Study Objectives of Well Cementing Services Market Report Are:

- Examine and study the global Well Cementing Services Market sales, value, status (2020) and forecast (2025).

- Focuses on the key Well Cementing Services Market manufacturers, to study the sales, value, market share and development plans in the future.

- Define, describe and forecast the Well Cementing Services Market by type, application, and region.

- Study the global and key regions market potential and advantage, opportunity and challenge, restraints and risks.

- Know significant trends and factors driving or inhibiting the Well Cementing Services Market growth.

- Study the opportunities in the market for stakeholders by identifying the high growth segments.

- Strategically examines each submarket with respect to individual growth trend and their contribution to the Well Cementing Services Market

- Examine competitive developments such as expansions, agreements, new product launches, and acquisitions in the market

- Strategically profile the key players and comprehensively analyses their growth strategies. …

Refer also to:

2020 07 17 From “Sanjel” website: Note the new Sanjel phone number, accessed today, is identical to Sanjel’s number in 2006.

2020 Phone number for Sanjel Energy Services, accessed from their website July 17, 2020:

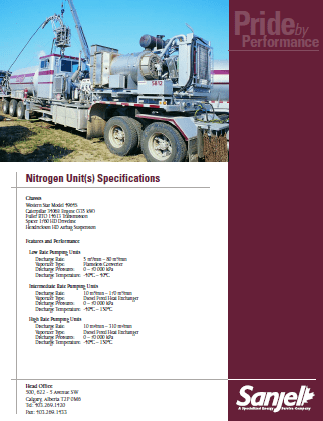

2006 Phone number for Sanjel Corp. on a nitrogen frac ad was the same:

Douglas Freel, Managing Director, ARC Financial Corp

Douglas Freel joined ARC Financial Corp in 1998 and is focused on the oilfield service sector. With $6.0 billion of committed capital, ARC is the largest private equity firm focused exclusively on energy in Canada. Douglas joined ARC with over two decades of oilfield services industry experience in engineering and investment roles, including nine years with a major multi-national oilfield service company.

Douglas currently represents ARC as Chairman on the boards of Sanjel Energy Services Inc., Citadel Drilling Ltd., Lifting Solutions Energy Services Inc., Wayfinder Corp. and STEP Energy Services Ltd. ![]() See font I hilighted in red below.

See font I hilighted in red below.![]()

He holds an MBA from the University of Toronto and a Bachelor of Science in Engineering from Queen’s University. In addition, Mr. Freel sits as the Chairman of the Board for Impact Society.

Jeremy Gackle, Senior Vice President, ARC Financial Corp.

Jeremy Gackle joined ARC Financial Corp in 2004 and is currently a Senior Vice-President and co-lead focused on the oilfield service sector. With $6.0 billion of committed capital, ARC is the largest private equity firm focused exclusively on energy in Canada. Over the last 16 years at ARC, Jeremy’s role has transitioned from analytical support roles to responsibilities ranged from deal origination and structuring to due diligence, execution, strategic development and investment monitoring.

Jeremy is currently a Director of STEP Energy Services Ltd., Sanjel Energy Services Inc., Lifting Solutions Energy Services Inc., and is the Chairman of Catapult Environmental Inc. Jeremy has also been a Board Observer of Global Tubing LLC, a Dayton, Texas-based company which was sold in July 2013.

Jeremy holds a Bachelor of Commerce in Finance from the University of Calgary, is a CFA charterholder and is an Institute-Certified Director from the Institute of Corporate Directors.

2020 03 20: Sanjel Energy Services announces exclusive cementing technology

licensing agreement with Schlumberger, Leading Canadian cementing company secures exclusive technology rights from international oilfield services company Press Release by Sanjel Energy Services

Sanjel Energy Services (Sanjel Energy) is pleased to announce it has entered into a technology licensing agreement with Schlumberger. This agreement provides Sanjel Energy the exclusive rights to select Schlumberger cementing technologies in Canada onshore.

