2012 11 28: Power of Attorney Calgary managing partner for Osler Hoskin Harcourt, Maureen Killoran, lawyer representing Encana in the Ernst vs Encana lawsuit:

And, to be perfectly frank, when you do energy law, as I do, or corporate litigation, you’re not dealing with life and death situations and people whose lives have been turned upside down, plaintiffs who are weeping. It’s just about money.

[No it’s not Maureen. No matter what any of you or my ex-lawyers or the judges do to me, I will never take money and gag.]

Cramer sees oil stocks in the ‘death knell phase,’ says they are the new tobacco by Jesse Pound, Jan 31, 2020, CNBC

- CNBC’s Jim Cramer said Friday that oil and other fossil fuel stocks are now like tobacco stocks.

- “This has to do with new kinds of money managers who frankly just want to appease younger people,” Cramer said. “We’re starting to see divestment all over the world.”

- Shares of Chevron and Exxon both fell in early trading Friday after announcing quarterly results.

WATCH AT LINK 01:59 Min.

Jim Cramer: ‘I’m done with fossil fuel’ stocks

CNBC’s Jim Cramer said Friday that he’s done with fossil fuel stocks because young investor’s concerns about climate change are holding them down.

On “Squawk Box,” Cramer compared oil and other fossil fuel stocks to the sigma attached to investing in tobacco companies, saying they are in the “death knell phase.” He added, “They’re tobacco. I think they’re tobacco.”

“I’m done with fossil fuels … they’re just done. We’re starting to see divestment all over the world,” Cramer said. “You’re seeing divestiture by a lot of different funds. It’s going to be a parade. It’s going to be a parade that says, ‘Look, these are tobacco and we’re not going to own them.’”

Cramer said there are reasons to think that some of the fossil fuel stocks look like attractive buying opportunities, but the desire of money managers and funds to avoid the sector makes him stay away.

[!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!]

The “Mad Money” host’s comments come a few weeks after BlackRock chief Larry Fink used his annual letter to the world’s biggest companies to warn that climate change will soon cause a “significant reallocation of capital.”

BlackRock, with more than $7 trillion in assets under management, will put “sustainability at the center of our investment approach,” from portfolio construction to launching new investment products that screen fossil fuels, Fink wrote.

“Look at BP; it’s a solid yield, very good. Look at Chevron; they’re buying back $5 billion worth of stock. Nobody cares,” Cramer said Friday. “This has to do with new kinds of money managers who frankly just want to appease younger people.”

[!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!]

Shares of Chevron and Exxon both fell in early trading Friday after announcing quarterly results. Chevron missed revenue expectations and saw its adjusted earnings decline, and Exxon’s earnings per share came in below what analysts expected.

Energy companies have been struggling in recent years in part due to persistently low prices for oil and natural gas.

Both Exxon and Chevron have seen their shares decline over the past year despite the broader market having one of its best runs in decades.

However, Cramer said that better financial performance for oil companies wouldn’t even turn their stocks around.

“Exxon could have reported an upside surprise, and I don’t think it would matter.”

Refer also to:

Heart-ripping must read! HOW THE ENVIRONMENTAL LAWYER WHO WON A MASSIVE JUDGMENT AGAINST CHEVRON LOST EVERYTHING

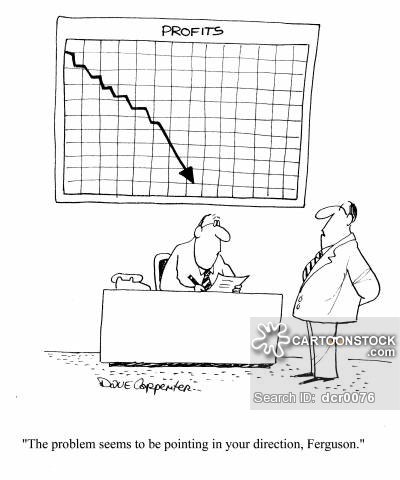

Why Encana Corp. Is Just a Big Disappointment; Stock price tanked 80% in the last 10 years

****

Happy Birthday HB! This delicious post is for you!