Reality Check Questions:

Bit player (like Pieridae, Binko and Ikkuma), Trident Resources, folded two years after buying 4,700 wells from massive Husky Energy in a deal financed by AIMCo.

Bit player Pieridae’s insane purchase of Shell’s $10Billion in sour gas liabilities was also financed by AIMCo.

Question #1: Is AIMCo being used by Alberta politicians to relieve major players of their reclamation obligations by financing the sale of the depleted resources accompanied by massive liablities to companies that are already either shaky and or have limited track records?

Question #2: Given that it is most likely impossible for Pieridae to be profitable beyond the 5 year guarantee of Shell buying their product and the risk that Pieridae follows Trident to bankruptcy, is AIMCo (and Alberta teachers’ pensions, etc) being used to expand the orphan well problem and or delay any remedy to it?

Malcolm Mayes cartoon in Edmonton Journal, Nov 2019

Question #3: Given the track record of bit players taking over depleted operations going broke, is AIMCo (supposedly the Alberta public’s savings account) intentionally being set up to take on the reclamation obligations?

End Reality Check Questions

THE AIMCo STENCH (SORRY TEACHERS ET AL, YOU HAVE MY CONDOLENCES, YOU WORKED HARD FOR YOUR PENSIONS):

Pieridae and AIMCo Agree to Extend Term Loan and Convertible Debenture Maturity Press Release by Pieridae Energy Ltd., September 30, 2019, Global News Wire

Pieridae Energy Limited (Pieridae or the Company) (TSXV: PEA) announces that Alberta Investment Management Corporation, on behalf of certain of its clients, and Pieridae have agreed to extend the maturity date of both (a) the $50 million senior secured term loan facility (the “Term Loan”), as described in the news release issued by the Company on December 18, 2018, and (b) the $10 million secured convertible debenture, as described in the news release issued by the Company on July 2, 2019, from September 30, 2019 to the earlier to occur of (i) October 16, 2019, or (ii) the day on which an acceleration notice is delivered, or deemed to be delivered under the Term Loan. This revised maturity date will align with Pieridae’s closing of its proposed acquisition of certain midstream and upstream properties from Shell Canada Energy as described in the news release issued by the Company on June 26, 2019 which Pieridae expects to occur on or before October 16, 2019.

About Pieridae

Founded in 2011, Pieridae, a majority Canadian owned corporation based in Calgary, is focused on the development of integrated energy-related activities, from the exploration and extraction of natural gas to the development, construction and operation of the Goldboro LNG facility and the production of LNG for sale to Europe and other markets. Pieridae is on the leading edge of the re-integration of the LNG value chain in North America. Pieridae has 86,713,713 common shares issued and outstanding which trade on the TSX Venture Exchange (PEA).

For further information please contact:

Alfred Sorensen, Chief Executive Officer

Telephone: (403) 261-5900

James Millar, Director, External Relations

Telephone: (403) 261-5900

WAS AIMCO’S SHELL-PIERIDAE SOUR GAS MARRIGAGE STENCH BREWING ON KENNEY’S REPORTEDLY ILLEGAL TAKE OVER OF THE UCP?

Ikkuma Resources Obtains Financing and Provides Activity Update Press Release by Ikkuma, November 15, 2018, EnergyNow Media

November 14, 2018 CNW, TSX Venture Exchange: IKM-V

CALGARY, Nov. 14, 2018 /CNW/ – Ikkuma Resources Corp. (“Ikkuma” or the “Corporation“) is pleased to provide an update on financing and its recent activity.

Ikkuma is pleased to announce that it has completed a financing for a $20 million senior secured term loan (the “Term Loan“) with Alberta Investment Management Corporation (“AIMCo“). The Term Loan bears annual interest at 9.5% and matures on the earliest of the closing of the Corporation’s proposed business combination (the “Business Combination“) with Pieridae Energy Limited (“Pieridae“) [!!!!!!!!!!!!!!!!!!] and March 31, 2022. Proceeds from the Term Loan will be used to repay the currently drawn balance of $4 million on the Corporation’s existing syndicated credit facility and will allow the Corporation to proceed with its flow-through drilling program of $12 million to be spent by December 31, 2018.

