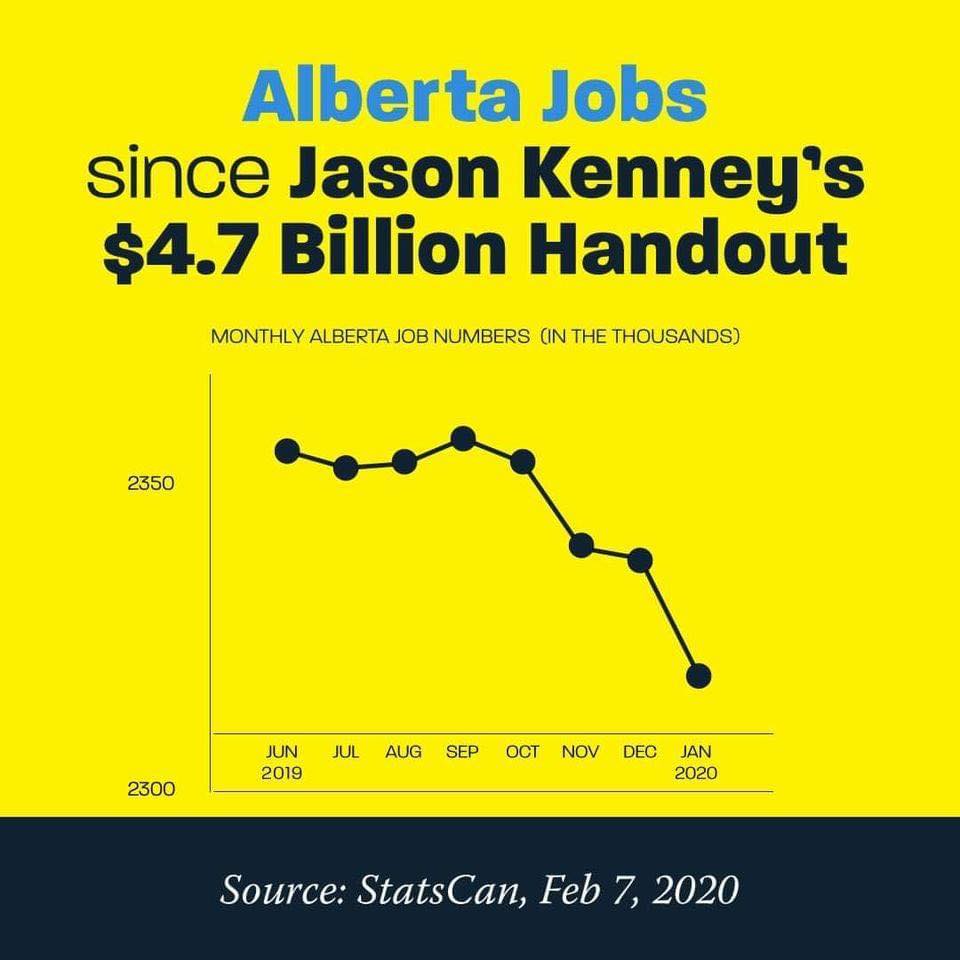

Alberta is in an uproar these days, with anti Canada, anti Rule of Law “Dead Eyes” Premier Danielle Smith giving law-violating, billion dollar profit-raping, polluting oil and gas companies more billions off the backs of taxpayers (to clean up abandoned wells, and likely also orphans which industry is already legally required to clean up, but just refuses to, decade after decade after decade), while destroying public health/education to privatize them for more corporate profit-raping.

Smith claims her new $20Billion gift to polluters will ensure wells are cleaned up. Pffffft. Just like the $billions the feds and Kenney already gave in “clean up” funding that went into CEO pockets, not clean up.

I expect not one well will be cleaned up with the $20Billion and Alberta’s Dead Eyes premier knows it. And after the $20 billion is gobbled up, multinationals, many of them American, will whine for more of our money while ordinary families starve and freeze.

Industry, its lying lobby groups like CAPP, and politicians, including the NDP, never intended oilpatch clean up. “Polluter Pay” is just more petroleum patch spin, another Synergy Alberta pipe dream, to keep dragging “hopeful” landowners out, keep them dutifully voting con (provincially and federally) while waiting, waiting, waiting, until they die.

The Alberta Advantage Plan was always to let the rich walk after raping us blind and leaving behind toxic farms, contaminated and divided communities and families, air, water including illegally frac’d aquifers, land, polluted night sky and ugly industrialized landscapes that were once beautiful, safe and clean.

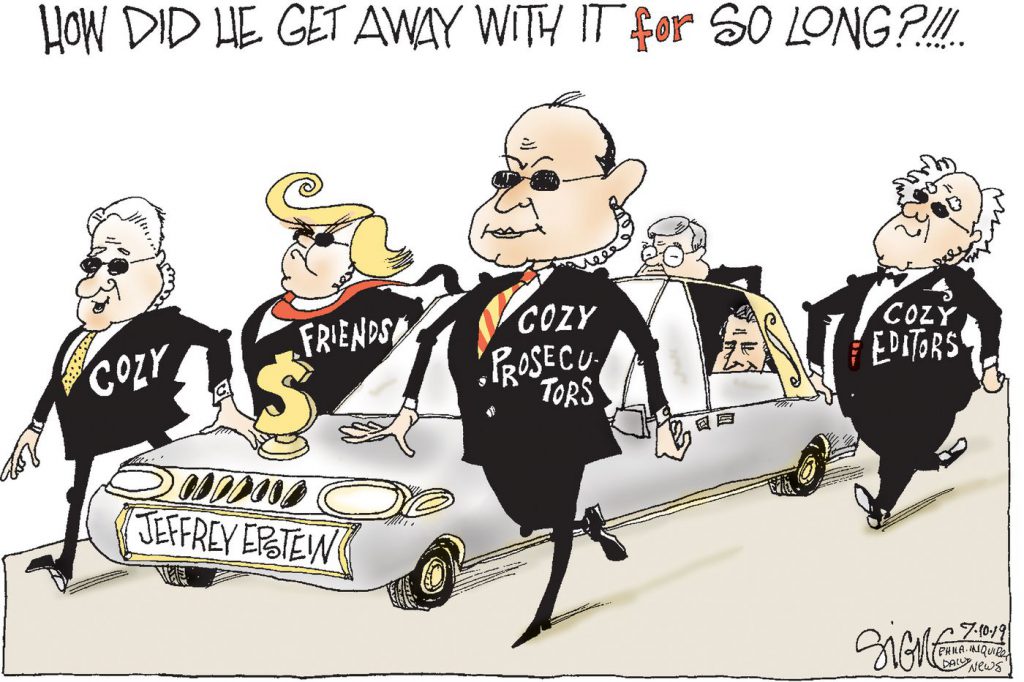

It’s ridiculous to read the outrage in so many politicians, lawyers, NGOs, landowner groups, Synergy and lobby groups, community leaders and landowners that enabled and or quietly watched decades of the rape and pillage: farmers, gas-in-water testers and community water towers blowing up, and law violations unfold by the hundreds, frac after frac after frac, seep after seep after seep, spill after spill after spill, company-caused worker death after worker death after worker death (which companies blame on the dead workers and use our courts to escape accountability), toxic dump after dump after dump, etc.![]()

Special Edition – Corporate Capture of the Legal System

The [F]law shares stories that reveal how corporate law and power create social problems and systemic injustices.

2023 02 11: Tyler Price, Justice for Sale: A Shopping List, How much does it cost to buy your own state supreme court justice?

… While spenders do their best to keep their identities secret, some larger influencers include the Judicial Confirmation Network (who has spent countless millions of dollars confirming conservative federal Supreme Court Justices such as Neil Gorsuch and Brett Kavanaugh) and the Republican State Leadership Committee. Special business interests have also increased their spending in state supreme court elections. For example, corporations in the oil industry donated $4.5[million?] to ideologically friendly state court judges in Texas in 2020—more than any other year in the past decade.

It seems as though, with the right amount of money, anyone can purchase a seat on a state supreme court’s bench. Strategic spending can put a state supreme court justice in your pocket. But where should you invest your funds? The simple shopping list below should have your answer.

… Using those contributions as an example, you too can purchase a state supreme court justice — for $190,000.

… That election year, Don Blankenship, the CEO of the coal processing company the Massey Energy Company, took advantage of that ruling to oust McGraw, who was historically unsympathetic to Blankenship’s corporate interests. Working secretly through political action committees, Blankenship spent over $2 million producing commercials claiming that McGraw had voted to “let a child rapist out of prison… to work at a local school.” The advertisements dubbed the incumbent as “Radical Warren McGraw” who was “too soft on crime” and “too dangerous for our kids.” That election, Justice McGraw lost to the candidate Blankenship supported. And that newly purchased justice went on to help overturn a $50 million ruling against the Massey Energy Company.![]() Rape & pillage profit by judge.

Rape & pillage profit by judge.![]()

So how much should you spend on television advertisements to guarantee your state supreme justice of choice? Interested parties like Blankenship regularly spend millions on advertisements, as such spending is the most effective at influencing public opinion. While $2 million may seem like a steep price — that is the price of justice.

… State supreme court candidates have naturally enjoyed a substantial boost in contributions as more eyes have watched their elections. For example, in the 2020 election cycle, candidates raised more than $62.6 million in funds — the largest amount ever. The majority of those contributions were provided by lawyers and business interests who had previously appeared before those courts, and were likely to argue before them again. …

But how much should you spend if you would like a state supreme court justice for yourself? A look at Texas’s 2020 supreme court election provides a helpful estimate. That year, Apache Corp., a Houston oil company, was held liable for $900,000 in damages after losing an age and gender discrimination lawsuit to a former employee. Apache subsequently appealed that lower court decision to the Texas Supreme Court, asking them to review and potentially overturn the jury verdict. The state supreme court swiftly declined.

In almost all cases, that would be the end of the story. Apache Corp. would pay up, and justice would presumably be served. However, in Texas, litigants can ask the state supreme court to reconsider their decisions, and, in October, Apache Corp. notified the court that it intended to file such an appeal.

While such a move generally fails — the Texas supreme court denies such appeals 98 percent of the time — Apache Corp. accompanied their appeal with something very few litigants can offer: a $250,000 donation. That donation was 100 times more than the oil company had ever donated to a judicial race in the past. The money was given by Apache Corp. to the Judicial Fairness PAC in support of the campaigns of four corporate-friendly Texas supreme court justices up for reelection. That PAC then used that money, along with another $4 million crowd sourced from other interest groups, to support those four incumbent Texas supreme court justices. Each of those justices won.

Several weeks later, the state supreme court suddenly changed its mind. The court granted Apache’s motion for reconsideration and threw out the lower court’s ruling. Siding with Apache, the supreme court ruled that the oil company was not guilty of employment discrimination, and the $900,000 jury award was overturned.

Apache Corp. turned a $900,000 bill into a $650,000 profit, simply by spending $250,000 to ensure the reelection of specific judges. When questioned about the influence the donation may have had on their victory, Apache Corp. stated merely that it contributed “to ensure the Texas Supreme Court continued to be composed of fair, experienced and highly qualified judges.”

Interested organizations such as Apache Corp. purchase “justice” everyday, and you can too! — For $250,000.

In many states, justice has a price. For $2,440,000, an individual can essentially guarantee themself at least one seat on a state’s supreme court bench. With that seat comes favorable decisions, partial outcomes, and a broken justice system. Having a neutral judge’s job security depend upon highly contested elections is a recipe for disaster. ![]() Similar in Canada where RCMP/judge pensions are invested in projects they police/rule on.

Similar in Canada where RCMP/judge pensions are invested in projects they police/rule on.![]() Judges naturally feel pressure to act not in line with justice, but instead with the fundraisers who keep them employed. Sitting state supreme court justices are often allowed to directly solicit campaign funds from potential benefactors, acting more like politicians than impartial jurists.

Judges naturally feel pressure to act not in line with justice, but instead with the fundraisers who keep them employed. Sitting state supreme court justices are often allowed to directly solicit campaign funds from potential benefactors, acting more like politicians than impartial jurists.![]() Similar in Canada where judges legislate from Calgary’s Petroleum Club, ooopsie, I mean bench.

Similar in Canada where judges legislate from Calgary’s Petroleum Club, ooopsie, I mean bench.![]()

In light of these issues, advocacy groups have begun urging states to reform their supreme court selection process. These reforms largely revolve around eliminating state supreme court elections entirely and instead using an independent nominating commission to place justice’s on the bench, and not allowing justices to serve on the supreme court for more than one term. ![]() Canada desperately needs that.

Canada desperately needs that.![]() Both of those proposals would alleviate the public pressure justices feel when making consequential decisions. Regardless of the exact solution, Americans are far more likely to end up in state than federal court, and the one in robes before them should not be decided by those with the deepest pockets.

Both of those proposals would alleviate the public pressure justices feel when making consequential decisions. Regardless of the exact solution, Americans are far more likely to end up in state than federal court, and the one in robes before them should not be decided by those with the deepest pockets.

… Learn more out about our Corporate Capture of the Legal System Conference (held on 1/27 – 1/28/22, at Harvard Law School) here.

***

A New Dawn For Corporate America: How the Rich and Powerful Use Bankruptcy to Evade Accountability, “Elite” lawyering means finding legal ways to insulate wealthy corporate clients from accountability for profitable harms by Delana Sobhani, January 26, 2023

Bankruptcy used to be something that companies fought to avoid. To go bankrupt was an admission of failure, a badge of shame. But in recent decades, bankruptcy has become something that companies, and the people profiting off them, have embraced with open arms. While it may seem counterintuitive, the explanation behind this shift is simple business strategy.

Bankruptcy offers companies facing costly legal liability an escape hatch that puts them beyond the reach of lawsuits.

Like a corrupt phoenix rising from the ashes, bankruptcy lets companies emerge from their own scandalous misconduct unscathed. It’s obvious that companies and the people who run them win in this system, but who loses? And what exactly have they lost?

Dominique Huett is one of the 100 women who has accused Harvey Weinstein of sexual misconduct. She alleges that Weinstein sexually assaulted her during a business meeting in 2010. When woman after woman came forward with similar accounts seven years later, Huett and others sued the Weinstein Company for negligence. In response, the Weinstein Company declared bankruptcy. Huett had planned to sue the Weinstein Company board of directors for their complicity in Weinstein’s serial misconduct.

U.S. Bankruptcy Judge Mary Walrath, however, granted the board members lifetime immunity from all lawsuits related to Weinstein.

The decision felt like a “gut punch,” Huett told Reuters. “They, essentially, got away with it,” she said.![]() Of course they did, enabled by the most heinous “legally immune” criminals of them all – self regulated judges that stay on far too long, in USA and Canada!

Of course they did, enabled by the most heinous “legally immune” criminals of them all – self regulated judges that stay on far too long, in USA and Canada!

And, cozy judges. How many of them rapists and or misogynists?![]()

The Weinstein Company’s bankruptcy is part of a pervasive and deeply troubling trend. Twenty-nine Catholic dioceses have declared bankruptcy in response to child sex abuse lawsuits. U.S.A Gymnastics filed for bankruptcy in 2018 after gymnasts sued the organization for failing to protect them from Larry Nassar’s sexual abuse. Boy Scouts of America, confronted with hundreds of sex abuse lawsuits from thousands of alleged victims, declared bankruptcy in 2020. Pharmaceutical giants Purdue Pharma and Mallinckrodt filed for bankruptcy in 2019 and 2020, respectively, in the face of a wave of lawsuits for fueling the opioid epidemic. And most recently, Johnson & Johnson created a subsidiary to hold all the legal liability arising from its talc baby powder—which allegedly causes ovarian cancer—just so the subsidiary could declare bankruptcy three days later.

Like a corrupt phoenix rising from the ashes, bankruptcy lets companies emerge from their own scandalous misconduct unscathed.

Each of these bankruptcies brought litigation to a screeching halt. In their wake, powerful institutions and those who run them became effectively untouchable.

Meanwhile, the people who suffered profound harm at the hands of these institutions suddenly found themselves without recourse.

Bankruptcy has become a powerful weapon in the arsenal of corporate defendants, empowering them to terminate lawsuits and grant their affiliates lifetime civil immunity. As the rich and powerful become increasingly brazen in their attempts to employ bankruptcy to circumvent litigation and limit their liability, they insist that bankruptcy is actually in the best interests of those they’ve harmed. ![]() The raping catholic church in my view, has been the most heinous at this evil trick and or the threat to use it to silence the harmed by settle ‘n gags. Satan can’t compete with the evil of priests, bishops, cardinals and popes!

The raping catholic church in my view, has been the most heinous at this evil trick and or the threat to use it to silence the harmed by settle ‘n gags. Satan can’t compete with the evil of priests, bishops, cardinals and popes!![]() This false and insidious narrative is a smoke screen that obscures the erosion of victims’ access to justice.

This false and insidious narrative is a smoke screen that obscures the erosion of victims’ access to justice.

