Ex-boss of SNC Lavalin, Pierre Duhaime, arrested by Quebec anti-corruption unit by The Canadian Press, November 28, 2012, Calgary Herald

Quebec’s anti-corruption squad has struck at the highest levels of Canada’s corporate world and has arrested former SNC-Lavalin CEO Pierre Duhaime. The provincial police unit says Duhaime faces charges of fraud, conspiracy to commit fraud and use of false documents. Duhaime was arrested at his home early today by anti-corruption squad agents. International proceedings are also underway against former SNC-Lavalin senior executive Riadh Ben Aissa, who was already arrested in Switzerland on fraud, money laundering and corruption charges. The 101-year-old company, considered a Canadian success story, has been embroiled in scandal since the fall of the Gadhafi regime in Libya.

SNC-Lavalin shares fall on reports that former exec charged for $139M in payments by The Canadian Press, November 26, 2012, Edmonton Journal

SNC-Lavalin (TSX:SNC) shares tumbled in Monday trading following reports that the company’s former head of construction has been formally charged in relation to at least $139 million in payments in North Africa. … Swiss public broadcaster RTS, citing unnamed sources, reported that Riadh Ben Aissa faces charges, including money laundering. Swiss authorities wouldn’t confirm the report, saying details of its criminal investigation are not made public before the trial phase. … An internal review by the engineering and construction giant led to it finding $56 million of payments to unidentified foreign agents. … The company has insisted that none of the $56 million in payments were directed to Libya.

Swiss Probe $139M SNC-Lavalin Laundering Case by CBC News, November 25, 2012, Huffingtonpost.ca

Prosecutors in Switzerland have formally indicted former SNC-Lavalin executive Riadh Ben Aissa on allegations he laundered vast sums of money tied to at least $139 million in mysterious payments by the company, according to Swiss public broadcaster RTS. CBC News has also learned RCMP officials are working with Swiss police and have travelled to Switzerland to assist in the joint investigation. Citing multiple confidential sources in Switzerland and North Africa, RTS investigative reporter Yves Steiner told CBC News that Swiss authorities have tracked money flowing from the Canadian engineering conglomerate to Swiss bank accounts registered to companies in the British Virgin Islands. Some of the funds then went directly into Swiss bank accounts controlled by Ben Aïssa, Steiner said his sources told him, and Swiss officials are working with the RCMP to get to the bottom of the mystery. “Swiss investigators are interested in this network of companies and accounts, transfers that were allegedly authorized by Riadh Ben Aissa to obtain contracts in Tunisia and, especially, Libya,” RTS reported Sunday. The RCMP has not commented on these latest reports but has previously refused to answer questions, citing the ongoing investigation. Ben Aissa was arrested in Switzerland last spring and remains in jail on suspicion of money laundering and corruption of public officials related to his business dealings in North Africa. Prosecutors have also charged Geneva-based lawyer Roland Kaufman with money laundering and corruption. According to RTS, authorities accuse him of helping Ben Aissa to set up two companies, Dinova and Duvel Securities, registered in the British Virgin Islands. The broadcaster reports investigators are probing millions of dollars in payments from SNC-Lavalin to those companies’ Swiss bank accounts dating back as early as 2001. CBC News placed multiple calls to Dinova and Duvel Securites last week but was unable to reach either of the lone directors listed on the company’s registration records in the BVI.

Swiss authorities are still trying to sort out the exact movements of the $139 million, Steiner said, and have interviewed several SNC-Lavalin officials. CBC News has confirmed that some interviews were completed in April, and that Sami Bebawi, Ben Aïssa’s predecessor as head of international construction projects, flew to Switzerland last week to talk to Swiss prosecutors. “I have many, many sources who say, ‘OK, there is a system of corruption, there is a system of money laundering — or could be used for this kind of thing at least — in fact based here in Geneva,'” Steiner told CBC News.

$139M more than double what SNC audit found

The RTS report that investigators are tracking $130 million Swiss francs ($139 million Cdn) only deepens the mystery around SNC-Lavalin payments to procure construction projects given the company’s own announcement in March that audits had discovered only $56 million in improper payments. Neither Ben Aïssa’s Canadian nor his Swiss lawyer would comment on these latest allegations. Reached Saturday, Canadian lawyer Michael Edelson did say, however, that Ben Aissa is not pleased with a recently launched civil suit by his brother against SNC. On Nov. 5, orthopedic trauma specialist Rafik Ben Aissa filed a $5-million lawsuit against SNC-Lavalin accusing the company of using his brother as a scapegoat and damaging his family’s name. “SNC-Lavalin knowingly allowed and condoned the use of millions of dollars to fund lobbyists in the Middle East to get lucrative contracts with major leaders of some countries, particularly in Libya,” the suit claims. None of its allegations have been tested in court.

The company declined CBC’s request for an interview with its CEO and would not answer whether Riadh Ben Aissa could have singlehandedly approved and concealed the $139 million in payments. “We continue to collaborate in all investigations with authorities as they are pursued,” SNC-Lavalin spokesperson Leslie Quinton said in an emailed statement. “Because these investigations are ongoing and we continue to cooperate, unfortunately there is nothing further that we are able to add at this time, except to reiterate that we hope that if anyone is found to have committed any wrongdoing, they are brought to justice,” she said. The ultimate purpose of the $139 million in SNC-Lavalin payments remains unclear. However, an SNC insider — the same person who anonymously accused Ben Aissa of wrongdoing in a December 2011 “poison pen” letter to company directors and executives — told CBC News “more has to be done” within the company. “There is no way that kind of money is moved without approvals” from people still within the company, the source said. “Employees who detested the rule of Ben Aissa are sympathetic to Ben Aïssa’s [brother’s] lawsuit that claims that the management knew and encouraged his acts.

“This is not a story of foreign criminals, but a sad story of Canadian greed.”

Is Gwynn Morgan in a conflict? By Cheryl Baron, October 5, 2012, The Province

How is it that SNC Lavalin can be selected by the B.C. Liberal government as the “preferred proponent” to design and build the $1.4-billion Evergreen rapid transit line while board chairman Gwynn Morgan donated $10,000 to Christy Clark’s leadership campaign and is actively advising the premier on her transition team, and while the actual company is still under active investigation for allegations of corruption in Quebec and overseas? Another fine mess B.C. taxpayers find themselves in. Isn’t that a huge conflict of interest? Is this the last “gift” before the election in May? It would sure be nice if the legislature was in session so that these questions could be asked. Are there any RCMP who might investigate this for us?

Executives at SNC-Lavalin won’t comment on allegation $22.5M payment linked to MUHC superhospital project, ‘Investigations by domestic and international authorities continue’: board chairman Gwyn Morgan by Jan Ravensbergen, October 2, 2012, The Montreal Gazette

Neither Gwyn Morgan, board chairman of engineering giant SNC-Lavalin Group Inc., nor Robert Card, its new chief executive officer, were willing to respond Monday morning to a bombshell allegation published in La Presse that suggests $22.5 million of $56 million in mystery payments from the company’s accounts involved its McGill University Health Centre superhospital contract. “Neither of us are in a position to respond to any questions concerning these matters during today’s teleconference,” Morgan said just after 9 a.m. He spoke during opening remarks prior to a brief question-and-answer session with investment analysts and reporters, a session organized earlier to introduce Card. Morgan later rebuffed a reporter’s request for more clarity on the multiple criminal investigations under way involving SNC-Lavalin. Morgan did confirm that “investigations by domestic and international authorities continue” involving the company. “We are hopeful that these investigations will get to the bottom of any wrongdoing that may have been committed.”

…

Since mid-winter, Montreal-based SNC-Lavalin has been roiled by revelations that payments of $56 million were apparently directed, through its Tunisian office, to what the company later concluded were unknown sales agents. The fallout, to date, has included the abrupt departure of Pierre Duhaime as SNC-Lavalin’s chief executive officer, and also as a director of the company. Morgan acknowledged that this period has been “a time of unprecedented turmoil in the company’s 101-year history.” Monday’s “web-accessible press conference and conference call for the financial community and media” had been announced by SNC-Lavalin Sept. 24, to introduce Card, Duhaime’s replacement. Card and Morgan made brief presentations and then began answering questions from financial analysts and media. “Being the first hour on my job, I’m not prepared to answer questions about strategy,” Card said in response to the initial question posed by a financial analyst. SNC-Lavalin has more than 30,000 employees. “Our first task,” Morgan said, has been “to restore the confidence” of those on the firm’s payroll, “keeping them focused on delivering on our clients’ high expectations.” SNC-Lavalin operates projects in more than 100 nations. Leslie Quinton, an SNC-Lavalin spokesperson, was quoted in the La Presse story as not wishing to confirm or deny that $22.5 million of the questionable payments that surfaced earlier this year involved the superhospital contract. “We have not been contacted specifically about the subject of this investigation,” she was quoted as saying. We are not in a position to make any comments concerning investigations being conducted by authorities so as not to influence those investigations,” Quinton told the French-language newspaper. Responding early Monday to an inquiry by The Gazette, Quinton said via email that “we continue to collaborate with authorities on any and all investigations under way.”

SNC-Lavalin is a core player in the MUHC superhospital project. After a three-year process, in April 2010 the contract to build the complex near the Vendôme métro station was given to the Groupe Immobilier Santé McGill, headed by SNC-Lavalin and a U.K.-based firm called Inisfree Ltd. They, in turn, have hired a number of architectural firms and construction companies. SNC-Lavalin has been navigating troubled waters lately. In April, its Montreal head office was raided by the RCMP, at the request of Swiss police who had arrested Riadh Ben Aïssa, SNC-Lavalin’s former executive vice-president, on allegations of improper payments to agents in North Africa and ties to the Gadhafi family in Libya. Ben Aïssa abruptly left his senior company post last Feb. 9. The late-evening announcement added that Stéphane Roy, vice-president in charge of finance, administration and investor relations, “is also no longer with the company.” Through a public-relations agency, Ben Aïssa subsequently announced plans to sue SNC-Lavalin “to set the record straight and reestablish his reputation.” Duhaime took early retirement, after it was revealed he had allegedly approved the improper payments. His departure package was valued at $4.97 million. A filing with securities authorities stated that Duhaime “was relieved of his duties” as president and chief executive officer. The same filing suggested Duhaime was not formally terminated “for cause,” which would have triggered another set of payment agreements. On Feb. 28, SNC-Lavalin had announced what it called a “voluntary independent review” of the mystery payments.

At the same time as Duhaime’s departure was announced March 26, SNC-Lavalin announced that the review concluded its internal records rule “was not complied with.” The engineering giant referred to “the improper documentation of agency arrangements in respect of projects to which they did not relate, and concealment thereof,” as well as “incorrect entries relating to payments in the books and records of the company, and concealment thereof.” Regarding “transactions not disclosed,” the report on the review stated, agents for two projects labelled “Projects A and B” were “neither properly disclosed within the company, nor were they disclosed to its internal or external auditors until shortly before the independent review began.” The nature and location of what the review simply referred to as Projects A and B have not, to date, been publicly confirmed.

The interim CEO, Ian Bourne, had overseen “the implementation of the board’s remedial measures on ethics and governance,” Morgan said, “aimed at ensuring that this chapter of the company’s otherwise stellar … history is never repeated.” “All of the recommendations” of late last March “aimed at improving compliance and oversight are being implemented throughout the company,” Morgan added. Meanwhile, he said, “the ongoing response to further fallout from the current police investigations will continue to be the purview of the board (of directors) and its audit committee, leaving our new CEO to focus on leading our company forward.”

CORPORATE SCANDAL SNC-Lavalin CEO forced out as scandal over missing funds probed by Paul Waldie and Sean Silcoff, September 6, 2012, The Globe and Mail

An unfolding corporate scandal struck one of Canada’s most successful global enterprises Monday, claiming the chief executive of SNC-Lavalin Group Inc. and prompting the board of directors to call in police to find out what happened to $56-million in missing company funds. Pierre Duhaime, who ascended to the top rung of the $7-billion Montreal-based construction and engineering giant in 2009, left abruptly after an independent board committee determined that he overruled his own chief financial officer and approved payments to an agent whose identity and function remains a mystery.

Chairman Gwyn Morgan said the board can’t determine what happened to the missing cash but said it doesn’t believe the mystery payments were related to SNC’s controversial operations in Libya, where recently ousted SNC senior executive Riadh Ben Aissa – the central figure in the scandal – had a close relationship with the son of the country’s late dictator Moammar Gadhafi and helped steer several megaprojects for the company. Mr. Duhaime “made some errors,” said Mr. Morgan, who heads a blue chip board that includes Senator Hugh Segal and Canadian National Railway CEO Claude Mongeau. However, Mr. Morgan portrayed the CEO’s departure as a retirement. SNC director Ian Bourne will be interim CEO until a replacement is hired. Mr. Duhaime and Mr. Ben Aissa could not be reached for comment. SNC revealed an investigation into the payments in February after allegations about its work to protect the Gadhafi family that landed one of its hired consultants, Cynthia Vanier, in a Mexican jail. The board said Monday the missing money had gone to commercial agents SNC hired to help win two major construction contracts. SNC didn’t say where the projects were located but did indicate that some of the payments went through the company’s office in Tunisia. It is not uncommon for companies operating overseas to hire local agents to help win contracts and facilitate projects. However, their roles can become murky and some agents have been used to pay bribes. SNC is already under investigation by the RCMP over bribery allegations related to a $10-million contract it bid for in Bangladesh.

SNC said it requires its agents to adhere to all laws and company policies and that the questionable payments were isolated violations of procedures. But the company’s internal probe raised questions about how seriously its own senior leaders took those codes, and of the relationship between Mr. Duhaime and Mr. Ben Aissa. The two executives joined SNC in the late 1980s and rose up through the ranks, eventually winning appointments to its elite Office of the President. In 2009, Mr. Duhaime, who is from Quebec City, became CEO. Tunisian-born Mr. Ben Aissa ran SNC’s activities in Libya as well as the company’s construction operations worldwide. That year, according to the board, Mr. Ben Aissa approved a $30-million contract to an agent to help win a contract. The company alleged Monday that the agent’s arrangements were not properly documented, had nothing to do with the project and the identity of the agent couldn’t be verified. Mr. Duhaime learned about the contract in a meeting in 2010 along with chief financial officer, Gilles Laramée, according to the SNC-Lavalin report. The CFO objected to the payments, but Mr. Duhaime did not. A year later, Mr. Ben Aissa entered into another agent contract worth $33.5-million for a different project. Once again Mr. Laramée objected. Mr. Duhaime later authorized Mr. Ben Aissa to make the payments anyway – an action that “did not comply” with SNC’s code of ethics and business conduct, the board said. Mr. Morgan said he had no reason to believe the former CEO “overtly wanted” to breach the code, adding he should have sought approval from the board before approving the payments. “For various reasons he felt he was obligated to pay the bill. In hindsight we all regret that.” He instead blamed Mr. Ben Aissa, suggesting his division had hidden and improperly documented the payments, and that Mr. Ben Aissa, unlike the CEO, had not co-operated with the investigation. Mr. Ben Aissa has denied any wrongdoing and threatened to sue SNC over his departure. Another former executive from his division, Stephane Roy, was also dismissed last month. Mr. Morgan said the board is confident it has uncovered all unauthorized agent payments. He also said the fees paid by Mr. Ben Aissa were extraordinary and that on average SNC pays agents about $700,000 in total.