The focus of the flow-through program will be on drilling locations associated with the Corporation’s Central Alberta foothills asset acquisition that was completed in the fourth quarter of 2017. Two drilling rigs have been commissioned for the flow-through drilling program; the first of which has commenced operations.

As a result of completing the Term Loan with AIMCo and repaying all outstanding bank debt, the Corporation has terminated its amended and restated syndicated credit agreement with its banking syndicate.

As previously announced on July 5, 2018, Ikkuma entered into a purchase and sale agreement to sell certain midstream assets in the Alberta foothills (the “Infrastructure Asset Sale“) for a total consideration of $23 million. The Infrastructure Asset Sale, which was under review in conjunction with the Business Combination with Pieridae, has now been terminated.

“AIMCo continues to provide Ikkuma with exceptional financial support in this very difficult oil and gas market and allows us to proceed with our flow-through program as well as positioning Ikkuma to complete our upcoming business combination with Pieridae.” says Tim de Freitas, Ikkuma’s President and Chief Executive Officer.

A Management Information Circular and Proxy Statement with respect to the Business Combination is now expected to be mailed to Ikkuma shareholders on or before November 19, 2018 with a special meeting of shareholders scheduled to be held on December 17, 2018.

About Ikkuma Resources Corp.

Ikkuma Resources Corp. is a diversified growth-oriented public oil and gas company listed on the TSX Venture Exchange under the symbol “IKM”, with holdings in both conventional and unconventional projects in Western Canada. The Corporation is focused in the Foothills Region of Western Canada with a team that has extensive experience in the area with the unique skills at successfully exploiting a complex and potentially prolific play type. Corporate information can be found at: www.ikkumarescorp.com.

AIMCo STENCH THICKENS AND SOURS, HOLD YOUR BREATH:

Briko Energy Developing Cardium Light Oil Assets by Briko Energy, June 2019

Page 2: Briko Energy Corp. commenced operations in December 2018 as a result of a plan of arrangement with Ikkuma Resources Corp. and Pieridae Energy Limited.

Briko is an Alberta company focused on the acquisition and development of Cardium light oil in the Alberta Foothills….

Page 10:

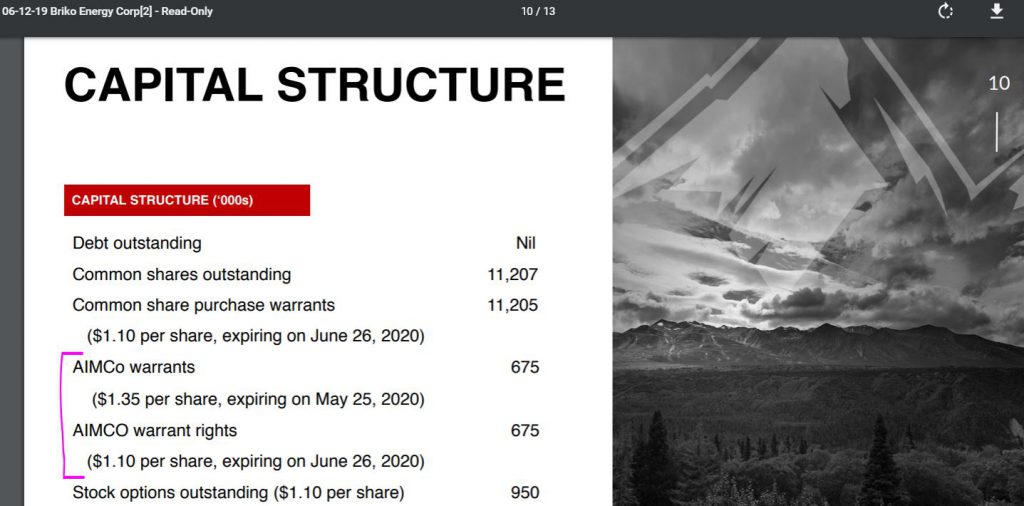

CAPITAL STRUCTURE [IN THOUSANDS!]

… AIMCo warrants 675 ($1.35 per share, expiring on May 25, 2020)

AIMCO warrant rights 675 ($1.10 per share, expiring on June 26, 2020)

Page 11:

NEAR-TERM MILESTONES

…

• Generate approximately $1 million of cash flow in 2019 (net of G&A expenses)

• Assess availability of incremental capital to finance a sustainable development drilling program [no such thing as “sustainable” drilling, especially not in formations that require frac’ing]

Public Interest in the Transfer of Licenses from Shell Canada to Pieridae Energy? by Shaun Fluker, November 7, 2019, ablawg.ca

PDF Version: Public Interest in the Transfer of Licenses from Shell Canada to Pieridae Energy?

Matters commented on: AER Public Notice of Applications 1925399, 1925400, 1925403, 1925404, 1925405, and 1925406

On November 5 the Alberta Energy Regulator (AER) posted notice of six applications made by Shell Canada to transfer well, pipeline and facility licenses to Pieridae Alberta Production Ltd. While it is hard to discern from the AER information portal what is actually proposed, it would appear these license transfers relate to the disposition by Shell of its foothills sour gas assets to Pieridae Energy. These assets include wells, pipelines, and associated facilities in the Waterton, Jumpingpound and Caroline gas fields west and southwest of Calgary.

This brief comment asks (1) whether the AER should conduct a public interest hearing to assess what measures should be imposed by the AER to eliminate the risk of unfunded liabilities associated with the abandonment and reclamation of these aging sour gas facilities, and (2) should the Attorney General exercise its parens patriae jurisdiction in this case.

Unlike the much-publicized cases such as Redwater Energy where trustees and the AER fight over the scraps left behind by a bankrupt company, this is a scenario with solvent parties and an opportunity for the AER to proactively address the risk of unfunded clean-up liabilities.

In this case assets are being transferred from an energy giant, Shell Canada, to a relatively small company with approximately $75 million in share capitalization which – perhaps ironically – trades as the symbol PEA on the TSX Venture Exchange. At the time this asset transaction was disclosed in July, it was reported that Pieridae hopes production from these foothills assets will feed its proposed, and yet-to-be financed, $10 billion LNG project in Nova Scotia. Pieridae’s 2019 third quarter interim financial statements state the company has a working capital deficit, negative cash flow, and needed to raise capital to make its $10 million deposit to Shell in July for this transaction (see notes 2 and 3 in the financial statements).

One wonders how much money a junior energy company in this financial position will be able to set aside in Alberta to ensure these fields are cleaned up at the end of their productive life? Or will Alberta taxpayers be left with the clean-up bill? As we all know, the price-tag on the reclamation of existing oil and gas facilities in Alberta is staggering and the number of orphaned facilities left for taxpayers to clean up continues to grow.

The AER information portal invites persons who believe they may be directly and adversely affected by these applications to file a statement of concern with the Regulator on or before 4pm on December 5, 2019. In light of the potential financial risk to Alberta taxpayers, and given that the AER’s standing rules effectively make it impossible for an ENGO to qualify, and the dire state of Alberta’s current finances, the Attorney General should file a statement of concern to protect the public interest! [Fat chance of that happening. The AG is part of the problem – the UCP!] Statements of concern filed in relation to these applications would assist the AER in deciding whether to conduct a public hearing on these applications. There is no doubt that Alberta needs to find a solution to the problem of unfunded liabilities associated with clean-up in the oil and gas sector, and a quasi-judicial hearing on these applications might be a good start in this regard.

MUST READ! AFTER EX-AG JODY WILSON-RAYBOULD’S PETTY NASTINESS, THIS WINS FOULEST SELFISH STENCH OF 2019! Pieridae Appoints New Chief Financial Officer by Pieridae Energy Ltd., November 12, 2019, EnergyNow Media

November 12, 2019 Globe Newswire

New CFO Well-Positioned to Take Company to the Next Level

CALGARY, Alberta, Nov. 12, 2019 (GLOBE NEWSWIRE) — Pieridae Energy Limited (“Pieridae” or the “Company”) (TSXV: PEA) is pleased to announce the appointment of Mr. Rob Dargewitcz as Chief Financial Officer (“CFO”) of the Company. Mr. Dargewitcz began his new role on November 11, 2019.

