Shell writedown is bad news for US shale by Guy Chazan, August 1, 2013, Financial Times

Over the past few years, the oil majors have been punch drunk on US shale. Now comes the hangover. Royal Dutch Shell surprised the market on Thursday with a $2.1bn impairment, mostly on its liquids-rich shale properties in North America. The writedown showed that the results from Shell’s exploration drilling for oil in its US shale acreage have been much worse than it anticipated. “Shale oil bulls take note,” wrote Oswald Clint of Bernstein Research. The news was sobering for a sector used to upbeat headlines. Production of tight oil in places such as North Dakota’s Bakken shale has increased so fast that it has reversed the decades-long decline in US oil output, reducing America’s reliance on oil imports and even fuelling talk of US energy independence. Shell’s news shows that some of the breathless rhetoric about shale’s potential may be unwarranted – a view Peter Voser, its chief executive, appears to endorse. The idea of a shale revolution spreading from the US across the world is “a little bit overhyped,” he told reporters on Thursday.

Shale impairments are nothing new. A clutch of companies, including BHP Billiton and BG Group, wrote down their US shale gas assets last year, as the low price of American natural gas reduced the value of their reserves. But it is far less common for the oil majors to take charges on their tight oil properties. … Analysts at Credit Suisse say Shell’s performance in its upstream – or exploration and production – division is a “real worry”. Ever since the oil industry figured out how to use hydraulic fracturing or “fracking” and horizontal drilling to extract gas from shale formations, the US “unconventional” gas story has had an irresistible allure for the supermajors. Shell has been more gung-ho than most. In 2008, it paid $5.7bn to buy Duvernay Oil, which held promising tight gas acreage in western Canada. Two years later, it paid $4.7bn for East Resources. which held big positions in the Marcellus Shale. … But some analysts have said it paid too high a price to gain entry into the sector. And such a large position proved a double-edged sword last year when the shale gas supply surge pushed gas prices to 10-year lows. Shell said at the time that it would switch its focus from gas to more profitable “liquids-rich shales” and Simon Henry, chief financial officer, said the company would produce 250,000 barrels of oil a day from its tight oil properties in five years’ time. But that could end up being way too optimistic. Mr Henry admitted on Thursday that the results of Shell’s exploration efforts in US tight oil had been disappointing, and “the production curve is less positive than we originally expected”. As of today, the company is only producing 50,000 b/d from these properties, he said. Shell’s experience has been echoed by others. Oil companies who rushed to buy acreage in Ohio’s Utica shale a few years ago have discovered the rock is not as porous as in other formations such as Texas’ Eagle Ford or the Bakken, and there is less natural pressure underground to help force the oil out. Many companies are now trying to sell their holdings there. [Emphasis added]

[Refer also to:

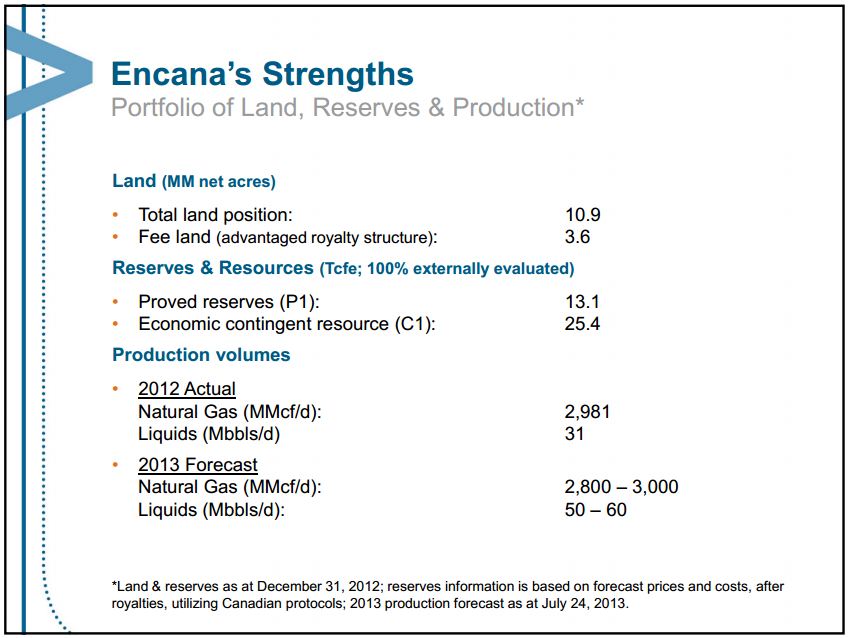

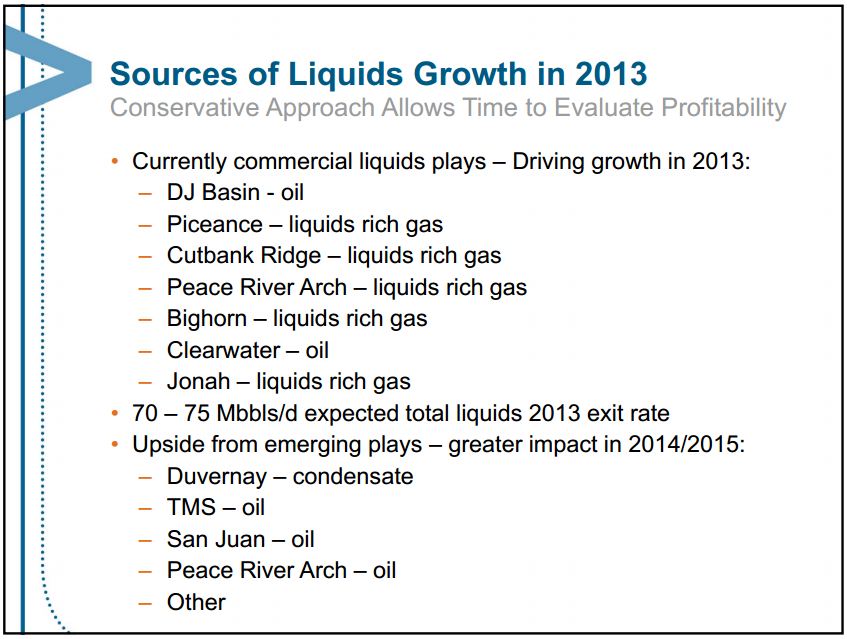

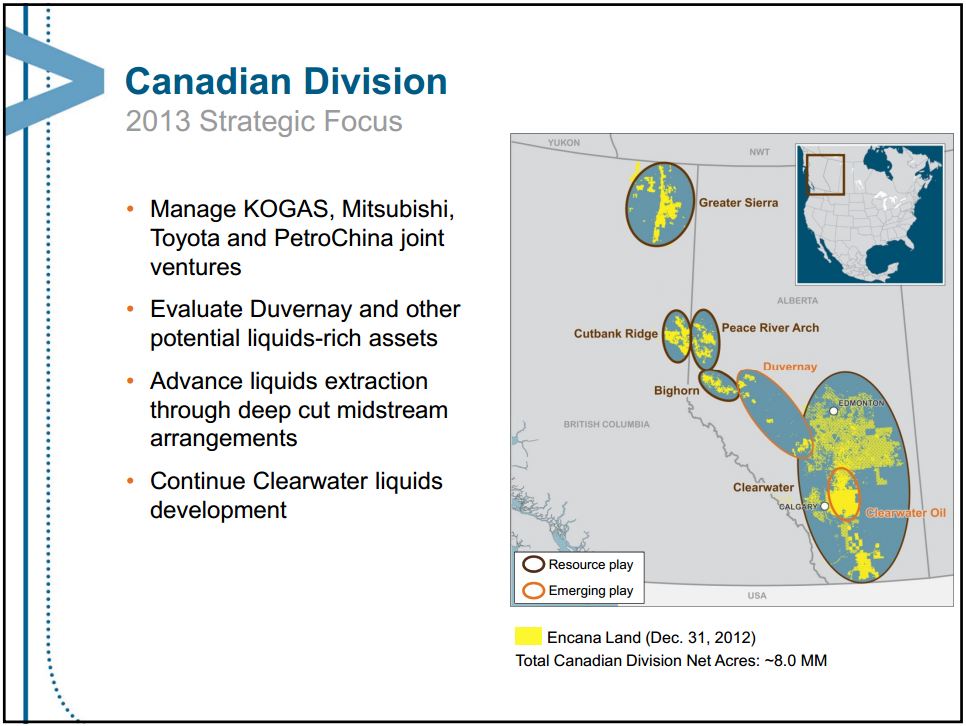

Source of slides: Encana Corporate Presentation, July 2013