Bankruptcy As a Shield to Deflect Mass Tort Litigation

Bankruptcy is a legal process through which people, companies, and organizations seek relief from the outstanding debts they owe their creditors. Bankruptcy law implicates themes of forgiveness, redemption, and redistribution. Historically, it has sought to reconcile policy considerations that are often in tension: giving a fresh start to debtors while ensuring creditors receive what they’re owed.

Drafted in the 1970s, the United States Bankruptcy Code establishes procedures and rules to balance the conflicting interests of debtors and creditors. Chapter 11 bankruptcy lets individuals and businesses with debts above a certain amount stay afloat and pay creditors over time. Once an entity files for Chapter 11 bankruptcy, it benefits from an “automatic stay” on assets, which immediately pauses all creditor action to collect debts, including lawsuits.

The automatic stay was designed to prevent a race to the courthouse among creditors, who may rush to sue to make sure they can recover outstanding debt before money runs out. In theory, the stay encourages creditors to cooperate and enables debtors to create an effective payment plan. In reality, however, corporate defendants exploit the automatic stay as a loophole to escape potentially costly litigation. This feature of bankruptcy has become “a malicious incentive for solvent corporations to file, and thus skirt liability that they would otherwise face.” Although companies traditionally considered bankruptcy a last resort, they are increasingly filing for Chapter 11 to benefit from the automatic stay.

The trend is especially pronounced in mass tort litigation— cases where many people are harmed in a similar way by a similar actor.

In addition to the automatic stay, Chapter 11 gives nondebtor third parties (those affiliated with the entity filing for bankruptcy who may also be liable for the harm at issue) a shield against current and future litigation. Nondebtor liability releases emerged in the 1980s as a tool to handle a massive influx of asbestos lawsuits. Manufacturer Johns-Manville declared bankruptcy and created a trust to compensate asbestos victims. Johns-Manville’s insurers contributed $770 million to the trust in exchange for nondebtor releases that insulated them from asbestos lawsuits. The nondebtor releases served to prevent claimants from collecting twice, through the trust and a separate insurance claim. In 1994, Congress amended the Bankruptcy Code to allow nondebtor releases in asbestos litigation.

Since then, businesses and their corporate lawyers have aggressively extended the application of nondebtor releases. They’re now a ubiquitous part of bankruptcy proceedings. According to a Reuters review of 626 bankruptcy cases compiled by BankruptcyData, judges approved nondebtor releases in 90% of the largest U.S. bankruptcy filings completed between 2012 and 2021. Bankruptcy scholar Lindsey Simon calls these solvent, nondebtor entities that take advantage of third party releases “bankruptcy grifters,” which “act as parasites, receiving many of the substantive and procedural benefits of a host bankruptcy, but incurring only a fraction of the associated burdens.”

Taken together, automatic stays and nondebtor releases extinguish legal claims against corporate defendants and their affiliates. The only option left for claimants is to pursue a payout from trusts created by Chapter 11 filings.

But the companies that file for bankruptcy are typically the ones that get to make the rules that govern their trusts, including their evidentiary standards, appeals processes, claims-payment regimes, and arbiter selections. Claimants are lucky if they get to recover anything at all.

Recent high-profile cases illustrate how corporate defendants exploit bankruptcy law to outmaneuver claimants seeking redress.![]() Even worse, judges help those corporations rip off the harmed as much as possible, to the point of fabricating a billion dollars to enable law violating, greedy, thieving frac’er, Chesapeake.

Even worse, judges help those corporations rip off the harmed as much as possible, to the point of fabricating a billion dollars to enable law violating, greedy, thieving frac’er, Chesapeake.![]()

Product Liability Cases

Over the past five years, companies have weaponized Chapter 11 bankruptcy to defend themselves from product liability litigation—lawsuits to compensate consumers for injuries caused by dangerous products.

Two perverse innovations in bankruptcy law have immunized corporate actors in the product liability context: nonconsensual nondebtor releases and the Texas two-step.

Nonconsensual nondebtor releases forcibly bind claimants to bankruptcy settlements that grant immunity to third parties. These releases enable the executives responsible for a company’s decision-making to hide behind its bankruptcy. Nonconsensual nondebtor releases have taken center stage in the fight to hold opioid suppliers accountable.

The opioid epidemic led to extensive litigation against the companies who fueled this public health crisis for profit. ![]() Just wait til the world sees the evil that judges engage in to financially protect our social murdering politicians and their chief health officers like Drs. Bonnie Henry, Kieran Moore, Deena Hinshaw et al, from the massive suffering and deaths that could have been prevented with honesty and minimally invasive health protections like telling the public the truth instead of lies, and air filtration and ventilation, and masking.

Just wait til the world sees the evil that judges engage in to financially protect our social murdering politicians and their chief health officers like Drs. Bonnie Henry, Kieran Moore, Deena Hinshaw et al, from the massive suffering and deaths that could have been prevented with honesty and minimally invasive health protections like telling the public the truth instead of lies, and air filtration and ventilation, and masking.![]() Faced with mounting legal liability, prominent pharmaceutical companies Purdue Pharma LP and Mallinckrodt PLC declared bankruptcy to extinguish the opioid lawsuits against them and shield their executives from liability. The billionaire Sackler family that ran Purdue Pharma has offered to contribute $6 billion to Purdue’s trust, “but if—and only if—every member of the family could ‘achieve global peace’ from all civil litigation.” Mallinckrodt chief executive Mark Trudeau paid nothing to Mallinckrodt’s trust but received a nondebtor release anyway, preventing claimants from pursuing any claims against him.

Faced with mounting legal liability, prominent pharmaceutical companies Purdue Pharma LP and Mallinckrodt PLC declared bankruptcy to extinguish the opioid lawsuits against them and shield their executives from liability. The billionaire Sackler family that ran Purdue Pharma has offered to contribute $6 billion to Purdue’s trust, “but if—and only if—every member of the family could ‘achieve global peace’ from all civil litigation.” Mallinckrodt chief executive Mark Trudeau paid nothing to Mallinckrodt’s trust but received a nondebtor release anyway, preventing claimants from pursuing any claims against him.

Another bankruptcy maneuver designed to skirt accountability is a strategy called the “Texas two-step.” First, a company splits itself into two entities (a parent company and a subsidiary) and offloads its legal liability onto the subsidiary. Then, the parent company has the subsidiary declare bankruptcy. This tactic allows corporate defendants to reroute lawsuits against them to bankruptcy court, where they get the benefits of bankruptcy protection but none of the reputational or financial drawbacks. The company get to ditch pesky lawsuits, keep its assets, and go about business as usual.

Johnson & Johnson has come under fire for its recent use of the Texas two-step. Over the past twenty years, the company has faced a rising wave of lawsuits concerning its talc baby powder. Plaintiffs allege that it contains traces of asbestos that gave them (or their deceased loved ones) ovarian cancer. Johnson & Johnson went to trial and lost big in several cases, with compensatory damage awards ranging from $5 million to $70 million and punitive damages ranging from $50 million to $347 million. So, in October 2021, Johnson & Johnson dumped its talcum liability into a subsidiary called LTL Management, which declared bankruptcy just three days later.

Johnson & Johnson emerged scot-free with tens of billions of dollars in assets and none of its talc liabilities.

While courts determine whether this tactic is legal, the lawsuits seeking to hold Johnson & Johnson accountable are frozen in limbo. ![]() Pfffft! Too many judges are enablers of corporations pissing on the rule of law and using bankruptcy tricks; judges could order the right thing done, but don’t. They gain too much by enabling the corporate crimes and legalizing escape hatches, and judges know their pensions are bigger the more profit-raping corporations are enabled to get away with.

Pfffft! Too many judges are enablers of corporations pissing on the rule of law and using bankruptcy tricks; judges could order the right thing done, but don’t. They gain too much by enabling the corporate crimes and legalizing escape hatches, and judges know their pensions are bigger the more profit-raping corporations are enabled to get away with.![]() Journalist Casey Cep noted that in the eleven months after Johnson & Johnson’s subsidiary filed for bankruptcy, “an average of one woman a day has died waiting to find out if her case against the company would ever be heard.”

Journalist Casey Cep noted that in the eleven months after Johnson & Johnson’s subsidiary filed for bankruptcy, “an average of one woman a day has died waiting to find out if her case against the company would ever be heard.”

The harms inflicted by bankruptcy in the product liability context are twofold. First, people who have been harmed by dangerous products are denied justice, forced into settlements designed to limit their recovery and to shield those responsible. Second, the fact that companies can evade liability for dangerous products diminishes their incentives to address potential safety hazards. Bankruptcy maneuvers like nonconsensual nondebtor releases and the Texas two-step exacerbate these harms and corrode consumer protection.![]() And worse, steadily destroy the earth’s ability to sustain human life and that of many other species. Greed by corporation, enabled by judges, will kill CEOs and judges, and if not them, their kids and or grand kids but seems the rich don’t give a damn about the well being of their loved ones either.

And worse, steadily destroy the earth’s ability to sustain human life and that of many other species. Greed by corporation, enabled by judges, will kill CEOs and judges, and if not them, their kids and or grand kids but seems the rich don’t give a damn about the well being of their loved ones either.![]()

Sexual Abuse Cases

Cancer patients and families wrought by the opioid epidemic are not the only victims of strategic corporate bankruptcies. Companies use bankruptcy to shut the door on sexual abuse victims too. Organizations that face lawsuits for enabling abuse have increasingly turned to bankruptcy to limit their legal liability. In this context, bankruptcy compounds the very same misconduct at issue in sex abuse litigation—institutional dismissal of survivors that excuses and perpetuates abuse. ![]() The Patriarchy won’t let it be any other way.

The Patriarchy won’t let it be any other way.![]()

Bankruptcy compounds the very same misconduct at issue in sex abuse litigation—institutional dismissal of survivors that excuses and perpetuates abuse.

When USA Gymnastics filed for bankruptcy, an automatic stay froze over 100 lawsuits by current and former gymnasts alleging that the organization had failed to properly investigate claims of Larry Nasser’s abuse. Settlement negotiations lasted for three years, during which survivors were “trapped in a tangled web of disputes involving USA Gymnastics, its insurers, and the United States Olympic and Paralympic Committee.” At one point in the process, survivors tried to dismiss USA Gymnastics’ bankruptcy petition on the grounds that the organization hadn’t been negotiating in good faith. A bankruptcy settlement was finally reached in 2021, and shortly thereafter USA Gymnastics emerged from bankruptcy to continue its control over the destinies of young gymnasts.

Boy Scouts of America also faced a fraught bankruptcy settlement process. Georgetown Law professor Adam Levitin noted that an estimated 40,000 troop sponsors—including municipalities, community organizations, schools, and churches—clamored to receive nondebtor releases. They all sought to limit their own liability for the sexual abuse of Boy Scouts from 1976 onward. All but one of these troop sponsors secured third party liability releases, enabling them to reap the benefits of Boy Scouts’ bankruptcy without actually having to pay a penny of their own money. The one troop sponsor that was denied a third party liability release was the Church of Jesus Christ of Latter Day Saints, which tried to pay $250 million to the settlement fund in exchange for broad legal protections from all sex abuse claims, not just those involving Boy Scouts.

Two years after Boy Scouts of America declared bankruptcy, a judge approved the settlement agreement. A group of insurers responsible for compensating claimants is now trying to challenge the settlement on the grounds that “a significant portion” of the 82,000 claims are “likely fraudulent.” Even after reaching a settlement, legal challenges by insurers force claimants to fight tooth and nail to receive compensation.

The Weinstein Company bankruptcy also involved a bitter fight over nondebtor releases. Former board members and company officials wanted releases granting them lifetime immunity for Weinstein’s abuse. And they got them, over the objections of four women who planned to hold board members accountable for enabling Weinstein. Not only did the settlement agreement force claimants to accept the third party liability releases, but it also strong-armed them into releasing Weinstein himself from liability. If they opted not to, their payout from the settlement would have been reduced by 75%. ![]() Legal settlements, especially those that come with ordered gags, are pure evil, especially those ordered by judges. Settlements ensure that no one but the perpetrators win – they hand over a bit of money while saying they are not guilty, and resume breaking the law and profit raping.

Legal settlements, especially those that come with ordered gags, are pure evil, especially those ordered by judges. Settlements ensure that no one but the perpetrators win – they hand over a bit of money while saying they are not guilty, and resume breaking the law and profit raping.![]() One woman who had planned to sue the company’s board members told Reuters that the bankruptcy settlement made her feel “like I was being coerced into something once again.”

One woman who had planned to sue the company’s board members told Reuters that the bankruptcy settlement made her feel “like I was being coerced into something once again.”

In each of these cases, those complicit in pervasive sexual abuse have used bankruptcy against survivors. Automatic stays effectively extinguished all existing and future sex abuse lawsuits against USA Gymnastics, Boy Scouts of America, and the Weinstein Company. Nondebtor liability releases extended this legal immunity to the people responsible for the decision-making of these organizations, as well as other organizations that helped enable the abuse.

Bankruptcy closes door after door to survivors, until their only remaining option for recourse is a coercive settlement agreement. Even if survivors are able to negotiate the agreement in their favor, insurers often fight to get out of paying. ![]() And, even if ordered to pay, many just don’t. My ex lawyers warned me that in the tiny chance that the rich and powerful allowed me to get anywhere in my lawsuit, and if a judge ordered a financial win (likely tiny) for me, the defendants would just refuse to pay it and no one would compel them to, much like our politicians and regulators do not compel companies to heed the law. There is no authority, no court, no judge, no lawmaker to help ordinary citizens collect court winnings, such is beneath our privileged judicial industry. This is intentional, just how the legal-judicial industry makes sure it perpetuates itself by bankrupting the harmed with endless horrific stress loaded delays (including dragging out releasing an ultra simple ruling for a year as the supreme court of Canada did in Ernst vs AER) and legal costs and judge ordered punishments, even in the rare times the ordinary citizen wins.

And, even if ordered to pay, many just don’t. My ex lawyers warned me that in the tiny chance that the rich and powerful allowed me to get anywhere in my lawsuit, and if a judge ordered a financial win (likely tiny) for me, the defendants would just refuse to pay it and no one would compel them to, much like our politicians and regulators do not compel companies to heed the law. There is no authority, no court, no judge, no lawmaker to help ordinary citizens collect court winnings, such is beneath our privileged judicial industry. This is intentional, just how the legal-judicial industry makes sure it perpetuates itself by bankrupting the harmed with endless horrific stress loaded delays (including dragging out releasing an ultra simple ruling for a year as the supreme court of Canada did in Ernst vs AER) and legal costs and judge ordered punishments, even in the rare times the ordinary citizen wins.![]() This process systematically delays and denies survivors compensation. In the end, bankruptcy imposes yet another series of barriers in the path of survivors who seek healing and justice.

This process systematically delays and denies survivors compensation. In the end, bankruptcy imposes yet another series of barriers in the path of survivors who seek healing and justice.

The Case for Bankruptcy & Other Optical Illusions

One of the most insidious parts of the strategic use of bankruptcy against victims is the narratives crafted to justify it.

The corporate attorneys behind these bankruptcy maneuvers maintain that bankruptcy serves the best interests of claimants. This is a lie.

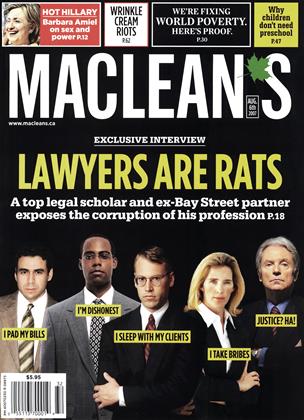

![]() Before my lawsuit, I always thought oil and gas firms and their PR consultants were the worst liars on earth; my lawsuit taught me that lawyers (including mine that I paid hundreds of thousands of dollars to) and judges take the lying cake.

Before my lawsuit, I always thought oil and gas firms and their PR consultants were the worst liars on earth; my lawsuit taught me that lawyers (including mine that I paid hundreds of thousands of dollars to) and judges take the lying cake.![]()

Over and over again, corporate lawyers try to convince the public that taking away paths to redress for victims is in everyone’s favor.

Like frac’ers and their enabling EnvNGOs, regulators and politicians telling us frac’ing improves the environment and is good for our health.

Powerful corporate lawyers argue that mass tort litigation isn’t suited for the civil legal system, where plaintiffs are subject to the whims of juries. According to them, while some plaintiffs may get large damages awards, others walk away with nothing. The fairest way to compensate claimants, they insist, is bankruptcy. They say bankruptcy leads to more consistent payouts ![]() Ya, NOTHING and bonus, bankruptcy gives rapists legal immunity for future rapes! Look out world, here come the kid raping priests! No more Slithering Silent Shuffle

Ya, NOTHING and bonus, bankruptcy gives rapists legal immunity for future rapes! Look out world, here come the kid raping priests! No more Slithering Silent Shuffle![]() across claimants, and plaintiffs aren’t forced to endure adversarial trails that may require them to take the stand. Plus, bankruptcy is arguably more “efficient” than litigation because it offers a streamlined process to resolve claims. Over and over again, corporate lawyers try to convince the public that taking away paths to redress for victims is in everyone’s favor.

across claimants, and plaintiffs aren’t forced to endure adversarial trails that may require them to take the stand. Plus, bankruptcy is arguably more “efficient” than litigation because it offers a streamlined process to resolve claims. Over and over again, corporate lawyers try to convince the public that taking away paths to redress for victims is in everyone’s favor. ![]() In my experience, even one’s own lawyers are bad for us, the truth, our lawsuits, savings and health; they compound evil harm upon evil harm. I still can’t decide which villain was the nastiest and most harmful to me: illegal aquifer frac’er – Encana, or Murray Klippenstein – my own lead lawyer.

In my experience, even one’s own lawyers are bad for us, the truth, our lawsuits, savings and health; they compound evil harm upon evil harm. I still can’t decide which villain was the nastiest and most harmful to me: illegal aquifer frac’er – Encana, or Murray Klippenstein – my own lead lawyer.![]()

Corporate lawyers have provided the following defenses of bankruptcy as a means to divert lawsuits to bankruptcy settlements:

Greg Gordon, the Jones Day partner who pioneered the Texas two-step, called the two-step the “greatest innovation in the history of bankruptcy.” Jones Day has made millions implementing the two-step for four different companies, each of which faced tens of thousands of product liability lawsuits. In response to claims that the two-step is an abuse of the bankruptcy system, Gordon has called the two-step “fair to everyone” and said, “I don’t lose sleep over [it].”

Neal Katyal, who represents Johnson & Johnson’s two-step subsidiary, LTL Management, stated that it’s not practical for the company to deal with the tsunami of talc litigation against it, and that bankruptcy is the only way to get a resolution that “protects” claimants.

Thomas Salerno, a bankruptcy lawyer at Stinson LLP, insists that bankruptcy and nondebtor releases serve the greater good, comparing them to prosecutor deals. “As distasteful as it is, bankruptcy is about recovery to creditors, monetary recovery – not about moral victory,” he said.

Representatives for USA Gymnastics claimed that filing for bankruptcy would help “expedite an equitable resolution of the claims made by the survivors of sexual abuse perpetrated by Larry Nassar,” adding that “We owe it to these brave women who have come forward.” The “it” referred to is, of course, a legal strategy to skirt actual accountability.

These statements shed light on the PR strategy companies are using to convince judges, the public, and claimants themselves that bankruptcy is the closest thing to justice. ![]() Judges could order justice done and deny the endless escapes corporations and rich rapists come up with, but they don’t and it seems they don’t even care anymore how corrupt they appear to us. Judges enable the rapes and murders, and are just as evil as the rapists, if not more so because most of them pretend (loudly) to serve “justice.”

Judges could order justice done and deny the endless escapes corporations and rich rapists come up with, but they don’t and it seems they don’t even care anymore how corrupt they appear to us. Judges enable the rapes and murders, and are just as evil as the rapists, if not more so because most of them pretend (loudly) to serve “justice.”![]() It’s true that bankruptcy settlements may give some claimants better payouts than they would get through mass tort litigation, which is far from perfect. But the narrative that bankruptcy is in the best interests of victims and survivors is patently false. Bankruptcy serves companies and the rich and powerful people who run them. Corporations’ arguments to justify bankruptcy as a superior means to settle lawsuits distort reality, reflecting a world in which they are conscientious, even benevolent, companies just trying to do the right thing for those they’ve harmed. In some ways, this narrative is the consummate act of evasion that allows them to escape accountability. These companies aren’t just legally bankrupt, but morally bankrupt too.

It’s true that bankruptcy settlements may give some claimants better payouts than they would get through mass tort litigation, which is far from perfect. But the narrative that bankruptcy is in the best interests of victims and survivors is patently false. Bankruptcy serves companies and the rich and powerful people who run them. Corporations’ arguments to justify bankruptcy as a superior means to settle lawsuits distort reality, reflecting a world in which they are conscientious, even benevolent, companies just trying to do the right thing for those they’ve harmed. In some ways, this narrative is the consummate act of evasion that allows them to escape accountability. These companies aren’t just legally bankrupt, but morally bankrupt too.![]() The judges enabling it though, are much much more legally and morally bankrupt.

The judges enabling it though, are much much more legally and morally bankrupt.![]()

The Costs of Bankruptcy

So what’s missing from this picture of bankruptcy that corporate America paints? The use of bankruptcy to “resolve” mass tort litigation impedes the broader purposes of these lawsuits: to hold responsible actors accountable and to dignify those who have been harmed. Bankruptcy has empowered the rich and powerful to evade responsibility while stripping claimants of their agency and rights. Bankruptcy scholar Lindsey Simon writes that strategic corporate bankruptcies “serve as an accelerant for the gravest due-process threats facing mass-tort victims.” The problems with bankruptcy aren’t bugs in the system. They’re intentional features that erode victims’ rights by design.

The problems with bankruptcy aren’t bugs in the system. They’re intentional features that erode victims’ rights by design.

The procedures of the bankruptcy settlement process are in and of themselves harmful to claimants. Once a company declares bankruptcy, all the lawsuits against it come to an abrupt end. The automatic stay plunges plaintiffs into uncertainty. They don’t know if their cases will ever be heard or if they will get their day in court. Bankruptcy also denies them the opportunity to learn what, exactly, happened that led to their harm.

Where justice should shine a light, bankruptcy casts a dark shadow.![]() Shadows and crimes enabled by judges.

Shadows and crimes enabled by judges.![]()

Automatic stays put an immediate pause on discovery, the process that allows parties to gather evidence to litigate their claims. In cases with stark information asymmetries (like consumers v. multi-billion dollar companies, or survivors of sex abuse v. the powerful organizations that enabled abusers), discovery is essential to understand what happened. As Juan Martinez wrote about the USA Gymnastics bankruptcy, for many “the main point of suing USA Gymnastics is not monetary, but rather to get to the truth of how the abuse continued for as long as it did and who within USA Gymnastics knew about it.”

By limiting discovery, bankruptcy preserves information asymmetries that ensures the truth doesn’t get out and protects the reputation of those responsible.

Clarity is particularly important in cases where victims have been vilified as the cause of their own undoing. Survivors of abuse, for example, are often told that that they’re misremembering, that they’re lying, that they wanted it. Litigation gives survivors access to otherwise inaccessible information showing that, in reality, they were targeted by abusers while those in a position to do something about it looked the other way. Victims of the opioid crisis have faced similar stigma and denigration. It took decades, and a wave of lawsuits, for people to realize that the crisis wasn’t the fault of those who became addicted, but rather the result of a coordinated campaign to exploit addiction for profit.

Many of those who have used bankruptcy to dodge lawsuits for misconduct have continued to deny any wrongdoing. The Sackler family is adamant that they have always acted lawfully and ethically. Mallinckrodt and its chief executive have denied that they engaged in any impropriety in their distribution and sales of opioids. Johnson & Johnson maintains that its talc-based baby powder does not contain any cancer-causing asbestos.

Using bankruptcy, corporations get to eat their cake and lie about it too.

Where justice should shine a light, bankruptcy casts a dark shadow.

The House Judiciary Committee recently proposed the Nondebtor Release Prohibition Act to stop companies from gaming the bankruptcy system. Given the political power of corporate America, however, it’s unlikely to pass anytime soon. And even if it did, corporate lawyers would continue to develop other legal strategies to undercut plaintiffs. Until the legal profession steps up to check the corporate capture of law, the rich and powerful will be able to pursue profit with impunity.

***

Oppression through Litigation, David vs Goliath: How Corporate Interests Dominate Civil Appellate Litigation & What We Can Do About It, A gap in access to expert appellate legal representation has enabled wealthy corporations to shape the legal landscape to their benefit. Plaintiff-side appellate litigators are trying to change that by Simone Unwalla, January 31, 2023, The [F]law

When someone sues a corporation for violating their rights, the path to success isn’t easy.![]() Notably when even one’s own lawyers are working against you (while eagerly pocketing your life long savings and using your suffering and case to further their careers and fatten their already too fat egos) pushing settle and gag to protect the abusive lying status quo.

Notably when even one’s own lawyers are working against you (while eagerly pocketing your life long savings and using your suffering and case to further their careers and fatten their already too fat egos) pushing settle and gag to protect the abusive lying status quo.![]() In courtroom dramas on TV, the story usually ends when the jury comes back from their deliberations and finds in favor of the brave individual who took on the corporate giant.

In courtroom dramas on TV, the story usually ends when the jury comes back from their deliberations and finds in favor of the brave individual who took on the corporate giant.

In real life, the plaintiff doesn’t get to celebrate their victory after winning a big trial. Instead of the screen fading to black, the real-life plaintiff must shift their focus to the next obstacle: the appeal. This is another round of litigation in front of a new audience, the appellate court. Appeals present a particular challenge to individuals seeking accountability from powerful, wealthy corporations. Corporate defendants have teams of legal experts that specialize in winning appeals and developing the law in the process. Plaintiffs typically don’t. The imbalance drives case outcomes and produces a body of legal precedent that heavily favors corporate interests.

This article explores the gap in expert appellate representation that is transforming our legal landscape and restricting the ability of individuals to secure justice when they are victims of corporate harm. Plaintiffs’ lack of access to appellate representation has systemic consequences, and the issue deserves more critical attention. In this moment – when business interests are influencing our courts more successfully than ever before – appellate representation on behalf of plaintiffs can do an enormous amount of good. Law students interested in appellate work should be aware of this imbalance and its consequences, and legal institutions should do more to encourage careers working on behalf of plaintiffs on appeal.

Litigating Against a Corporation

Tom Sobol is a prominent plaintiff-side litigator and the President of Public Justice – a nonprofit legal advocacy organization dedicated to fighting abuses of corporate power. He spent the first 17 years of his career, however, working in a large corporate law firm. “The bulk of my work was to represent corporate interests, or moneyed, interests.

In that role, the primary thing that you do is try to create roadblocks.” Tom describes civil corporate defense as a very deconstructive kind of lawyering. “Every single thing you do as a defense lawyer is intended to drag the litigation out. Everything you do. If somebody says, ‘Can you get back to me tomorrow?’ You get back to them next week. If somebody says, ‘Can you be available on this day?’ You can’t be. If a court sets a hearing, you’re not available. Ever. If there’s an opportunity to seek to take an interlocutory appeal, you seek to take the interlocutory appeal.” In Tom’s words, dragging things out is “absolutely thoroughgoing” in everything that civil corporate defense lawyers do. Some of the firms that defend corporate interests pay their attorneys to do just this. “Some of my competitors got incentive awards if their case went on for a certain period of time. They were actually getting paid to delay litigation.”

Working on behalf of plaintiffs and against powerful corporations is very different. “One thing that I learned when I went over to work on the plaintiff side, is that it’s all creative,” Tom told me. “It’s all about trying to make sure that everything gets put together the right way, and that everything goes forward. You’re really trying to do what you can to get to the substance of a dispute and not spend as much time getting held up by way of procedural issues.![]() My ex lawyers, especially Klippenstein, and the judges at all levels of court hearing preliminaries on my case, seemed to be serving the defendants, delaying for them even more than the defendants and my own lawyers worked to delay. Mighty dirty when you’re taking on a massive corporation and its enablers, even more dirty when your own lawyers and the judges were working against you, the rule of law and that illusion called justice.

My ex lawyers, especially Klippenstein, and the judges at all levels of court hearing preliminaries on my case, seemed to be serving the defendants, delaying for them even more than the defendants and my own lawyers worked to delay. Mighty dirty when you’re taking on a massive corporation and its enablers, even more dirty when your own lawyers and the judges were working against you, the rule of law and that illusion called justice.![]()

David Seligman’s work on behalf of plaintiffs in Aurora, Colorado, exemplifies this dynamic. For eight years, David has been litigating a class action suit against GEO Group—a corporation that runs for-profit detention centers under contract with U.S.Immigration and Customs Enforcement (“ICE”). In Colorado, GEO Group allegedly forced detainees to perform unpaid labor under threat of solitary confinement. David is arguing, on behalf of current and former ICE detainees who were confined in the facility, that the company violated federal human trafficking law and unjustly enriched itself off of forced detainee labor. After nearly a decade of pre-trial litigation, the GEO Group case is finally expected to go to trial in the spring of 2023.

“These cases can be really, really, really expensive,” David explained. “On the defense side, your client is paying; they’re footing the bills all along. On the plaintiff side, that’s not happening. Sometimes you’re not getting paid at all, sometimes for years. ![]() I paid my lawyers in full, all along. And kept my trust account full to the amount Klippenstein demanded which was initially $100,000.00 out of the blue, after telling me he couldn’t charge me because my case was in the public interest. Even paying in full, whenever he demanded (I often had to cash in my RRSPs at a massive loss to pay Klippensteins and keep my trust account where he demanded it) only got me shit service that stabbed me and my drinking water in the back. And one highly stressful day, Klippenstein had the fucking condescending sexist gall to tell me to get a pedicure and relax (no way could I afford such, while paying for a lawsuit and driving two hours to haul water).

I paid my lawyers in full, all along. And kept my trust account full to the amount Klippenstein demanded which was initially $100,000.00 out of the blue, after telling me he couldn’t charge me because my case was in the public interest. Even paying in full, whenever he demanded (I often had to cash in my RRSPs at a massive loss to pay Klippensteins and keep my trust account where he demanded it) only got me shit service that stabbed me and my drinking water in the back. And one highly stressful day, Klippenstein had the fucking condescending sexist gall to tell me to get a pedicure and relax (no way could I afford such, while paying for a lawsuit and driving two hours to haul water).![]() And that does, unfortunately, put people in a position where they must settle cases and move towards settlement, maybe prematurely.” This is one of the systemic pressures that enables wealthy corporations to shape the legal landscape to their benefit over time. Plaintiffs often trade off on the possibility of winning a case and producing “good law” due to financial pressures. Corporations can throw money at a dispute and settle it if it might produce “bad law” for them, and they can afford to litigate a case for years and years if they think it has the potential to produce “good law” for corporate interests.

And that does, unfortunately, put people in a position where they must settle cases and move towards settlement, maybe prematurely.” This is one of the systemic pressures that enables wealthy corporations to shape the legal landscape to their benefit over time. Plaintiffs often trade off on the possibility of winning a case and producing “good law” due to financial pressures. Corporations can throw money at a dispute and settle it if it might produce “bad law” for them, and they can afford to litigate a case for years and years if they think it has the potential to produce “good law” for corporate interests.

The GEO Group lawsuit was first filed in 2014, and David and his team have been fighting non-stop in the years since to overcome pre-trial hurdles so that the case can be heard on the merits – that is, the actual issue of whether GEO Group violated the law. One of these pre-trial hurdles included getting the class of detainees “certified” by a court and then defending that certification on appeal in front of the Tenth Circuit Court of Appeals. Unlike most legal issues, class certifications can be appealed before a case ever goes to trial through a mechanism called an interlocutory appeal (and remember what Tom told us: if there’s an opportunity to seek to take an interlocutory appeal, corporate defense attorneys always seek to take the interlocutory appeal). Unsurprisingly, GEO Group sought the appeal.

The certification question got kicked up to the appellate level for review, and the case was paused until David and his team won the appeal. A seven-year study of these kind of appeals shows that plaintiffs tend to do worse than defendants both in getting appellate courts to agree to hear their claim and in convincing appellate courts to rule in their favor. This pattern is observed across the legal field: civil plaintiffs tend to do worse on appeal. There are various potential explanations for plaintiffs’ low appellate success rates, and the best evidence we have suggests that there’s a link between plaintiff losses and the plaintiff-defendant gap in access to specialized appellate representation.

David’s organization, Towards Justice, handles appeals in the way that most small plaintiff-side practices do. “If it’s your case, you argue it all the way up. You’ll file the complaint, you’ll do the discovery, and you’ll argue the appeal,” David explained. This is starkly different than what goes on at the corporate defense firms that David often litigates against. At big law firms, experienced appellate specialists take over the briefing and argument on appeal. “It’s really rare for a plaintiffs’ shop to have something like that,” David explained. “That experience matters.” There is a major imbalance between civil plaintiffs and defendants when it comes to expert appellate representation. As a Stanford Law Review article observed, the lack of available appellate representation on the plaintiff-side is particularly acute in cases in which an individual sues a corporation. Law firms with appellate practices are often willing to take on pro bono cases representing plaintiffs, but big firms are typically unwilling to take on plaintiffs who are challenging corporate interests.

Conservative Origins of this Appellate Imbalance

This imbalance in appellate representation between plaintiffs and corporate defendants didn’t occur by accident. The development of a specialized field of appellate advocacy that heavily favors corporate interests is a result of a coordinated mission by the conservative business lobby starting in the 1970s. In 1971, corporate lawyer Lewis Powell wrote a letter to the head of the education committee of the U.S. Chamber of Commerce, urging the Chamber to combat the growing influence of public-interest litigation groups by launching a “multifront lobbying campaign on behalf of business interests, including hiring top business lawyers to bring cases before the Supreme Court.” In what is now famously known as the ‘Powell Memo,’ he laid out a plan to coordinate conservative, pro-business interests and to utilize appellate courts as a crucial arena in which corporations could advance their agenda:

“Strength lies in organization, in careful long-range planning and implementation, in consistency of action over an indefinite period of years, in the scale of financing available only through joint effort, and in the political power available only through united action and national organizations… [T]he judiciary may be the most important instrument for social, economic and political change… This is a vast area of opportunity for the Chamber, if it is willing to undertake the role of spokesman for American business and if, in turn, business is willing to provide the funds.”![]() Holy shit, that’s even dirtier than my own lawyers betraying me and the public interest.

Holy shit, that’s even dirtier than my own lawyers betraying me and the public interest.![]()

Two months later, Lewis Powell was appointed to the Supreme Court by President Nixon. ![]() I’ll never understand why lawyers think the self-regulated Canadian judicial industry is not corrupted by politicians that appoint dirty judges to the bench. Perhaps magical thinking is required to keep lawyers taking pay cheques against the public interest, against ordinary citizen litigants, and against a livable planet for lawyers’ kids.

I’ll never understand why lawyers think the self-regulated Canadian judicial industry is not corrupted by politicians that appoint dirty judges to the bench. Perhaps magical thinking is required to keep lawyers taking pay cheques against the public interest, against ordinary citizen litigants, and against a livable planet for lawyers’ kids.![]()

A few years later, the Chamber established the National Chamber Litigation Center to litigate on behalf of business interests across the judiciary. ![]() How especially vulgar. Now my view of judges is even worse than what I directly experienced from them, notably their smears and lies, and horrific delays and tricks that stank with the obvious. The stench made worse by Klippenstein trying to make me lie to the public and say Canada has a great “justice” system and wonderful judges during my speaking events and interviews.

How especially vulgar. Now my view of judges is even worse than what I directly experienced from them, notably their smears and lies, and horrific delays and tricks that stank with the obvious. The stench made worse by Klippenstein trying to make me lie to the public and say Canada has a great “justice” system and wonderful judges during my speaking events and interviews.![]() The Chamber’s strategy was highly coordinated and exceedingly effective (especially at the Supreme Court). It identified cases that could advance business interests and offered moot court arguments for the lawyers arguing them. It hired highly respected appellate advocates to convince the Court to hear more business cases. And it filed amicus – ‘friend of the court’ – briefs on behalf of corporations litigating their own cases. When law firms started developing specialized appellate practices of their own, the Chamber coordinated the strategy of those lawyers in the most important business cases. From a bird’s eye view, the Chamber was deciding which cases had the capacity to bring long-term strategic advantages to corporate interests, and they were devoting time, resources, and expertise to ensure victory.

The Chamber’s strategy was highly coordinated and exceedingly effective (especially at the Supreme Court). It identified cases that could advance business interests and offered moot court arguments for the lawyers arguing them. It hired highly respected appellate advocates to convince the Court to hear more business cases. And it filed amicus – ‘friend of the court’ – briefs on behalf of corporations litigating their own cases. When law firms started developing specialized appellate practices of their own, the Chamber coordinated the strategy of those lawyers in the most important business cases. From a bird’s eye view, the Chamber was deciding which cases had the capacity to bring long-term strategic advantages to corporate interests, and they were devoting time, resources, and expertise to ensure victory.

Today, the Chamber’s success in the Supreme Court serves as a good proxy for quantifying how coordinated, specialized appellate representation shapes our legal landscape. The Chamber’s win/loss ratio at the nation’s high court – a whopping 70% – is staggering, but the group’s influence is more insidious than that. The Constitutional Accountability Center (“CAC”) tracks the success of corporate interests at the Supreme Court by monitoring the Chamber’s broader influence. Its findings reveal a troubling pattern.

First, in selecting cases for review, the Supreme Court rarely reviews lower-court victories for business interests. This maximizes the opportunities for the corporate lobby to undo unfavorable lower-court decisions while minimizing those opportunities for the people who challenge corporate wrongdoing. Second, when the Supreme Court does side with plaintiffs against corporate interests, it generally does so in narrow, cabined decisions. Meanwhile, the Court “regularly issues landmark rulings that fundamentally transform the law in favor of corporate interests.” The result is devastating. As the CAC concluded, “this lopsided pattern means that year after year, efforts to promote corporate accountability or restrain harms caused by industry generally tread water, at best, while big business repeatedly enjoys seismic victories that reshape the legal landscape in its favor.”

What’s at stake here is not just big wins in big cases. Instead, it’s the very landscape of our law and the legal tools available to hold powerful actors accountable for inflicting widespread harm. In his seminal 1974 article, “Why The ‘Haves’ Come Out Ahead,” Marc Galanter described the phenomenon that we’re seeing play out: repeat players have the capacity to play for rules in litigation instead of just playing for short-term gains. The resulting body of precedent cases – which then influence the outcome of future cases – are skewed in favor of those repeat players. The Chamber has successfully coordinated litigation efforts across the judiciary to play for rules that help corporations entrench their power and evade accountability. There’s no comparable force on the plaintiffs’ side.

How Appellate Expertise Influences Courts

To appreciate the systemic consequences of the gap in appellate representation, we should consider how appellate work differs from trial work and what makes appellate expertise so influential.

Michael Dreeben is an appellate expert who served in the Solicitor General’s Office for more than 30 years and has argued over 100 cases in the Supreme Court. He currently co-runs Harvard Law School’s Supreme Court and Appellate Advocacy Workshop, where he helps students understand how appellate courts are influenced by advocates and how advocates can participate in the process of developing the law. In describing how an appellate advocate’s skills differ from those of a trial lawyer, Michael explained, “the task in appellate litigation is to explain, develop, and apply law, and the kinds of things that you need to do in interacting with law are a little bit different than what you need to do in developing facts at the trial level. It’s a specialized audience. Understanding the constraints and priorities of an appellate court is different from thinking about how to persuade a jury.”

Adam Hansen and Colin Reeves work at Apollo Law, a plaintiff-side appellate firm that represents employees and consumers who challenge corporate wrongdoing. Apollo’s mission is to do much of what the civil defense bar has been doing at the appellate level. As Adam described it, Apollo’s goal is “to collaborate with trial lawyers, nonprofit lawyers, and academics in order to pick and choose cases in a way that’s going to have a meaningful impact on the on the body of legal precedent for the types of folks that we represent.” Adam and Colin described the key benefits of having an appellate specialist working with a trial team on appeal. “Appellate specialists can see the law differently. They can understand how the appellate court is approaching the law, what they care about, and what they don’t care about. They can see around the next corner and understand where the law is headed, where the judges might be interested in pushing the law, or where the judges might be tempted to put on the brakes. Having that institutional background knowledge tends to be very valuable.” Both Adam and Colin – like many appellate specialists – previously worked as clerks in federal appellate courts. As Colin explained, “clerkship experience provides insight into what clerks and judges are like and what kinds of arguments and ways of framing a case might work for them. We’re thinking in those kinds of terms and trial attorneys are not.”

Michael Dreeben expressed a similar sentiment regarding the impact of specialized appellate advocates. “In a great many cases, it doesn’t matter who the advocates are. So long as the briefs are above minimum, the judges will do the work and get it right. But in many important cases, success stems from judgments about what arguments to make and what arguments to drop, seeing developments in law over time and projecting them outward, and borrowing analogies from one area to another area of law. An appellate specialist is more likely to do those things than a generalist.”

These accounts align with the data that’s out there on the impact of specialized appellate representation: empirical studies suggest that access to expert appellate representation often determines who wins and who loses. There’s also evidence indicating that appellate expertise has a powerful peripheral effect on our legal landscape, aside from directly impacting who wins and who loses. One way is through simple name recognition. A 2004 study based on interviews with 70 former Supreme Court law clerks found that 88% of clerks lent more careful consideration to amicus briefs filed under the name of a reputed, repeat-player appellate advocate. Being an experienced appellate player can also impact how courts use cited precedent. A 2013 study of Seventh Circuit Court of Appeals decisions suggests that an attorney’s prior appellate experience (or lack thereof) often influences whether the court will use the precedents that were cited in the attorney’s brief, regardless of who won the case. Even when they lose, attorneys with appellate experience are more likely to see the court’s opinion address the precedents they raised positively. Through the identification of relevant precedents, appellate advocates can shape the contours of a court’s opinion, even in defeat.

Plaintiff-side appellate specialist Deepak Gupta has written on this plaintiff-defendant gap, and he summarizes the issue well: “Whether through skill, name recognition, or a combination of the two, having a repeat-player appellate advocate on your side seems to make a difference. By extension, plaintiffs should be concerned when only their opponents have access to this reservoir of talent and influence.”

Increasing Appellate Representation for Plaintiffs

Some firms and non-profits on the plaintiff-side are working to remedy this imbalance, but the endeavor is no small feat. Adam from Apollo Law described the ways in which the defense side is still far ahead. Much of it comes down to coordination. “The defense side is beating us in two respects. First, they’re making better decisions about which cases to appeal.![]() I bet extreme religions and republican judges are helping, on the sly.

I bet extreme religions and republican judges are helping, on the sly.![]() Oftentimes, when defendants lose at trial they just pay and move on. When defendants do choose to appeal, most of the time there’s a substantial issue there. There’s some real risk that the plaintiff could lose. The plaintiffs, by contrast, appeal a lot more often, especially when they lose. Plaintiffs tend to generate a lot more losses in the appellate courts for that reason.”

Oftentimes, when defendants lose at trial they just pay and move on. When defendants do choose to appeal, most of the time there’s a substantial issue there. There’s some real risk that the plaintiff could lose. The plaintiffs, by contrast, appeal a lot more often, especially when they lose. Plaintiffs tend to generate a lot more losses in the appellate courts for that reason.”

Decades of organizing by the business lobby has enabled it to avoid these kinds of losses. The Chamber of Commerce’s Institute for Legal Reform works with private firms to coordinate activity and files amicus briefs to urge courts to reject cases that could make bad appeals. There’s no comparable force on the plaintiffs’ side with the resources and authority to prevent plaintiffs from taking on doomed appeals. The body of legal precedent – the appellate cases that set the legal rules for future disputes between individuals and corporations – tends to favor corporate defendants as a result.![]() In my view, in today’s judicial industry in North America, it appears corporations are favoured in every legal matter, no matter how many they kill, how much they contaminate, or with what deadly “forever” chemical. Judges’ pensions ride on corporate profit by rape and pillage, and deceit (so do self regulators’ and cops’). It seems judges and lawyers think they are above the limitations of their bodies in our increasingly toxic cesspool of pollution and the earth’s growing limited ability to sustain life.

In my view, in today’s judicial industry in North America, it appears corporations are favoured in every legal matter, no matter how many they kill, how much they contaminate, or with what deadly “forever” chemical. Judges’ pensions ride on corporate profit by rape and pillage, and deceit (so do self regulators’ and cops’). It seems judges and lawyers think they are above the limitations of their bodies in our increasingly toxic cesspool of pollution and the earth’s growing limited ability to sustain life.![]()

The second way the defense side is out-coordinating plaintiffs involves their ability to identify and overturn key plaintiff wins. According to Adam, “when the plaintiffs win and the defendant does take it up on appeal, the plaintiffs’ counsel often don’t appreciate the risk.” It’s natural to assume that, after you’ve won at trial, winning the appeal will be a slam dunk. “Oftentimes, yes,” Adam acknowledged, “but that’s not always the case.” Overall, “the civil defense bar does a really good job of evaluating the appeals and bringing in appellate counsel at the appropriate point for the cases that they are strategically picking to push. While the plaintiffs’ bar does the same thing, I don’t think we’re doing quite as effectively,” Adam concluded.

Deepak Gupta provided a blueprint for leveling the playing field on appeal and strengthening the plaintiff-side appellate bar, and his firm Gupta Wessler plays a vital role in this space, especially when it comes to litigating on behalf of plaintiffs at the Supreme Court. The solution to the appellate imbalance requires increased coordination among existing plaintiff-side players, and it also requires changes at the legal education stage.![]() Which means academia and the self regulators of lawyers will make sure those changes do not happen. Corporate donations conquered control of education/academia years ago; politicians will do nothing to fix that corruption because retirement plans of politicians ride on profit by rape and pillaging corporations too. Legal and judicial ego and greed is rampant.

Which means academia and the self regulators of lawyers will make sure those changes do not happen. Corporate donations conquered control of education/academia years ago; politicians will do nothing to fix that corruption because retirement plans of politicians ride on profit by rape and pillaging corporations too. Legal and judicial ego and greed is rampant.![]()

A Call to Law Schools and Law Students

One of the factors stunting growth in plaintiff-side appellate work has to do with how legal institutions orient students as they start their careers. During his first year at Harvard Law School, Matt Jones noticed the prevalent interest in appellate litigation among his peers. “I asked myself, does anyone here not want to do appellate litigation?” Despite this popularity, it’s relatively rare for students to pursue plaintiff-side appellate work. The vast majority of law firms that Harvard hosts during its on-campus interview program are corporate firms, and there’s a general sense that success is defined by working at a big corporate defense firm. For the past three years, students in the Harvard Plaintiffs’ Law Association have organized their own plaintiffs’ law job fair, but there’s been no significant institutional support for the endeavor.

“The more stakeholders that recognize that this is a thing, the better,” Adam emphasized. “There may be law students as well as lawyers, practitioners, and law professors who are just unaware of this space in the legal market as a matter of first principle. Getting the word out and letting people know that this is a part of the legal labor market and this is an area that people can practice in… That’s an enormous part of solving this imbalance.” When asked about legal education, Adam and Colin agreed that there’s more law school outreach to be done.

The dearth of talent in this practice area also stems from internal pressures. “The people who would be best positioned to be plaintiff-side appellate practitioners are top law students who go to top law schools and who have good clerkships,” Adam explained. “Those people have a lot of options, and they particularly have a lot of options that are economically secure.” On the plaintiff-side, work is often contingency-based. You can have just as much success representing plaintiffs, Adam assured me, but “you need to be the kind of lawyer who is comfortable with risk. You need to have something of an entrepreneurial bone in your body.” Those two characteristics, high levels of success in law school and an entrepreneurial spirit, seem to have a strangely small overlap. “There’s something about being a good student in law school and having a lot of offers and opportunities that almost causes an atrophy to the entrepreneurial muscle,” Adam explained. Students tend to think: ‘I have all these great opportunities in front of me, so I’m just going to take the one that’s the most stable and traditional.’

Tom Sobol also recognized the dissonance that occurs in the minds of students who attend elite educational institutions. “I’ll see people who got an extraordinarily fantastic private grammar school education, who go to a wonderful private high school and have gobs of money spent on them to get a great education. They go to a fantastic college, go to one of the great Ivy League law schools, and clerk for a judge. They come out of all of that, and do you know what their contribution to society is? Dragging out litigation and creating roadblocks as corporate defense attorneys. Their job, day in and day out, is to avoid adjudication on the merits.”![]() So gross, and so incredibly unjust.

So gross, and so incredibly unjust.![]()

Of course, many people graduate from law school with a mountain of debt that can make career options seem limited. Many law students find it nearly impossible to turn down more traditional and economically stable routes to success (especially when they come with a standard $215,000 starting salary). However, attending an elite law school like Harvard also gives students the power and privilege to choose something different. Having that name on your resume opens doors. It gives you the ability to take risks, and it gives you the safety of knowing you’ll likely be able to land on your feet if things don’t go according to plan.

There has long been a flawed (but persistent) myth that there is only one reputable path to success in the law: working at a big corporate law firm. “A lot of people over a lot of years have internalized that idea and then woken up one morning and realized they were taking other people’s expectations and pretending that they were their own. There’s finally some pushback against that idea,” Adam told me. “You can do plaintiff-side appellate work and have an outstanding career. We could use more people doing it, and we need more people thinking about it.” As I finished up my conversation with the lawyers from Apollo law, Adam’s last point was this: “To the bright people who are interested in appellate work, don’t be afraid to be a bit more entrepreneurial. Don’t be afraid to be a bit more risk taking. As this practice area matures, the value and benefits should become even more self-evident to even more people.”

If you pick up any law school brochure, the pages will likely be flooded with rhetoric about “pursuing justice” through your legal career. Justice seems to be the central promise of law school![]() Those attending law school believing that promise need to learn human nature and the abusive exploitative toxic way of humanity. There is no justice in the human world, most especially not in the legal and judicial industries (people need to remind themselves that rats hiding as lawyers become rats sitting on the bench as judges

Those attending law school believing that promise need to learn human nature and the abusive exploitative toxic way of humanity. There is no justice in the human world, most especially not in the legal and judicial industries (people need to remind themselves that rats hiding as lawyers become rats sitting on the bench as judges![]() , but it’s not always the guiding principle around which law students build their careers. For those who are passionate about using their legal practice to develop the law and promote justice, plaintiff-side appellate litigation is an area where there’s important work to be done. Leading firms and nonprofit groups are working to combat the appellate advocacy imbalance between plaintiffs and corporate defendants, and law students and legal institutions should follow their lead.