“Sanjel Energy’s premier solutions in primary and remedial cementing will be enhanced by the addition of these unique technologies,” says Murray Bickley, President of Sanjel Energy. “This agreement presents positive benefits for both companies. It will strengthen value and improve well integrity for our clients through complementing Sanjel Energy’s own innovative technologies, such as the patent pending Visweep DM IS.”

Since its ![]() name switcheroo from Sanjel to Sanjel

name switcheroo from Sanjel to Sanjel![]() inception as an independent private company almost four years ago, Sanjel Energy has emerged as the Canadian market leader with a strong record of accomplishment for safety, operational excellence and delivering optimal technical solutions to its vast network of highperforming clients.

inception as an independent private company almost four years ago, Sanjel Energy has emerged as the Canadian market leader with a strong record of accomplishment for safety, operational excellence and delivering optimal technical solutions to its vast network of highperforming clients.

-30-

About Sanjel Energy Services

Sanjel Energy Services is an industry leading energy services company, providing primary and remedial cementing solutions to the oil and gas industry in Canada. The company partners with clients to solve their unique challenges, providing innovative and solutions focussed results that improve productivity, mitigate risk and maximize the value of their wells.

Headquartered in Calgary, Alberta, Sanjel Energy Services has 13 locations across the Western Canadian Sedimentary Basin.

For more information, visit www.sanjel.com.

Media Contact

Shauna MacDonald

Brookline Public Relations, Inc. for Sanjel Energy

email hidden; JavaScript is required

O: (403) 538-5645

C: (403) 585-4570

2018: Sanjel donates $20,000 to cancer, copying cancer-causing-chemical-injecting frac’er Trican?

Sanjel Corporation by PricewaterhouseCoopers LLP (last updated in 2019)

Documents Court Application – CCAACourt Orders – CCAACreditor CommunicationsMonitor’s Reports – CCAAUS Proceedings

Status as of November 28, 2018

On November 28, 2018, the Court of Queen’s Bench of Alberta extended the Stay period, as defined in paragraph 14 of the Initial Order, until and including December 31, 2019. A copy of this order may be accessed on this website.

Status as of December 6, 2017

On December 5, 2017, the Court of Queen’s Bench of Alberta extended the Stay period, as defined in paragraph 14 of the Initial Order, until and including December 31, 2018. A copy of this order may be accessed on this website.

Status as of May 3, 2017

On May 3, 2017, the Court of Queen’s Bench of Alberta extended the Stay period, as defined in paragraph 14 of the Initial Order, until and including December 31, 2017. A copy of this order may be accessed on this website.

Status as of January 18, 2017

On January 18, 2017, the Court of Queen’s Bench of Alberta extended the Stay period, as defined in paragraph 14 of the Initial Order, until and including June 30, 2017. A copy of this order may be accessed on this website.

Status as of September 28, 2016

On September 28, 2016, the Court of Queen’s Bench of Alberta extended the Stay period, as defined in paragraph 14 of the Initial Order, until and including January 31, 2017. A copy of this order may be accessed on this website.

Status as of August 31, 2016

On August 31, 2016, the Court of Queen’s Bench of Alberta extended the Stay period, as defined in paragraph 14 of the Initial Order, until and including September 30, 2016. A copy of this order may be accessed on this website.

Status as of July 13, 2016

On July 13, 2016, the Court of Queen’s Bench of Alberta extended the Stay period, as defined in paragraph 14 of the Initial Order, until and including August 31, 2016. A copy of this order may be accessed on this website.

Status as of May 2, 2016

On May 2, 2016, the Court of Queen’s Bench of Alberta extended the Stay period, as defined in paragraph 14 of the Initial Order, until and including July 15, 2016. A copy of this order may be accessed on this website.

On April 29, the Court of Queen’s Bench of Alberta approved the Company’s application for sale transactions involving it’s Canadian and US operations, noting the Transaction is in the best interests of the Vendors, its creditors ad its other stakeholders. A copy of this order may be accessed on this website. ![]()

![]() How much did Canadian taxpayers fork over for these many Sanjel applications eating up the court’s time, granting delay after delay after delay, for years? How many citizen cases, including mine, stagnated in our over run courts because of Sanjel and name change/debt busting/bankruptcy trickery by other oil and gas and frac companies? All while my community’s drinking water aquifers remain unfixed, I am still hauling water and six years after ordered by the same court to complete document exchange with me (by Dec 2014), Encana still hasn’t given me all relevant documents related to my lawsuit. Canada’s courts, time and time again, proves itself to be a dirty devil run haven for polluting, public health harming, bankrupting (dumping clean-up costs on taxpayers to the tune of many hundreds of billions of dollars), name changing frac’ers, and oil, tar and gas companies the frac’ers service.

How much did Canadian taxpayers fork over for these many Sanjel applications eating up the court’s time, granting delay after delay after delay, for years? How many citizen cases, including mine, stagnated in our over run courts because of Sanjel and name change/debt busting/bankruptcy trickery by other oil and gas and frac companies? All while my community’s drinking water aquifers remain unfixed, I am still hauling water and six years after ordered by the same court to complete document exchange with me (by Dec 2014), Encana still hasn’t given me all relevant documents related to my lawsuit. Canada’s courts, time and time again, proves itself to be a dirty devil run haven for polluting, public health harming, bankrupting (dumping clean-up costs on taxpayers to the tune of many hundreds of billions of dollars), name changing frac’ers, and oil, tar and gas companies the frac’ers service.![]()

Status as of April 4, 2016

On April 4, 2016 PricewaterhouseCoopers Inc. was appointed Monitor of Sanjel et al pursuant to an Order of the Court of Queen’s Bench of Alberta, Calgary Judicial Centre. A copy of this Order may be accessed on this website.

Sanjel Energy Services is proud to announce the successful launch of its company, which is focused on providing cementing and acidizing solutions throughout Canada. Sanjel Energy Services is an ARC Financial Corp. sponsored company, having received equity capital from ARC Energy Fund 8, a $1.55-billion-dollar private equity fund.

The new, privately owned oil and gas services company purchased the Canadian cementing and acidizing assets, as well as the rights to the “Sanjel” brand given the former entity’s strong history and legacy in cementing and acidizing.

Since commencing operations May 31, 2016, Sanjel Energy Services has completed its 900th job, spanning British Columbia, Alberta and Saskatchewan.

13 DAYS EARLIER:

… Sanjel Corp., the privately held oil-field services company, is being broken up and sold to two rivals under a court-supervised process for undisclosed sums, it said on Monday.

Calgary-based Sanjel said STEP Energy Services, owned by private-equity firm ARC Financial Corp., is buying the Canadian hydraulic fracturing, coiled tubing and well-cementing business.

Meanwhile, Denver-based Liberty Oilfield Services is acquiring Sanjel’s U.S. business. Liberty operates in the Williston, DJ and Powder River basins in the United States. …

Sanjel said on Monday that it obtained an initial order from an Alberta court under the Companies’ Creditors Arrangement Act to help with the closing of the deals. ![]() Tory-touted free market? Why can’t oil, gas and frac companies take care of their own debts and businesses, why must so many of them use courts financed by taxpayers?

Tory-touted free market? Why can’t oil, gas and frac companies take care of their own debts and businesses, why must so many of them use courts financed by taxpayers?![]()

2014 08 27: Sanjel Corp. plans frac fleet expansion, Customer demand drives 120,000 h.p. decision

… “A lot of that is coming from the fact that intensities continue to increase around larger job sizes … we’re not only adding capacity but also supplementing current fleets.” He said the new fracking units will be deployed to the United States, where Sanjel focuses on the North Dakota Bakken and South Texas plays, while Canada will get incremental horsepower additions in unconventional plays such as the Montney and Duvernay. According to its website, Sanjel has 3,800 staff in over 30 field districts, 11 laboratories, 11 regional maintenance facilities and three training centers. It has international offices in Denver, Mexico City and Dubai.

2012 06 07: How rural america got fracked, The environmental nightmare you know nothing about: Frac-sand vs. food

… Brian Norberg and his family in Prairie Farm, 137 miles northwest of Tunnel City, paid the ultimate price: he died while trying to mobilize the community against Procore, a subsidiary of the multinational oil and gas corporation Sanjel. … “When you start talking about industrial mining, to us, you’re violating the land,” Brian’s widow, Lisa, told me one March afternoon over lunch. She and other members of the family, as well as a friend, had gathered to describe Prairie Farm’s battle with the frac-sanders. “The family has had a really hard time accepting the fact that what we consider a beautiful way to live could be destroyed by big industry.”

Their fight against Procore started in April 2011: Sandy, a lifelong friend and neighbor, arrived with sand samples drillers had excavated from her land, and began enthusiastically describing the benefits of frac-sand mining. “Brian listened for a few minutes,” Lisa recalls. “Then he told her [that]… she and her sand vials could get the heck — that’s a much nicer word than what he used — off the farm. Sandy was hoping we would also be excited about jumping on the bandwagon. Brian informed her that our land would be used for the purpose God intended, farming.”

Brian quickly enlisted family and neighbors in an organizing effort against the company. In June 2011, Procore filed a reclamation plan — the first step in the permitting process — with the county’s land and water conservation department. Brian rushed to the county office to request a public hearing, but returned dejected and depressed. “He felt completely defeated that he could not protect the community from them moving in and destroying our lives,” recalls Lisa.

He died of a heart attack less than a day later at the age of 52. The family is convinced his death was a result of the stress caused by the conflict. That stress is certainly all too real. The frac-sand companies, says family friend Donna Goodlaxson, echoing many others I interviewed for this story, “go from community to community. And one of the things they try to do is pit people in the community against each other.”

… In April 2012, Prairie Farm’s three-man board voted 2 to 1 to pass such an ordinance to regulate any future mining effort in the town. No, such moves won’t stop frac-sand mining in Wisconsin, but they may at least mitigate its harm. Procore finally pulled out because of the resistance, says Glass, adding that the company has since returned with different personnel to try opening a mine near where she lives. “It takes 1.2 acres per person per year to feed every person in this country,” says Lisa Norberg. “And the little township that I live in, we have 9,000 acres that are for farm use. So if we just close our eyes and bend over and let the mining companies come in, we’ll have thousands of people we can’t feed.” …

Chairman Henry A. Waxman and Subcommittee Chairman Edward Markey today sent letters to eight oil and gas companies that use hydraulic fracturing to extract oil and natural gas from unconventional sources in the United States. The Committee is requesting information on the chemicals used in fracturing fluids and the potential impact of the practice on the environment and human health.

… “As we use this technology in more parts of the country on a much larger scale, we must ensure that we are not creating new environmental and public health problems. This investigation will help us better understand the potential risks this technology poses to drinking water supplies and the environment, and whether Congress needs to act to minimize those risks.” …

As Chairman of the Committee on Oversight and Government Reform in the last Congress, Rep. Waxman requested and received information from the largest hydraulic fracturing companies – Halliburton, BJ Services, and Schlumberger – on the chemicals used in their fracturing fluids. According to this data, two of these companies used diesel fuel in their fracturing fluids between 2005 and 2007, potentially violating a voluntary agreement with EPA to cease using diesel. Halliburton reported using more than 807,000 gallons of seven diesel-based fluids. BJ Services reported using 2,500 gallons of diesel-based fluids in several fracturing jobs. Halliburton and BJ Services also indicated that they used other chemicals – such as benzene, toluene, ethylbenzene, and xylene – that could pose environmental risks in their fracturing fluids.

Today Chairmen Waxman and Markey sent letters seeking additional information from Halliburton, BJ Services, and Schlumberger on these and related issues. The Chairmen requested similar information from five smaller fracturing companies that comprise a growing share of the market: Frac Tech Services, Superior Well Services, Universal Well Services, Sanjel Corporation, and Calfrac Well Services.

In addition, the Chairmen sent a memo to Members of the Subcommittee on Energy and Environment detailing the background on the issue, including EPA’s recent work on hydraulic fracturing, the Committee on Oversight and Government Reform’s investigative findings, and the need for additional oversight and investigation.