“We are excited to officially welcome Rob to our leadership team as our new CFO,” said Pieridae CEO Alfred Sorensen. “He did a stellar job in helping to secure the financing needed to close the transformational Shell asset acquisition. After helping to raise $10 billion to construct the North West Redwater refinery, Rob’s skill set is well positioned to bring in the larger financing needed to build Pieridae’s Goldboro LNG Project.” [AIMCo AIMCo AIMCo? Is this one of the reasons why Kenney needs to take away pension funds from hard working Albertans and hand them over to AIMCo? To fund hot air projects?]

Sorensen adds that Mr. Dargewitcz’s strong and proven leadership of the Company’s finance team will continue to strengthen the Company’s financial controls, helping Pieridae become a true mid-cap company as it looks to graduate to the TSX. [Roaring laughter! Sadly, many idiotic investors will fall into the greed trap!]

Mr. Dargewitcz spent 15 years working at Shell Canada Limited (“Shell”) where, among other responsibilities, he successfully managed the financial profitability of Pieridae’s newly acquired Foothills assets. [Laughing so hard, I’m about to lose my teeth! GOOD THING ALBERTANS ARE AS GREEDY AS THEY ARE, MOST WILL BITE SHELL’S STINGY MEASILY $2 MILLION BRIBE AND FALL FOR THE CON]

Mr. Dargewitcz has been interim CFO of Pieridae since August 2019, having previously been Senior Vice President of Finance and Risk Management.

Mr. Dargewitcz has over 20 years of experience in the Energy sector including five years prior to Pieridae as Treasurer of North West Redwater Partnership (“NWRP”), where Mr. Dargewitcz helped to lead the financing of their $10 billion Upgrader/Refinery project in Alberta.

$ REALITY INTERLUDE:

“The NWR Sturgeon Refinery seemed like a good idea on paper,” said a news release from the university’s School of Public Policy, “[but] Albertans are on a very long-term hook for a refinery unlikely to ever make money.”

END $ REALITY INTERLUDE.

Prior to NWRP, Rob spent 15 years with Shell where he had several positions over the years including: Senior Manager of Mergers, Acquisitions & Commercial Finance; Treasurer; Business Manager – Foothills Gas; Senior Economist – Oil Sands; and various other financial positions in all four divisions of Shell including Upstream, Downstream, Oil Sands, and Corporate. He is also a retired Army Officer, retiring with the rank of Captain from the Canadian Armed Forces after having served in the Army for five years post completion of his undergraduate degree in Economics and Commerce at the Royal Military College in Kingston, Ontario.

Mr. Dargewitcz also holds a Master of Business Administration (MBA) from the University of Ottawa and is a Chartered Professional Accountant (CPA).

About Pieridae

Founded in 2011, Pieridae, a majority Canadian owned corporation based in Calgary, is focused on the development of integrated energy-related activities, from the exploration and extraction of natural gas to the development, construction and operation of the Goldboro LNG facility and the production of LNG for sale to Europe and other markets. Pieridae is on the leading edge of the re-integration of the LNG value chain in North America. After completion of all the transactions disclosed in this news release, Pieridae has 157,459,584 common shares issued and outstanding which trade on the TSX Venture Exchange (PEA).

For further information please contact:

Alfred Sorensen, Chief Executive Officer

Telephone: (403) 261-5900 James Millar, Director, External Relations

Telephone: (403) 261-5900

***

Brilliant comment to Nikiforuk’s article below, Mr. Sawyer sums it all up:

Mike Sawyer

To wit, the massive foreign-owned Shell Canada, with over $13 Billion in revenue and ~ 8000 employees, recently sold its Foothills assets, including the Waterton, Jumping Pound and Caroline gas plants and associated gas fields, to the minuscule Pieridae Energy Ltd, with a 2018 net income loss of $34.9 Million and 5 employees. Shell’s Foothills assets including three of the largest and some of the oldest sour gas plants in Alberta and have an estimated environmental liability of ~ $10 billion, an impossible liability for a peanut sized company like Pieridae to assume. This transaction has been raised in front of the Alberta Energy Regulator which needs to approve the transaction but the Alberta taxpayer is likely to get stuck with this enormous liability. Again.

Crazy Days in Alberta: The Poison Wells File, The province let oil and gas firms create a $100-billion disaster. They expect you to foot the bill by Andrew Nikiforuk, Dec 16, 2019, The Tyee

Every day something crazy happens in Alberta to illustrate how thoroughly oil politics have eroded the province’s grip on reality.

Judy Aldous, who hosts a province-wide CBC Radio noon show, recently devoted an hour to one particularly crazy item — orphaned and unreclaimed wells in Alberta.

Guest Gary Mar, CEO of the Petroleum Services Association of Canada, argued that federal taxpayers fund tax credits for the oilpatch worth $700 million over three years to help pay for the cleanup.

“All Canadians benefited from this industry and all Canadians should be part of the solution,” he said.

An average listener unaware of the history of the province’s derelict well, pipeline and gas plant liability problem might have concluded Mar was being reasonable.

But Mar, a former provincial Conservative cabinet minister, was really asking for taxpayer’s money to make up for 43 years of misrule by Tory governments. They created the current crisis by failing to require oil and gas companies to provide security deposits to cover their cleanup responsibilities, and by allowing them to put off remediation of inactive wells indefinitely.

That’s how crazy the situation has become in Alberta. Taxpayers are being asked to pay for the failures of government and oil and gas companies by a former politician whose party was responsible for the problem.

(For the record, companies can’t get away with that kind of irresponsible nonsense in some other jurisdictions. New Mexico and North Dakota both require upfront deposits and timely reclamation for inactive wells. )

It’s a massive problem.

The province has 107,000 wells that produce less than 10 barrels a day and are depleted beyond profitability. It has another 93,000 inactive wells — not producing at this time — and another 77,000 abandoned ones that have been plugged but not reclaimed. All need to be cleaned up.

Bankrupt energy companies have already walked away from 3,500 orphan wells.

More than 40 per cent of the oil and gas wells in the province are not pumping hydrocarbons or generating revenue. Many are leaking methane, CO2, radon or hydrogen sulphide into the air, ground or water table.

The cost of cleaning up the sites and decommissioning the wells can range from tens of thousands of dollars to hundreds of thousands, depending on their age and type.

In a 2018 presentation, Robert Wadsworth, vice-president of closure and liability for the scandal-plagued Alberta Energy Regulator, estimated that the cleanup liability for the province’s 400,000 oil and gas wells was likely at least $100 billion. Pipelines, he added, represented another $30 billion unfunded liability.

But the Alberta Energy Regulator has only collected $226 million in security deposits to pay for cleanup if companies declare bankruptcy and won’t pay.

That’s bad news for taxpayers — and for oil and gas investors. [And they know it, and investors are thus on the run. Kenney, trying to dazzle them in London, UK, or anywhere, will bring back only farts]

The $100-billion unfunded liability, combined with low commodity prices and the high costs of hydraulic fracking in shale formations, has already scared investors away from the oil patch.

In the last four years more than 200 North American oil and gas companies (at least 30 in Alberta) have declared bankruptcy.

Laws [But, in Canada, when it comes to crimes by oil and gas industry companies, Rule of Law means nothing! Judges lie to enable the crimes] in most Canadian and U.S. jurisdictions require bankrupt or insolvent firms to cover cleanup costs before they pay unsecured creditors. As the cleanup liabilities increase, investors and some creditors face the risk they’ll get nothing. [Companies, regulators, and politicians are doing a damn find job making sure clean up doesn’t happen either. The billions in gifts from taxpayers and billions in profits keep on piling up in corporate cash accounts, with clean up budgets amounting to oilfield workers pissing in the wind]

That principle [So what, that means nothing in Canada] was affirmed in a Supreme Court of Canada ruling in January. Even Alberta Premier Jason Kenney has acknowledged that the ruling “has done so much to restrict access to both capital and credit, equity and credit, for this industry.”

The government-industry revolving door

Mar, who became president of the Petroleum Services Association of Canada in 2018, glossed over this reality in his CBC appearance.

Mar served as a cabinet minister in five different ministries in Ralph Klein’s Conservative government between 1993 and 2007. He was also the province’s representative in Washington, D.C., lobbying for oil sands projects and pipelines.

Now he has a comfortable oilpatch job. (In the petro state of Alberta, revolving doors connect government and the oil and gas industry.)

During the show Mar joked in an aw-shucks sort of way that he was a “recovering politician.” But politicians rarely recover.

In fact Mar’s industry group now pumps out overtly political press releases that read as though they had been composed by Kenney or the government’s new energy propaganda wing.

A recent release thundered that the “Oil patch braces for continued uncertainty with new federal minority government.”

It blamed forecasts of low drilling by oil and gas companies on Liberal policies — not on low methane prices or industry debt or the high cost and low returns from fracking. [and not on industry’s greed overflowing supplies causing the 2008 crash]

Trudeau may well be an unlikeable promise-breaker, but he isn’t responsible for low oil and gas prices or the notoriously unsustainable economics of fracking.

The familiar sounding press release groaned on. “It’s time our country had a vision for energy, a vision that could inspire Canadians to join together in support of our responsible energy development that benefits the lives of all Canadians.”

During the radio show Mar offered his vision for a federal bailout. He made a pitch for a $700-million resource environmental tax credit for energy corporations funded by Canadian taxpayers.

What could be more reasonable than privatizing gains — the money the companies made in the good years — and socializing costs?

Experts don’t think Mar’s request for a federal handout is honest or reasonable.

Darryl McMahon, an Ottawa-based expert on oil spill cleanup technologies, said a fund just dumps industry’s and government responsibilities on the public.

“I very much believe the cleanup costs should be paid by the industry and the provinces who collected the oil royalty revenue and should have created a cleanup fund,” he said.

[No new approvals ought to be given by the AER, without full bonds to cover all clean up and abandonments. Let them whine, let them leave. At least the billions in liabilities would stop accumulating!]

A government-created problem

During the CBC broadcast Aldous asked Mar a simple question: How much did the Alberta Energy Regulator collect over the years in security deposits for cleanup costs?

Mar said he couldn’t answer the question. He said it wasn’t in his bailiwick.

But the answer is easy to find. Alberta has a paltry $220 million in deposits to cover an estimated $100-billion liability just for plugging and reclaiming old wells. And that’s because Mar’s political party never required upfront security deposits.

The province only collects deposits — tiny ones — when companies are already heading toward failure, with liabilities exceeding their assets. [But that’s the plan! It’s intentional and Albertans keep voting for it. Notley was same as Klein or Stelmach or Harper when it came to bending over for oil and gas, perhaps worse because she pretended to be something she’s not – integral and ethical. AER and govt are enabling the rapes – environmentally and economically – just like the pope and vatican are enabling the rapes of children by priests. So are other regulators in Canada and provinces. Canadians are idiots letting companies rape out billions while shitting their leftover messes, frac’d aquifers, leaking wells, public health harms, etc on taxpayers struggling to feed and house their families (some can’t even provide safe uncontaminated drinking and bathing water).]

And the AER’s Wadsworth correctly characterized the system for monitoring liabilities as “deeply flawed.”

“For security, the problem is we collect or try to collect it when a licensee is already showing declining financial capacity,” he said.

In his presentation Wadsworth also posed a good question. “Why has there been no political will to make changes to the liability programs?”

Mar’s non-answer to Aldous’s question avoided the reality that his political party, largely funded by the industry, authored a colossal public policy failure. [Failure? It’s been — for companies and our filthy polticians — a huge success. Alberta politicians and Canadian politicians don’t work for Canadians! They work for corporations, mostly foreign owned. That’s obvious and has been for decades]

The Tory’s ruinous liability scheme has endangered the province’s credit rating. And now these dirty old wells threaten the wallets of federal taxpayers.

And they’re not the only risk.

The province’s Auditor General warned in 2015 that oil sands cleanup costs represent a $21-billion liability, but the regulator has only required the profitable industry to set aside $1.6 billion. The estimated liability has now grown to $28 billion while security deposits hover at $1.4 billion.

The U.S.-based Institute for Energy Economics and Financial Analysis recently summed up the dire nature of the industry’s cleanup liabilities across North America.

The oil and gas sector, it reported, faced severe financial stresses “stemming from low energy prices, poor financial returns, and massive amounts of outstanding debt.”

“Any additional pressures — such as climate-related legislation or litigation, or lower oil or gas demand stemming from the boom in renewable energy — could force companies to retire some of their assets far sooner than expected,” it noted.

And that would trigger the requirement for cleanup and remediation costs.

Mar was part of a government that ignored the problem for decades. [Ignored? Or fed it, gleefully? How many billions in bribes did Alberta/federal politicos get over the years?]

Now, as an employee of the industry, he wants taxpayers to foot the bill.

It is all rather convenient — and crazy.

But here’s what should be the incontestable reality:

Polluters must pay to clean up their messes before they go bankrupt.

It is irresponsible for Mar and the Kenney government to not address the failures of the province’s liability programs.

It is irresponsible to make Canadians pay for the incompetence of Alberta governments. [Incompetence or intentional set up to steal from taxpayers – Alberta and Canadian? I see it as corruption, enabled by greedy, selfish, corrupt Albertans who cowardly scream bloddy murder if anyone mentions accountability, or clean up, or regulators daring to regulate other than pump out more and more approvals, faster and faster]

It is irresponsible to let zombie oil and gas companies with few assets — the corporate walking dead — endanger the province’s economic security and credit rating.

… But don’t bank on any immediate outbreak of sanity in Alberta.

And if you are a Canadian taxpayer, hang onto your wallet. [That won’t do any good Andrew. Look at the Teachers in Alberta. Kenney already stole their billions in pension fund to give to AIMCo, sleazy investor in bankrupt frac entities]

****

Subject: No Drilling License Should Be Offered Oil And Gas Developers —Untill Our Government Holds Enough Funds To Totally Reclaim Those Leases Entirely !

Date: Wed, 18 Dec 2019 12:09:36 -0700

From: Stewart Shields email hidden; JavaScript is required

To: email hidden; JavaScript is required <>, Prime ministre email hidden; JavaScript is required, letters email hidden; JavaScript is required, Liberal Canada email hidden; JavaScript is required, email hidden; JavaScript is required, email hidden; JavaScript is required

CC: email hidden; JavaScript is required, Brian Jean email hidden; JavaScript is required, Calgary MountainView email hidden; JavaScript is required, email hidden; JavaScript is required, Doreen Mueller email hidden; JavaScript is required, Facebook , grande prairie email hidden; JavaScript is required, innisfail email hidden; JavaScript is required, Lacombe Ponoka email hidden; JavaScript is required, letters email hidden; JavaScript is required, Ministerial Unit email hidden; JavaScript is required, Prime ministre email hidden; JavaScript is required

The Alberta landscape is not changing fast enough!!! With the public stuck for lease rentals on many of these idle wells and their numbers reaching higher than 90,000 in total it is alarming for Alberta Tax payers to have $ 260 billion dollars in environmental debt held over our head??

And now our premier who lacks any sign of class has tried to blackmail our federal taxes from our federal government—to pass-on to the petro.industry for reclamation of idle wells !! Although well abandonments has outpaced new wells drilled—-Abandoned and reclamation leases have failed miserably to keep pace with the Idle Well Scandal that has shook Alberta when industry decided not to keep their promises with respect to Idle Wells??

Any government offering drilling licenses to developers– with no solid agreement on how those wells are to be treated at their end of production life —-should face Class-Action Law Results by Alberta public—for totally endangering the financial security of our province—as exampled by our Prime Minister seeking $2.4 billion in stabilization funding for oilfield reclamation that industry is refusing to provide!!

The industry have been spending large sums on buying back their allowed allotments of their private stock– and other investments rather than lowering the number of Idle wells left to rot on our landscapes??

Our “Petro-Pigeons” in the Conservative Government Of Alberta have made a Colossal-Mess of managing the Alberta Publics petroleum properties– proven to lose who have undertaken a cursory comparative to any other Petro-State!! Alberta should be capable under the present price for our petroleum products to manage our affairs without federal hand-outs!!

Stewart Shields [Brilliant and courageous, as ever Stew!]

Lacombe Alberta [Sent with the article below attached]

Oil pumpjacks and the changing Alberta landscape, For the past five years, well abandonment is outpacing drilling by Kyle Bakx, CBC News, Dec 18, 2019 [WARNING, TERRIBLE ARTICLE FILLED WITH CORPORATE LIES. Looks like right out of Kenney’s war room. PATHETIC. CBC OUGHT TO BE ASHAMED AND JOIN FOX NEWS OR TRUMP’S TWITTER ACCOUNT.]

….since 2015, more oil and gas wells in the province have been decommissioned, compared to new wells drilled. …

“Not only are we going to see the landscape start to clean up with respect to wells decommissioned and pumpjacks being taken away and land reclaimed [What a lie! Clean up is not happening. Companies are refusing to clean up unless taxpayers are made to pay! Derelict pump jacks are taking over the landscape, along with other messes, some toxic, some deadly dangerous], but the wells we will drill are fewer,” said Salkeld.

“Driving down the highway to Lethbridge or Medicine Hat and seeing pumpjacks on the side of the highway — you can see that change.” [How much money is CBC and or Mark Salkeld getting from Kenney’s war room for this?]

In addition, instead of a few dozen pumpjacks spread across an area, in some newer developments they are placed side-by-side to reduce the number of pipelines needed.

.. ‘We’re drilling less but the wells are far more complex. They’re longer, deeper and significantly more productive than the wells that we used to drill,’ [Another lie! Frac’d wells are terrible producers. Take a look at the data!] says Mark Salkeld, the past president of the Petroleum Services Association of Canada. (CBC)

SHELL FINALIZES TRANSACTION WITH PIERIDAE ENERGY LIMITED FOR FOOTHILLS SOUR GAS BUSINESS AND ANNOUNCES COMMUNITY LEGACY FUND Press Release by Shell, Oct 16, 2019, Shell.ca

Calgary- Shell Canada Energy today announced completion of the previously publicized agreement that will see Pieridae Energy Limited purchase its Foothills sour gas assets.

Effective October 17, 2019, Ikkuma Resources Corp. (“Ikkuma”), a subsidiary of Pieridae Energy Limited, will operate the Foothills assets. Shell previously confirmed the buyer will retain all site-based Shell employees and some Calgary-based Shell employees who predominantly support the Foothills assets.

The assets include three distinct sour gas plants (Waterton, Jumping Pound and Caroline) and the gas fields which feed them, as well as a portion of the Shantz Sulphur Forming Facility that is tied to the Caroline gas facility. While Shell will retain a 60% ownership interest in Shantz, Ikkuma will operate the facility on behalf of the Caroline owners. Shell will maintain its sulphur, natural gas liquids and condensate sales and marketing businesses.

“Shell has built a strong foundation of reliable, competitive and safe sour gas operations in Alberta over many decades. I want to thank the many Shell employees and contractors who contributed to the success of these assets,” [And worn the operations out with years of profit raping? How much sour gas is leaking? How much groundwater contaminated? How many sick from air pollution? How many settle and gag cases in the area by Shell?] said Shell Canada President and Country Chair Michael Crothers.

To recognize the support of longstanding Indigenous and community partners, Shell has established a $2 million legacy fund. [Bribery?] The fund will provide non-profit organizations with access to funding to continue delivering important services in local communities in the greater Foothills region through 2020 and 2021. [That’s a million a year! That’s big bribe!]

Shell maintains a strong continued presence in Canada as one of the country’s largest integrated energy companies employing about 4,000 people. Shell has a 40% share in the multi-billion dollar LNG Canada project and also maintains other upstream assets and significant downstream operations in Canada through refining and chemicals, and a growing retail business with around 1,400 Shell-branded sites across the country.

Notes to editor:

Details on the Shell Foothills Legacy Fund can be found at www.shell.ca/foothillsfund

In the last ten years alone, Shell has invested over $5 million in the communities surrounding the Jumping Pound, Caroline and Waterton sour gas complexes.

Enquiries:

Media

Shell Canada Media Relations: email hidden; JavaScript is required

Investor Relations

North America: +1 832 337 2034

Refer also to:

The Promise: Fracking brings prosperity & jobs.

Reality: Tens of thousands of oil patch workers out of work and $300 billion in liabilities.

***

Yup! AER gold standard best in the world, best in class “regulations,” guaranteed to steal from Albertans (and now trying to steal from all Canadians) while polluting us all to hell!

Ernst’s no more talk, no more study action plan

Thanks for nothing AER, Alberta Environment and Alberta gov’t! May you all rot in the new year and all years thereafter.