Refracking brings ‘vintage’ oil and gas wells to life by Reuters, August 22, 2014, The Daily Times

A fracking boom isn’t enough for U.S. oil and gas producers – they’re now starting the re-fracking boom. [Encana’s been refrac’ing its wells at Rosebud, Alberta, for over a decade. Even above the Base of Groundwater Protection, Encana refracs wells wells again and again and again]

Wells sunk as little as three years ago are being fracked again, the latest innovation in the technology-driven shale oil revolution. Hydraulic fracturing…has been troubled by quick declines in oil and gas output. The development highlights how producers must constantly invest and tinker, both to raise overall oil recovery rates that can be as low as 5 percent and to limit steep drops in production suffered by wells drilled into tight oil deposits.

Canada’s Encana Corp invested $2 million to refrack two wells in Louisiana’s Haynesville shale formation earlier this year, after seeing its production in the area dip 27 percent from 2012 levels. “There were a significant number of wells that we considered unstimulated,” said David Martinez, Encana’s senior manager for Haynesville development. Using minuscule plastic balls, known as diverting agents, pumped at high speeds with water into the old wells, most of which are three to five years old, Encana blocked some the older fractures, or cracks. “The thought is that the diverting agent will go to the cracks with the least amount of pressure,” bypassing cracks with higher pressure and boosting the pressure of the entire well so output climbs, Martinez said. He said the process can’t be as precisely controlled as an initial round of hydraulic fracturing….

…

Refracking cost Encana about $1 million per well, compared with about $12 million for wells it drilled in 2012. Encana is no longer drilling new wells in the Haynesville formation, executives said.

Since it isn’t clear how long the benefits of a refracking last, Encana plans to collect more data when it refracks five more Haynesville wells this quarter, Martinez said. If those prove fruitful it may consider expanding the practice to its holdings in the Denver-Julesburg Basin of Colorado and the Eagle Ford formation in Texas. Another Haynesville operator, Dallas-based Exco Resources Inc, said it boosted output from a 2010 refracked test well by 1.3 million cubic feet of gas per day. It didn’t say how much gas it was producing before the refracking. Average initial production from new wells Exco drilled in the second quarter was 12.9 million cubic feet per day.

Some of Exco’s Haynesville wells after four years were producing about a fifth of what they did in their first year, with output declining 69 percent that first year alone, according to the company. Exco believes the technology can be applied to 400 of its so-called “vintage” wells that were drilled several years ago using what is now outdated technology. The company is planning a refracking campaign for 2015, Hal Hickey, Exco’s president, told investors on a July 30 conference call. “We’ve been at the forefront” in the Haynesville, he said.

Marathon Oil Corp is now targeting some of its older wells in the Bakken field in North Dakota and using the latest technology, including re-fracturing, to increase crude output. Marathon owns or has a stake in about 2,300 wells in the Bakken, though it won’t say how many wells are in production. When horizontal drilling was just starting to take off in the Bakken in 2007 and 2008, “(well) completion technology was quite different than it is today,” said Lance Robertson, Marathon Oil’s vice president of North American production operations. For example, some early Bakken wells were readied for production by using a single frack stage, or a single section that creates multiple fissures in rock, and about half a million pounds of sand. Now companies use an average of 30 to 35 frack stages and as much as 6 million pounds of sand per well, Robertson said. “We go back in and use the best available technology,” Robertson said in an interview. Marathon’s refracked wells have so far exceeded the company’s expectations, delivering returns that are large enough to merit additional investment, the company said. [Emphasis added]

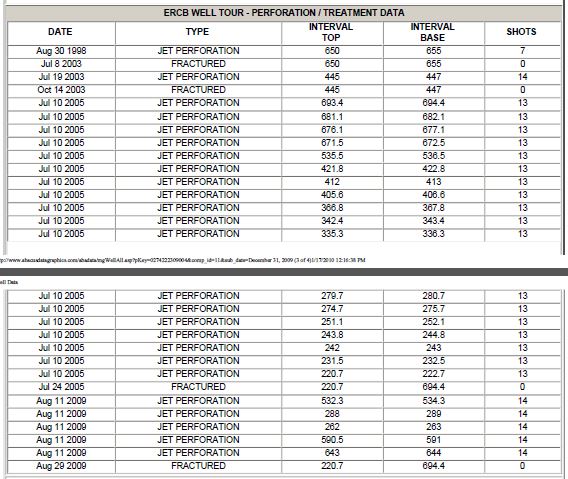

Example of a 2009 refrac of 2005 fracs by Encana, 00 09 23 27 22 W4M at Rosebud, Alberta: