Comment by a citizen in BC:

I have no words adequate to describe the planet-destroying evil that is fracking.

2004: Encana/Ovintiv illegally frac’d my community’s drinking water aquifers; politicians and authorities (AER, Alberta Environment and Alberta Health) help(ed) Encana get away with it, and worse, covered it up and kept it secret from the people.

2007: Ernst files lawsuit against Encana, Alberta Environment and AER

2011 04: Ernst lawsuit goes public.

2011 09:

2012: Encana/Ovintiv dumping its waste on foodland at Rosebud, Alberta

Fracking Firms Fail, Rewarding Executives and Raising Climate Fears, Oil and gas companies are hurtling toward bankruptcy, raising fears that wells will be left leaking planet-warming pollutants, with cleanup cost left to taxpayers by Hiroko Tabuchi, July 12, 2020, The New York Times

The day the debt-ridden Texas oil producer MDC Energy filed for bankruptcy eight months ago, a tank at one of its wells was furiously leaking methane, a potent greenhouse gas, into the atmosphere. As of last week, dangerous, invisible gases were still spewing into the air.

By one estimate, the company would need more than $40 million to clean up its wells if they were permanently closed. But the debts of MDC’s parent company now exceed the value of its assets by more than $180 million.

In the months before its bankruptcy filing, though, the company managed to pay its chief executive $8.5 million in consulting fees, its top lender, the French investment bank Natixis, later alleged in bankruptcy court.

Oil and gas companies in the United States are hurtling toward bankruptcy at a pace not seen in years…. And in the wake of this economic carnage is a potential environmental disaster — unprofitable wells that will be abandoned or left untended, even as they continue leaking planet-warming pollutants, and a costly bill for taxpayers to clean it all up.

Still, as these businesses collapse, millions of dollars have flowed to executive compensation.

Whiting Petroleum, a major shale driller in North Dakota that sought bankruptcy protection in April, approved almost $15 million in cash bonuses for its top executives six days before its bankruptcy filing. Chesapeake Energy, a shale pioneer, declared bankruptcy last month, just weeks after it paid $25 million in bonuses to a group of executives.

And Diamond Offshore Drilling secured a $9.7 million tax refund under the Covid-19 stimulus bill Congress passed in March, before filing to reorganize in bankruptcy court the next month. Then it won approval from a bankruptcy judge to pay its executives the same amount, as cash incentives.

“It seems outrageous that these executives pay themselves before filing for bankruptcy,” said Kathy Hipple, an analyst at the Institute for Energy Economics and Financial Analysis and a finance professor at Bard College. “These are the same managers who ran these companies into bankruptcy to begin with,” she said.

MDC’s listed telephone number appears to be disconnected, and repeated attempts to contact its C.E.O., Mark Siffin, and the company’s bankruptcy lawyers were unsuccessful. Whiting Petroleum and Diamond Offshore did not respond to requests for comment, and Gordon Pennoyer, a Chesapeake spokesman, declined to comment.

The industry’s decline may be just beginning. Almost 250 oil and gas companies could file for bankruptcy protection by the end of next year, more than the previous five years combined, according to Rystad Energy, an analytics company. Rystad analysts now expect oil demand will begin falling permanently by decade’s end as renewable energy costs decline, energy efficiency improves, and efforts to fight climate change diminish an industry that has spent the past decade drilling thousands of wells, transforming the United States into the biggest oil producer in the world.

The environmental consequences of the industry’s collapse would be severe.

Even before the current downturn, methane, a powerful greenhouse gas, was being released from production sites in America’s biggest oil field at more than twice the rate previously estimated, according to a recent study based on satellite data. Some experts say that with the industry in disarray, efforts to fix leaks of methane, which pound for pound can warm the planet more than 80 times as much as carbon dioxide over a 20-year period, may fall by the wayside. Low natural gas prices may lead to increases in flaring or venting, the intentional release of excess gas, the International Energy Agency said this year.

It is also likely that many companies haven’t set aside enough money, as required by law, to restore well sites to their original state. An analysis of recently bankrupt oil and gas companies’ financial statements, prepared for The New York Times, shows a funding shortfall. ![]() Have frac’ers ever heeded the law? Why bother when Friends on the Bench let them get away with breaking it?

Have frac’ers ever heeded the law? Why bother when Friends on the Bench let them get away with breaking it?![]()

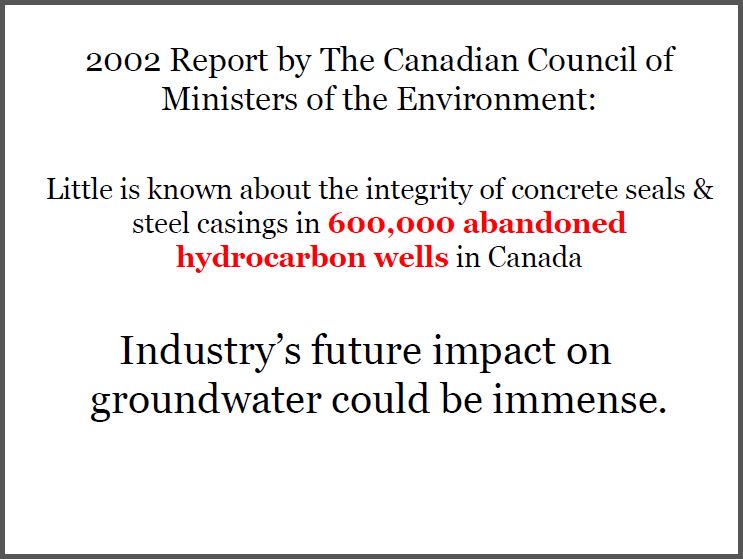

The federal government estimates that there are already more than three million abandoned oil and gas wells across the United States, two million of which are unplugged, releasing the methane equivalent of the annual emissions from more than 1.5 million cars.

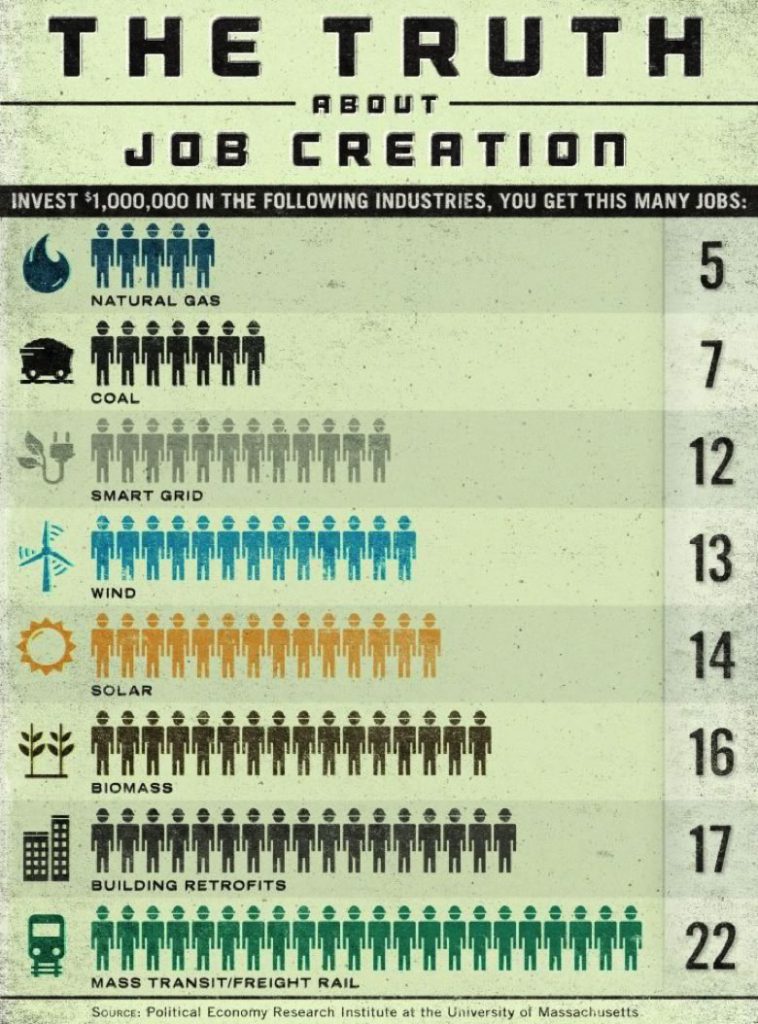

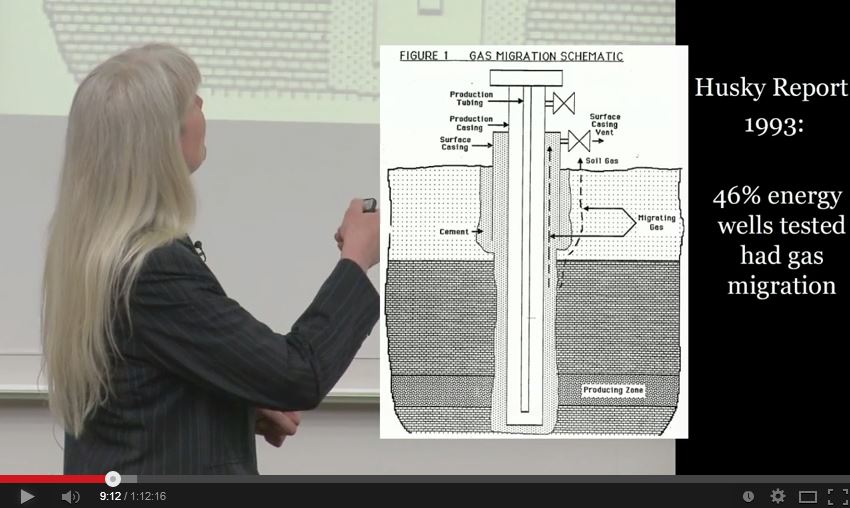

How many more abandoned wells in Canada since? That CCME report was nearly 20 years ago. Slide from Ernst presentations.

“They’re sitting there and they’re leaking. And they’re much leakier than a well that’s still in production and being monitored, although those leak, too,” said Robert Schuwerk, executive director for North America at Carbon Tracker.

“And companies haven’t been setting aside the money, because they’d rather spend the money on drilling a new well.”

Executives Reap Millions

The various business interests of Mr. Siffin, MDC’s chief executive, have included a towering skyscraper at New York’s Times Square, which once boasted an interactive “NFL Experience” space, a Hershey’s store and an LED sign several stories high. But by last fall, the building — like Mr. Siffin’s separate shale oil enterprise — was bleeding money.

In mid-November, MDC Energy filed to reorganize in bankruptcy court, and creditors foreclosed on the Times Square tower the next month. Only after the bankruptcy did Natixis, MDC’s top lender, learn of the $8.5 million payment to Mr. Siffin, the bank’s lawyer told the bankruptcy court. The fees appeared to be paid with no formal contract, Natixis alleged in federal bankruptcy court in Delaware.

They have since settled, and Mr. Siffin remains chief executive.

Bankruptcy judges have sometimes allowed companies to pay bonuses to their executives as incentives for them to stay with the company, a practice that has come under increasing scrutiny.

MDC and its lawyers did not respond to repeated requests for comment. Daniel Wilson, a spokesman for Natixis, declined to comment.

Many oil and gas companies are going through a Chapter 11 bankruptcy, which allows them to restructure or sometimes lower their debts. The process would not release them from environmental obligations — presuming there is money available to satisfy them.

As MDC Energy’s bankruptcy proceeded, so did its methane leak. Texas environmental regulators have issued six violations against MDC at the site related to harmful emissions.

An MDC operations manager who spoke on condition of anonymity said he was not allowed to spend money for repairs unless the bankruptcy judge gave permission.

Preliminary estimates this year by researchers examining the immense oil fields of Texas and New Mexico suggest a substantial increase in methane concentrations in March and April of 2020 compared with a year earlier, said Claus Zehner of the SRON Netherlands Institute for Space Research.

“Our explanation is that due to less gas demand, and companies even going bankrupt, there’s less maintenance,” Dr. Zehner said. “And there’s more uncontrolled flaring and even more venting,” he added, referring to the intentional burning of methane atop towering flares, and the release of methane straight into the atmosphere.

Despite that evidence, the Trump administration is finalizing a plan that would effectively eliminate requirements that oil companies install technology to detect and fix methane leaks from oil and gas facilities. By the federal government’s own calculations, the rollback would increase methane emissions by 370,000 tons through 2025, equivalent to what it would take to power more than a million homes for a year.

“Industry says they can reduce their emissions voluntarily,” said Sharon Wilson, a Texas coordinator for the environmental group Earthworks, who monitors leaks in the Permian and elsewhere. “But there are large emitters everywhere you look.”

Costly Environmental Toll

Denver’s Extraction Oil & Gas, founded at the start of the shale oil boom in 2012, paid 18 officers and key employees a combined $6.7 million in “retention agreements” last month. Three days later, it filed for bankruptcy protection.

Patricia Garcia Nelson, whose 7-year-old son attends school on grounds just 700 feet away from one of the company’s fracking sites in Greeley, Colo., fears the site will now be neglected.

Air pollution monitors at the school, which serves a fast-growing immigrant community, have shown that, over a period of about seven months last year, there were more than 100 periods of elevated levels of benzene, a toxic compound that can cause blood cancers such as leukemia.

“Are we going to be responsible for the mess that these companies leave behind?” Ms. Nelson said. “Are we going to be OK if something happens?”

The wells near Bella Romero are particularly contentious because they were initially planned to lie closer to a more affluent, majority-white charter school, but were moved after an outcry from parents there.

Extraction Oil & Gas has said it offered key employees bonuses after determining that its previous compensation was “ineffective in motivating and incentivizing” them, and that its operations will continue as normal through its restructuring process. The Colorado site was equipped with “air monitoring equipment and some of the best available technology,” and the company had the appropriate financial reserves to meet environmental obligations, said Brian Cain, a company spokesman.

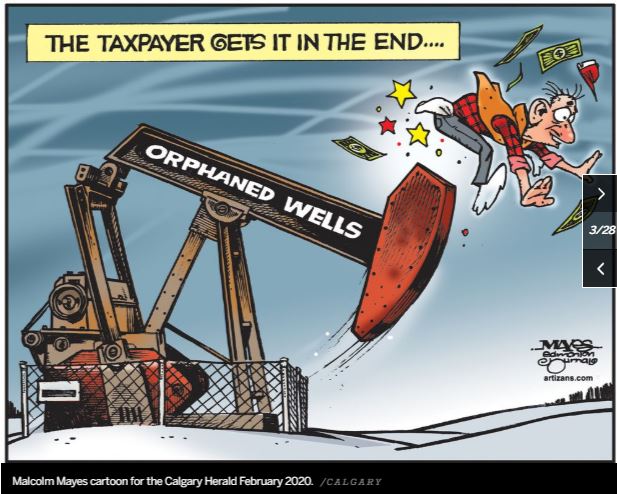

Wells Become ‘Orphaned’

Across the country, wells are already being abandoned.

North Dakota, in the heart of fracking country, has gone from zero to 336 so-called abandoned “orphan” wells in just the past two months. In New Mexico, officials have identified 708 orphaned wells, and “there is the risk for many more,” said Adrienne Sandoval, oil conservation director at the New Mexico Energy, Minerals and Natural Resources Department.

“These sites often include leaking tanks and pipelines, unremediated spills, damaged fencing, noxious weeds, erosion and other hazards that pose risks,” Sara Kendall, a program director at the Western Organization of Resource Councils, a network of community groups, said at a recent congressional hearing.

Without action, she said, the country “can expect to face an orphan well crisis with billions of dollars in taxpayer liability, with thousands of Americans forced to live with leaking orphaned wells.”

Companies are legally required to set aside funds to clean up, plug and restore wells and other sites to their original state. But accounting standards give companies wiggle room, experts say. Companies can put off plugging wells by selling or spinning them off to smaller companies. And while most states also require bonding or guarantees from drillers to plug wells, those deposits often fall short, forcing states and taxpayers to foot the bill. Those cleanups can face further delays if the government lacks the funding.

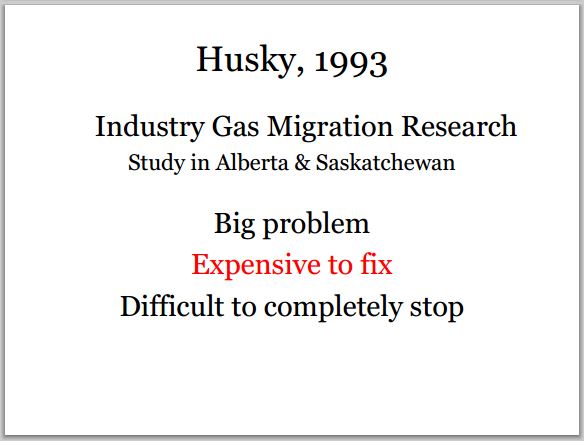

A recent report by Carbon Tracker estimated that the cost to plug a typical shale well is close to $300,000 — far higher than the estimates used by companies, regulators and financial analysts — because the wells are far deeper than conventional ones.

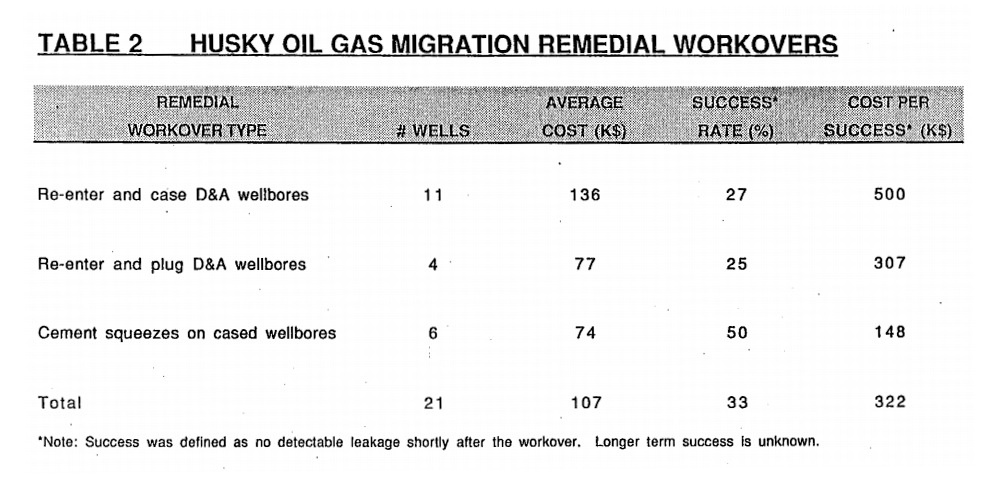

Slides from Ernst presentations. Note 1993 costs, especially “cost per success.”

Based on the new estimates, MDC, the company that paid its C.E.O. the $8.5 million in consulting fees, could require more than $40 million to clean up its 140 wells if they are permanently closed, according to an analysis by Greg Rogers, a co-author of the report and a former adviser to BP and its auditors, Ernst & Young.

Extraction Oil & Gas’s cleanup costs for its 1,000 wells could exceed $200 million, in excess of its reported liabilities, Mr. Rogers estimates. “It may be the case that many of the U.S. frackers now heading for bankruptcy were insolvent before Covid-19” if environmental liabilities were properly accounted for, he said.

Workers Injured, Lawsuits On Hold

The bankruptcies have painful consequences for some employees as well.

This past January, a crew of engineers was upgrading a well head at a Chesapeake Energy site in east central Texas when leaking natural gas ignited. Three workers died; a fourth worker sustained “catastrophic and permanent” injuries, according to a lawsuit he later filed.

Chesapeake Energy, which declared bankruptcy last month after paying out executive bonuses, might also be environmentally insolvent, Mr. Rogers estimates, with potential cleanup costs of $1.4 billion, nearly as much as its year-end market value of $1.6 billion. Chesapeake’s filings show that it has set aside only $41 million in bonds to cover the cleanup of its 6,800 wells.

Now, however, all lawsuits against the company have been put on hold by the bankruptcy process.

The families’ lawyers are pushing to resume their cases and argue that settlements should be resolved separate to creditors’ claims against the company. Chesapeake declined to comment.

“You have large corporations protecting and enriching their top executives, while they’re cutting corners and putting their companies in a death spiral,” said Ryan Zehl of Zehl Associates, who is representing Justin Cobb, who was severely injured, and the family of Wendell Beddingfield, who died in the explosion.

“Ordinary Americans, the people who need the money the most, are being left behind and neglected,” he said. ![]() Of course! That’s always been the Satan-Hailing Frac Patch & Justice Industry Way. That’s why judges and the thieving law-violating oil and gas industry polluters work so well together!

Of course! That’s always been the Satan-Hailing Frac Patch & Justice Industry Way. That’s why judges and the thieving law-violating oil and gas industry polluters work so well together!![]()

Refer also to:

2020: Alberta’s tar, oil ‘n gas patch: Piss on the law and steal from the taxman

2017:

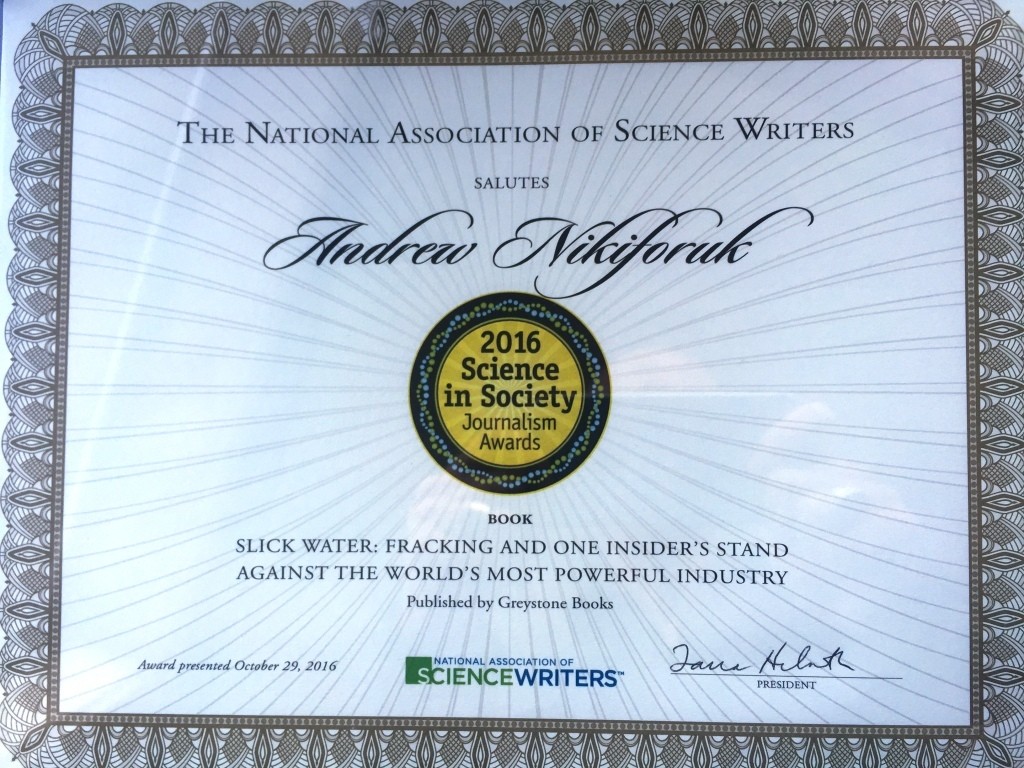

2016: Andrew Nikiforuk’s Slick Water wins USA Science in Society Journalism Award and others.

2015 09: Andrew Nikiforuk’s Slick Water is published

My water hauling tank by Encana/Ovintiv ugly piece of shit noise makers (since dumped by Encana onto a bit player company, I expect to avoid fixing the leakers, to avoid clean up and to avoid repairing our frac’d aquifers) about 900 metres from my home at Rosebud, Alberta.

I am still hauling water, 45 min drive one way, in a pandemic no less.