New laws could pump billions of dollars into Permian Basin’s rapidly growing water recycling industry by Sergio Chapa, Aug. 2, 2019, Houston Chronicle

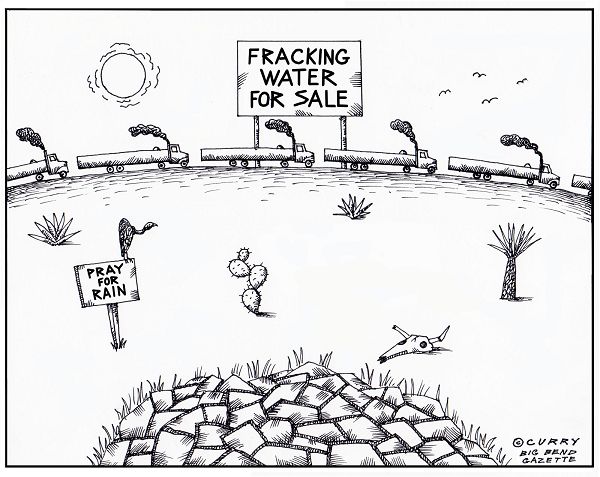

Whether by pipeline tanker, truck or hose, more water is moving around the arid Permian Basin than crude oil at any given moment.

Water has become the lifeblood of the modern energy industry with hydraulic fracturing using high-pressured slurry of water, sand and chemicals to unlock oil and gas from shale formations in Texas and across the country. In the arid Permian Basin, the nation’s most productive oil field, drilling and fracking operations consume more than 195 million gallons of water per day in West Texas and southeastern New Mexico — enough water to fill nearly 300 Olympic-sized swimming pools.

All this has made water and water management in the Permian a big business that’s only expected to get bigger, following the recent enactment of three laws in Texas and New Mexico, the two states encompassing the sprawling oil basin. The laws, which essentially clarify water rights issues and encourage the reuse of water, could pump billions more dollars of investment into the region’s rapidly growing water recycling industry.

At least a dozen water recycling companies operate in the Permian Basin, according to the Houston research firm Simmons Energy, and they are attracting increasing interest from from private equity firms and other investors. In December, Houston oilfield water company WaterBridge Resources secured up to $800 million in private equity money to add more water pipelines and disposal facilities.

So far this year, companies have made more than $2.5 billion of water-related mergers, acquisitions, private equity investments and other deals in the oilfield, according to the global energy research firm Wood Mackenzie.

Those deals only expected to accelerate as the new laws take effect. Last week, the Midland oil company Concho Resources entered into a joint venture with the Houston water management firm Solaris Water Midstream with the aim of recycling more wastewater from the oil field. Financial terms were not disclosed.

“Encouraging recycling makes sense,” said Mark Patton, president of the Conroe oilfield water recycling company Hydrozonix. “Everything you recycle is that much less water that goes into disposal wells. You’re keeping it in the hydrological cycle on the surface for a lot longer.”

****

Reality checks:

AEA: Support to the identification of potential risks for the environment and human health arising from hydrocarbons operations involving hydraulic fracturing in Europe

A proportion (25% to 100%) of the water used in hydraulic fracturing is not recovered, and consequently this water is lost permanently to re-use, which differs from some other water uses in which water can be recovered and processed for re-use.

Canada’s NEB: A Primer for Understanding Canadian Shale Gas – Energy Briefing Note

Flow-back water is infrequently reused in other fracs because of the potential for corrosion or scaling, where the dissolved salts may precipitate out of the water and clog parts of the well or the formation.

End reality checks.

****

Three New Laws

Wastewater is produced in the oil field in two main ways, through fracking, which uses millions of gallons of water for each well, and drilling, which brings up brackish water left behind by the ancient inland sea that covered central North America in the days of the dinosaur. As many as 15 barrels of water are produced for each of the 4.2 million barrels of oil per day that come out of the Permian.

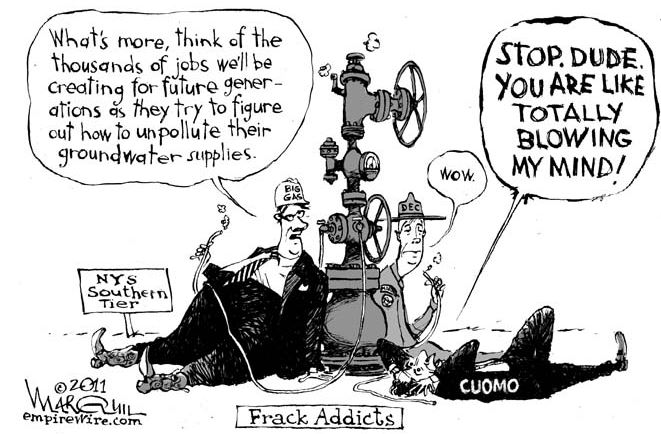

What to do with all that water has become a problem, particularly in the Permian, where the vast amounts of wastewater — most of it pumped underground into deep disposal wells — are testing the geological limits of the basin. Disposal wells also are blamed for the increase in earthquakes in areas near oil and gas fields, particularly in a 50-mile corridor between Fort Stockton and Pecos.

Texas and New Mexico legislatures began addressing water issues in the oilfield this year. Although the states share the Permian Basin and various aquifers, they vary greatly on water laws.

Texas is a capture state, in which a landowner can drill a water well and keep or sell all the water captured. Following the Spanish colonial tradition and because of its large amounts of state and federal land, New Mexico is a water rights state, in which government issues a permit setting the parameters of how much water can be drawn.

The different approaches to water rights created a gray area and raised new legal questions about the wastewater — called produced water — that comes to the surface with oil and natural gas. Specifically, if produced water can be treated, sold and reused, who owns it? Could a Texas landowner claim it as theirs under rule or capture? Or could the government claim it under water rights in New Mexico?

Passed into law this spring, New Mexico House Bill 546 and Texas House Bill 3246 determined that oil and gas operators own the produced water and they could sell it to recyclers, who then take over legal responsibility for the toxic brine. The New Mexico law went into effect on July 1 while Texas law goes into effect on Sept. 1.

John Tintera, president of the oil industry trade group Texas Alliance of Energy Producers, said 50 water management companies of all types — pipeline operators, disposal companies, recyclers — operate in the Permian Basin. Over the past year, Tintera said he has fielded up to a dozen calls from private equity firms each seeking to invest $100 million in Permian Basin water operations but questions about who owned produced water led them to hesitiate.

“This transfer of ownership was one of the things that had been identified as a potential risk for investors,” Tintera said. “At what stage, does who own what? These statutes clarify that. It’s a green light to bring those investment dollars in. We’re open for business.”

‘Ocean Under The Desert’

During the first two months of an oil well’s life, most of the water that comes to the surface is known in the industry as “flow back,” water used during the drilling and hydraulic fracturing process. But after that, most of the water that comes up as already present inside the geological formation.

With the Permian Basin part of an inland sea during prehistoric times, the decayed organic matter that became oil and natural gas over millions of years is also locked underground with ancient sea water that has become hypersaline and mixed with hydrocarbons, heavy metals and other [radioactive] compounds.

“There’s an ocean under the desert in the form of this produced water but it’s a very salty brine that can be used for very little else outside industrial uses,” said Jason Jennaro, CEO of Breakwater Energy Partners.

Headquartered in Houston, Breakwater buys and moves freshwater to drilling and hydraulic fracturing sites. The company also recycles around 7 million gallons of produced water per day.

The treated water is reused in the oil field, meaning that companies do not have to find new sources of fresh water in the desert region.

Although recycled water is still a proverbial drop in the bucket for the Permian Basin’s overall water consumption, Jennaro believes the new laws in Texas and New Mexico will change that.

“It’s a sea change of regulation that will open the door to much more recycling across the Permian Basin,” Jennaro.

New Mexico Advantage

Recycling has an economic advantage on the New Mexico side of the Permian Basin where the Houston company Solaris Water Midstream has emerged as the largest independent water recycler. Solaris Water CEO Bill Zartler said freshwater for oilfield operations costs generally 40 to 65 cents per barrel on the Texas side of the Permian Basin compared to $1 to $2.25 per barrel sourced in New Mexico.

With recycled water selling for 75 cents to $1.25 per barrel, it is more economical for operators to recycle in New Mexico. The company’s Pecos Star System, Lobo Ranch and Bronco facilities in New Mexico receive produced water from nearby operators, treat it and if needed, blend the recycled water with non-potable water before sending it back out for use in the oilfield.

“We’re not talking about water going to drinking standards or even irrigation standards, because there’s still a lot of salt left in it,” Zartler said. “But with today’s frac chemistry, the salt is not as big of an issue.”

Big business

Just as the recycling technology varies from company to company, so do the deals.

Ryan Duman, a senior analyst with Wood Mackenzie, said some oil companies that sold their water pipelines and disposal wells took off those assets off their balance sheets but keep the rights to the services. Others prefer to hold equity into the water companies that they divested into.

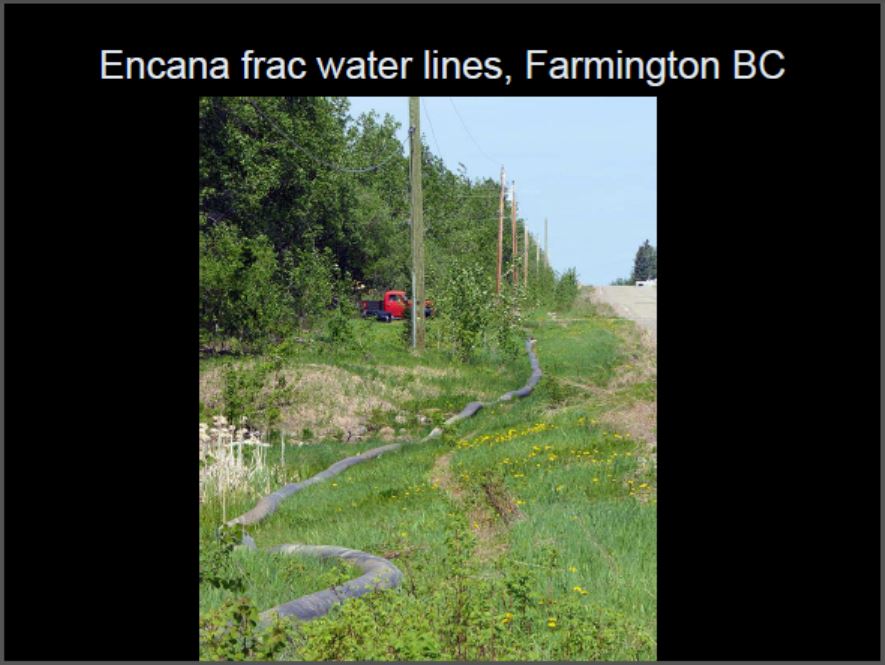

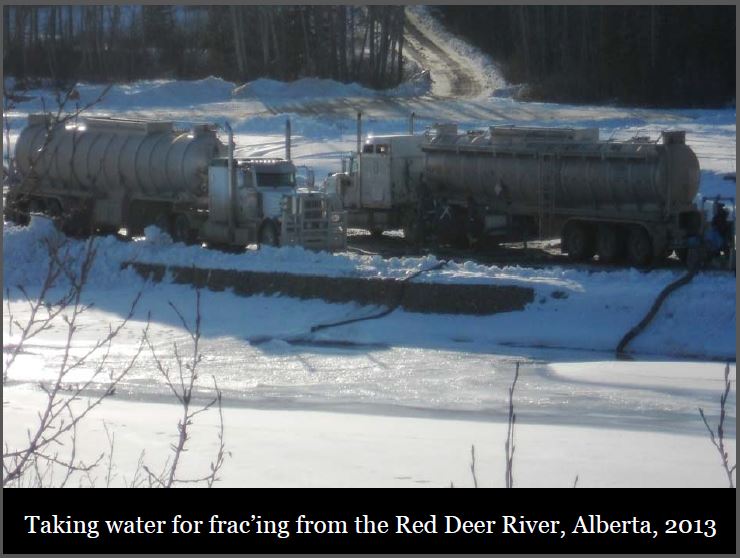

In Canada too (many thanks to Will Koop of BC Tap Water Alliance and others for the photos below):

Water being taken for frac’ing from Alberta’s famous Bow River

But no water bans for frac’ers! Just for fire fighting, towns and families

AER Frac Pilot Project: Earthquakes, tax increases, water restrictions, double homicide, spills and accidents shake Alberta town’s faith in fracking; Aging sour facilities in deregulated Fox Creek a big worry for council; AER’s FracQuake Red Light stops Chevron only 16 days; Families moving out

Alberta issues 40 water shortage advisories while continuing to let frackers inject hundreds of millions of gallons fresh water losing much of it from hydrogeological cycle forever. Worse, Notley Govt is subsidizing frac industry’s water abuses while making frac contaminated families live without safe water