Federal Conservatives: Remember to Promise to Stand Up for Ontario Industry Strike Update by Society of Professional Engineers and Associates, August 22, 2012

When the federal government engaged in the secret, closed-door “fire sale” of the commercial division of Atomic Energy of Canada (AECL) to SNC-Lavalin, SPEA warned that the Ontario-based CANDU nuclear industry was at risk, along with the tens of thousands of supply-chain jobs associated with it. We questioned why the federal Conservative government was willing to subsidize the western based oil sector to the tune of billions of dollars while abandoning the Ontario-based, clean and efficient nuclear energy sector. We asked Ontario Conservative MPs to stand up for our province in what is clearly a Western-Canada dominated Conservative party. We were promised that the CANDU would not go the way of the Avro Arrow. Unfortunately, our most pessimistic predictions for the future of CANDU are coming true. The sale was announced in May of 2011 and closed in October 2011. Since the sale was announced more than 240 SPEA members (scientists, engineers, technicians and technologists) have fled the company. Approximately 180 did so as part of a voluntary termination programme, in which they received generous layoff packages paid for by Canadian taxpayers. Since the close of the sale, another 60 employees have fled; these were employees who had passed up the earlier opportunity to leave with a generous package. They didn’t like what they saw of SNC-Lavalin and moved to more enlightened employers in Ontario, across the country and overseas – in most cases for more generous compensation. SNC-Lavalin has hired replacements. Many of these are new graduates who will not be able to fill the role of those who have fled for many years and we fear may not be able to at all, without the mentorship of skilled, experienced staff. Relations between SNC-Lavalin and employees continue to disintegrate and the flight of expertise continues to accelerate. Engineers, scientists, technicians and technologists are now in their 7th week of a labour dispute. SNC-Lavalin seeks to extract concessions which we believe will lead to a further mass exodus of expertise and places the future of CANDU technology at risk. The loss of high tech jobs in this area is bad for this riding. The stakes are high for our province: More than 50% of our energy is generated by nuclear power. There is a real risk that the expertise required to properly maintain and prolong the life of these investments will be lost, at a huge cost to our province and a huge loss for Ontario taxpayers. Thirty-thousand high quality jobs are tied directly to the CANDU industry (supply chain jobs). If the CANDU goes the way of the Avro, these jobs will disappear. We don’t believe SNC-Lavalin cares about the future of CANDU technology. After all, the Canadian taxpayer actually paid SNC-Lavalin to “take” AECL’s commercial division. SNC-Lavalin paid a nominal $15 million, but has secured $75 million in funding in return (not to mention the money funded by the government for voluntary termination packages and discontinuation of certain liabilities). SNC-Lavalin has already made a tidy profit out of this deal with help from its Conservative Party friends.

The sale of AECL involved the transfer of nuclear technology to a private company. One would expect a high level of due diligence would be employed to ensure this technology was going into the right hands. What kind of due diligence was employed to ensure that SNC-Lavalin was a good corporate citizen who could be trusted with nuclear technology? Since the sale occurred in a shroud of secrecy behind closed doors we will never know for sure, but we can speculate in hindsight that there was not much scrutiny attached to this sale. Would you trust SNC-Lavalin with nuclear technology?

Here’s a sampling of SNC-Lavalin ethics in play:

• In the 1990s, SNC-Lavalin was involved in questionable hydro project in Kerala, India, which resulted in a $75 million loss for the state government of Kerala.

• Corruption allegations connected to the Padma Bridge Project in Bangladesh led to an RCMP raid at SNC-Lavalin’s Toronto offices in September of 2011. In April of 2012, the World Bank suspended the right of the SNC subsidiary involved in the Bangladesh project to bid on projects.

• A major growth area for SNC-Lavalin over the past decades appears based in developing relationships with corrupt dictators, in countries like Bangladesh, Tunisia and Libya.

• SNC-Lavalin’s CEO, Pierre Duhaime “resigned” and received $4.9 million dollars, for breaching the Code of Ethics and approving questionable payments in April 2012

• Two of SNC longstanding Executives appeared on Toronto Court in June on charges of corrupting foreign officials

Did the federal Conservative Party adequately scrutinize the sale? Perhaps the answer lies in SNC-Lavalin’s intimate ties with the Conservative party. The Chair of SNC-Lavalin’s Board of Directors, Gwyn Morgan, was a former fundraiser for Stephen Harper and is also on the Board of Conservative-based Manning Centre for Building Democracy. Fellow Board member Hugh D. Segal is a Conservative Senator. In 2009, 10 SNC-Lavalin Directors including Patrick Lamarre, along with their spouses, contributed $25,000 to Quebec Conservative candidates – money which ended up in the coffers of Conservative Party Quebec Lieutenant Christian Paradis. In turn, SNC-Lavalin has benefited from lucrative contracts with the Conservatives. In addition to its sweet deal for AECL, SNC-Lavalin was awarded the contract to maintain 320 federal buildings worth$5.9 billion dollars. An audit by PricewaterhouseCoopers found questionable financial practices in connection with that contract. It may not be too late to scrutinize this secret deal and ensure that SNC-Lavalin does not destroy a crucial Ontario industry. As a southern Ontario Conservative MP, we urge you to live up to your promise to ensure CANDU technology survives. If the safety of current nuclear generating stations does not worry you, if the pride of preserving made-in-Canada technology does not move you, perhaps the impact of your riding’s economy will motivate you to stand up for something better

World Bank Statement on Padma Bridge Press Release by the World Bank, June 29, 2012

The World Bank has credible evidence corroborated by a variety of sources which points to a high-level corruption conspiracy among Bangladeshi government officials, SNC Lavalin executives, and private individuals in connection with the Padma Multipurpose Bridge Project. … In Canada, where SNC Lavalin‘s headquarters are located, after executing numerous search warrants and a year-long investigation based on a referral from the World Bank, the Crown Prosecution Services brought corruption charges against two former SNC executives in connection with the Padma Bridge Project. Investigation and prosecution are ongoing but the court filings to date underscore the gravity of this case. … We proposed that when the first bids would be launched, the Bank and the co-financiers would decide to go ahead with project financing if they had determined, based on the Panel’s assessment, that a full and fair investigation was under way and progressing appropriately. In an effort to go the extra mile, we sent a high-level team to Dhaka to fully explain the Bank’s position and receive the Government’s response. The response has been unsatisfactory. The World Bank cannot, should not, and will not turn a blind eye to evidence of corruption. We have both an ethical obligation and a fiduciary responsibility to our shareholders and IDA donor countries. It is our responsibility to make sure IDA resources are used for their intended purposes and that we only finance a project when we have adequate assurances that we can do so in a clean and transparent way. In light of the inadequate response by the Government of Bangladesh, the World Bank has decided to cancel its $1.2 billion IDA credit in support of the Padma Multipurpose Bridge project, effective immediately.

SNC-Lavalin won’t name execs who OK’d $56M payouts by Dave Seglins and John Nicol, May 4, 2012, CBC News

SNC-Lavalin is refusing to identify which of its company executives signed off on $56 million in ‘improper payments’ under the direction of a former executive of the company’s construction division who was arrested in Switzerland last month. … An SNC-Lavalin spokesperson told CBC News that the payments were under the direction of Ben Aissa, but refused to identify the other company officials involved. Veritas Investment Research, based in Toronto, has been highly critical of SNC-Lavalin and in late April the company published a research report titled Skeletons In the Closet. It determined that, based on SNC’s own public statements, “as many as eight senior executives appear to have been involved in, or had some knowledge of, certain of the improper acts.” “Along with former members of management, we believe there is significant evidence that the CFO committed violations of SNC’s internal controls,” the April 26 report from Veritas states. SNC is disputing the Veritas report but won’t reveal who else knew about the mysterious financial activity. “The payments themselves were conducted and paid within the division and by the people that have been released,” SNC-Lavalin chair Gwyn Morgan told reporters Thursday at the company’s annual general meeting in Toronto. “The problem is where it went,” Morgan said, conceding he remains concerned what else police might find about where the money wound up. … Morgan told investors that tighter controls are now in place but would not discuss specifics, citing the fact the company has handed to the RCMP all of its findings around the $56 million in mysterious payments.

Former SNC-Lavalin exec accused of funneling cash to Gadhafis by Dave Seglins and John Nicol, May 2, 2012, CBC News

An angry insider at engineering giant SNC-Lavalin has accused the company’s former head of construction, Riadh Ben Aissa, of secretly funneling money to members of Libya’s Gadhafi family, according to a “poison pen” email obtained by CBC News. “Since the early 1990s Ben Aissa has organized more than 300 million [dollars in] payments to shell companies acting as intermediaries between SNC-Lavalin and the Libyan government (ie the Gaddafi family),” the anonymous insider wrote in the email, which was sent to the company’s executives and board of directors in December. The message called on them to show “courage and ethics” to fix internal problems within the company, urging them to “move your ass!” Ben Aissa was forced to resign from SNC-Lavalin two months later in February, along with his VP controller Stéphane Roy, amid company audits which have since found Ben Aissa was involved in$56 million of improper paymentsto undisclosed agents, according to the company. On Sunday, CBC/Radio-Canada and Swiss public broadcaster RTS revealed authorities in Switzerlandrecently arrested Ben Aissa and are detaining him on accusations of fraud, corrupting a public official and money laundering tied to dealings in North Africa. Swiss justice official Jeannette Balmer refused to discuss any other details. CBC has no proof of the substance of the allegations contained in the “poison pen” email, nor any evidence it relates in any way to the allegations Ben Aissa now faces in Switzerland. Ben Aissa is also the executive who hired Cyndy Vanier, the Canadian consultant who is sitting in a Mexican jail. She is accused of plotting to smuggle Saadi Gadhafi — who had a long history of directing billions of dollars in construction projects to Ben Aissa – out of Libya last fall. Vanier maintains Ben Aissa hired her to oversee the chartering of airplanes for SNC-Lavalin, and to advise on an “employee reintegration plan” to be implemented when the Libya conflict subsided. Ben Aissa’s Canadian lawyer Michael Edelson refused to discuss the letter, Vanier’s plight or his client’s current status in Switzerland when reached Tuesday by CBC News.

What is clear is that that the December email — amid media reports of Vanier’s arrest — sparked a cascade of internal company audits, revelations of missing millions and three high-profile resignations within the company, including that of Ben Aissa prior to his arrest. SNC-Lavalin’s share price has plummeted over the past year from a high of $59.97 in June to $38.52 at close on May 1, a trend that’s prompted a group of shareholders to launch a class-action lawsuit over governance of the company.

…

The anonymous email was sent to SNC-Lavalin’s executives, as well as to board members including chair Gwyn Morgan, Hugh Segal, Pierre Lessard and Claude Mongeau. It was also sent to billionaire investor Stephen Jarislowsky, who is the company’s largest shareholder with 14 per cent of its stock. “The Office of the President, Vice-President and Board of Directors are all aware of the long association between Kadhafi and Ben Aissa,” the email says.

“They have all benefited financially from this association as recipients of bonuses, stock options, dividends, directors’ fees etc., during the golden years of juicy profits from Libya. The question is whether the Council and the Office of the President is so afraid of the consequences of correcting this situation they will continue to risk everything.”

The person who wrote the email said they sent it in the hope that the board “will have the courage and ethics to share the truth of this crisis with their families — you know what is right action and moral … move your ass!”

SNC-Lavalin wins Alberta contract as corruption scandal deepens by Lynn Moore , May 1, 2012, Postmedia News, Financial Post

SNC-Lavalin Group Inc. has been awarded a contract by AltaLink LP for work on portions of transmission infrastructure projects in Alberta, the Montreal-based engineering giant said Tuesday. The contract — estimated by an industry analyst to be worth about $1.6 billion — comes as SNC-Lavalin tries to shake off scandals that have depressed its stock price as well as its staff. In announcing the contract, the company took pains to point out that it was awarded “following an open and competitive process” overseen by an independent fairness adviser. “We are proud to have successfully competed for this new contract and we are pleased to have been able to demonstrate value for money through our proposal,” Patrick Lamarre, SNC-Lavalin executive vice-president, said in a statement. “This further demonstrates that we have a competitive value proposition for all of our transmission and distribution clients and further strengthens our track record of delivery.” The contract is to deliver engineering, procurement and construction for transmission lines and substations based on project need assessments and permitting. SNC’s contract constitutes the lion’s share of the anticipated development that AltaLink is planning for the next five years, Desjardins Securities analyst Pierre Lacroix said. He estimated the SNC portion of the work to be worth about $1.6-billion of the $2-billion development. “We believe this contract win is a significant development for SNC,” Lacroix said in a note to clients. “This contract, combined with recent wins (total value of $1.5 billion to $2 billion), should offset, to a reasonable degree, investors’ concerns about SNC’s ability to win new business following recent internal issues.”

…

An internal investigation recently ordered by the company’s board of directors found $56-million worth of missing payments at its construction unit. Three executives, including CEO Pierre Duhamine and executive vice-president Riadh Ben Aissa, were dismissed or departed the company.

A brief history of SNC-Lavalin, One of the world’s largest construction and engineering firms under scrutiny by CBC News, April 30, 2012

SNC-Lavalin CEO Pierre Duhaime stepped down in March due to a breach of the company’s code of ethics. One of the world’s largest construction firms, Montreal-based SNC-Lavalin, was formed in 1991 as a result of the merger of Surveyer, Nenniger & Chenevert Consulting Engineers and Quebec City-based Lavalin. The company instantly became one of the five largest engineering firms in the world. It has grown to become an international powerhouse with 28,000 employees worldwide and operations in more than 100 countries.

Among the iconic projects the company has spearheaded in recent years are the Hibernia offshore oil platform, the 407 toll highway north of Toronto, extensions to Montreal’s subway system, light-rail transit systems in Calgary and Vancouver, and the new fixed roof on Montreal’s Olympic stadium. Its two original firms were also instrumental in the construction of Quebec’s massive James Bay hydro project, beginning in the 1970s. A subsidiary, SNC-Lavalin ProFac, is “a well recognized leader in the provision of real property management,” according to the the federal government and manages many of its buildings. The company also manages the main offices of the CBC across Canada. In 2011, the company bought the reactor division of the federally owned Atomic Energy of Canada Ltd. for $15 million. The federal government is also providing SNC up to $75 million to complete development of a new reactor, Enhanced Candu 6.

SNC-Lavalin has been in the news recently regarding corruption allegations in Bangladesh and Libya after results of an internal investigation showing $56 million in mysterious payments became public in March 2012.

The allegations are that SNC made a series of unauthorized payments to undisclosed agents connected to the company’s operations in Libya. Those operations include what the company calls, “the largest civil engineering project ever-conceived,” a 4,000-kilometre pipeline to bring water from underground aquifers in the southern desert to Libyan cities in the north.

In September, RCMP raided SNC-Lavalin’s offices near Toronto in connection with a corruption probe into the Padma bridge project in Bangladesh. The World Bank’s anti-graft unit had provided information to the RCMP. The next month, the World Bank suspended a $1.2 billion loan it had offered to Bangladesh for the project. Then in April, the World Bank temporarily banned an SNC-Lavalin subsidiary from bidding on new bank contracts. SNC-Lavalin was to supervise the contractor for the bridge on behalf of the Bangladesh government. The company’s name had also surfaced in connection with Canadian consultant Cyndy Vanier, who is accused of masterminding a plot to smuggle members of Libya’s Gadhafi family into Mexico. Vanier has been in jail in Mexico since October 2011. No executives or SNC-Lavalin employees have been charged, but Stéphane Roy, then a vice-president of finance for SNC-Lavalin, was detained and released by Mexican police in November. In March, SNC-Lavalin chief executive Pierre Duhaime resigned under the weight of the allegations. Duhaime has not been charged with any crime, but the company said his signing off on payments to undisclosed agents was a breach of the company’s code of ethics.

In mid-April, Riadh Ben Aïssa, the former SNC-Lavalin vice-president of global construction, was arrested in Switzerland and taken into custodyon fraud and money-laundering allegations. In a statement on its website, SNC-Lavalin reiterated that Aïssa left the company on Feb. 9. “SNC-Lavalin is doing its utmost and has offered its complete co-operation to the authorities in order to obtain the answers required about situations concerning ex-employees as expeditiously as possible,” SNC-Lavalin said in a statement on the company’s website. “We reconfirm that we voluntarily and proactively turned the results of our internal investigation over to the authorities.” The RCMP had searched SNC-Lavalin’s headquarters on April 13 in connection with the Swiss investigation.

Ben Aïssa, known for his intimate ties to two of Gadhafi’s sons, oversaw a project that hired Edis Zagorac, the husband of Canada’s ambassador to Libya, Sandra McCardell. The project, a military-civilian engineering unit SNC-Lavalin created with the Gadhafi government, also hired Canada’s former ambassador to Tunisia, Bruno Picard. It’s initial project was to build a $271 million prison in the north African country. In January, Foreign Affairs Minister John Baird requested a review into a potential conflict of interest concerning Zagorac’s hiring. McCardell was reassigned in March. On April 20, Standard and Poor’s revised its outlook for SNC-Lavalin to negative because of the news about the company. On April 30, the company’s share price closed at $37.14. Although up for the day, the shares are down 38 per cent from their 52-week high on July 5, 2011.

SNC-Lavalin: dysfunctional, amoral, and open for business in Canada by La politica, April 28, 2012

Corporations tend to be craven entities. Why? Because they are financially rewarded for being disloyal to those who do not serve their interests, no matter who those people might be. There is no better example of this than the Canadian engineering giant, SNC-Lavalin, which has repeatedly engaged in suspect activity for its own financial gain. When it gets caught, it cuts loose people who, up until they landed in hot water, were considered stand-up folks doing good work for the company. Below is a list of some of the troubles that the firm has faced, followed by an analysis of a few of the company’s issues, and, finally, an accounting of how good business has been in Canada recently.

1990s. SNC-Lavalin, with funding assistance from Export Development Canada (EDC) and the Canadian International Development Agency (CIDA), lands a big hydro deal in India. Investigators find that SNC-Lavalin’s lack of professional oversight and financial mismanagement results in a financial loss of about 375 core, or $75 million, to the state of Kerala.

2011: September. The RCMP raids SNC-Lavalin’s offices in Toronto as part of an investigation into corruption at the Padma Bridge project in Bangladesh.

2011. November. SNC-Lavalin contractor Cynthia Vanier is arrested in Mexico City, accused of leading a plot to smuggle Saadi Gaddafi to Mexico. Saadi, the third son to fallen Libyan dictator Muammar Gaddafi, was the point person for hundreds of millions of dollars of SNC-Lavalin business in Libya.

2011. November. The day after Ms. Vanier’s arrest, SNC-Lavalin executive Stephane Roy, a financial controller who hired Ms. Vanier, is briefly detained by police in Mexico City.

2012: February. Stephane Roy and his boss, executive vice-president Riadh Ben Aissa, resign or are let go, depending on who is lying. In a statement, SNC-Lavalin vaguely asserts that “all employees must comply with our Code of Ethics and Business Conduct”. Stephane Roy goes dark, and Ben Aissa, in an impressive display of moral outrage, threatens legal action, (though that may now be more difficult, given that as of mid-April has been in a Swiss jail cell).

2012: April. The World Bank, the world’s largest development organization, sets its sights on the SNC-Lavalin subsidiary connected to the Bangladeshi job, and suspends its right to bid on projects.

2012: April. SNC-Lavalin CEO Pierre Duhaime resigns after an “internal investigation” determined he had signed off on unauthorized payments. To date, those payments total $56 million, and appear to be related to Riadh Ben Aissa’s habit of playing fast and loose with contracts in North Africa. As a reward for steering the Titanic into the iceberg, Mr. Duhaime is given a $4.9 million kiss-off.

2012: April. The RCMP raids SNC-Lavalin’s headquarters in Montreal – twice.

2012: April. The Globe & Mail reveals close ties between the Ben Aissa family and SNC-Lavalin’s business in Tunisia, including the use of family property and the hiring of a Philadelphia-based firm Ramla Benaissa Architects, which is owned by Mr. Ben Aissa’s sister. The firm was hired by SNC to plan a $275-million prison and also to rehabilitate lakes in the city of Benghazi, in eastern Libya.

2012: April. The northern Chicago suburb of Peotone, Illinois, remains embroiled in controversy regarding the awarding of a contract for the construction of a new airport to SNC-Lavalin. Governor Quinn and Congressman Jesse Jackson support the project, but continue to be dogged by questions about how the construction would be funded. Jackson has said that the $700 million project would be privately-funded by SNC-Lavalin, and has claimed that funding would be backed by the Canadian government. The government of Canada has denied this.

2012: April. SNC-Lavalin persists in saying that Ms. Vanier was not legally contracted to the company, because the executives who employed here were acting outside of the company’s code of ethics. Morally suspect, and on a weak footing legally, SNC-Lavalin continues to strum the same tune while arguing that it is changing how it does business.

2012: April. Riadh Ben Aissa is arrested in Switzerland and held on accusations of corrupting a public official, fraud and money laundering tied to his dealings in North Africa.

Canada is SNC-Lavalin’s back yard

Now, given that rather frightening accounting of human and corporate folly, you’d think that people would be a little gun-shy on the home front. Three RCMP raids. Three executives let go. Tens of millions of dollars in wayward cash, possibly lost to bribes. Getting shut out by the World Bank. This is Canada, after all, and SNC-Lavalin is a Canadian corporation. We do things right here. Canada ranks #10 as one of the “least corrupt” countries in the world. But Libya, unfortunately, ranks #168 (a pre-revolutionary number, when the murderous Gaddafi regime was doling out cash to SNC-Lavalin and its friends). Tunisia, which was ruled by the horribly corrupt President Ben Ali, was ranked at #73, though it is worth remembering that it was here that street vendor Mohamed Bouazizi lit himself on fire and ignited the Arab Spring. India, where SNC-Lavalin got nailed in the 1990s, ranks a pathetic #95. Bangladesh, where SNC-Lavalin is now shut out from bidding due to the Padma Bridge project, ranks even worse, at #120. That long and rather depressing list is intended to suggest that SNC-Lavalin may be able to peddle for cover abroad, but not on the home front.

After all, the fact that Gwyn Morgan, Chairman of the Board of SNC-Lavalin, is a long-time friend of Stephen Harper’s, surely has little effect on how both SNC-Lavalin and the Harper government have hung Cynthia Vanier out to dry. Mr. Morgan is a Conservative party supporter and former fundraiser for the Conservative Party of Canada. In 2006 Stephen Harper unsuccessfully attempted to appoint Morgan as chair of a new public appointment commission. Opposition MPs objected, and Mr. Morgan was rejected, largely due to his close ties to the Conservative Party. Also on SNC’s list of board of directors is Honourable Hugh D. Segal, a conservative who moonlights as a senator in Ottawa, and who is seen by many as responsible for improving Mr. Harper’s image to make him more “electable”.

These and other board members were asleep at the wheel as former SNC-Lavalin CEO Duhaime overrode his own CFO and authorized $56 million of questionable payments to undisclosed agents, and as Mr. Roy, authorized by Mr. Ben Aissa, financed Ms. Vanier’s work in Libya. