Shale Driller Sells Leases for Third of What It Paid in 2014 by David Wethe, March 24, 2021, Bloomberg Markets

Ovintiv Inc., the shale oil producer recently pressed by an activist investor to cut its debt load, agreed to sell drilling rights in South Texas to Validus Energy for $880 million.

The price tag is less than one-third of the $3.1 billion Ovintiv paid Freeport-McMoRan Copper & Gold Inc. in 2014 to acquire the assets in the Eagle Ford, one of the two busiest shale fields in the Lone Star State.

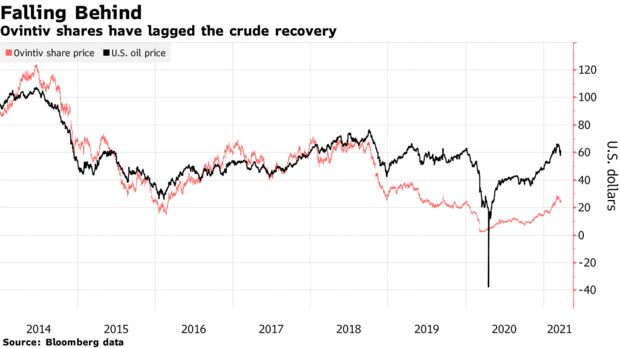

The decline in value of the assets highlights the challenges faced by the shale industry over the intervening years. Oil and gas prices have slumped in that time and many companies, including Ovintiv, have struggled to generate sustainable free cash flow and returns for their shareholders.

The poor track record spurred Kimmeridge Energy Management Co. to launch a campaign against Ovintiv in January, releasing an 18-page presentation that argued the company was falling behind its peers as a result of misguided spending, expensive acquisitions, poor governance and inadequate environmental stewardship.

Kimmeridge agreed earlier this month to drop its push to nominate directors to Ovintiv’s board after the company appointed Katherine Minyard to its board, established a debt reduction target, and aligned its executive compensation with the debt plan and efforts to cut methane emissions.

Ovintiv said Wednesday that with the Eagle Ford deal and the sale announced last month of assets in Canada for $263 million, it has now exceeded its target of $1 billion in divestments. It now expects to achieve its target of cutting debt to $4.5 billion by the middle of next year rather than the end of 2022 as forecast last month.

Shares of Ovintiv pared earlier gains after the Eagle Ford deal was announced and closed little changed at $23.81.

Refer also to: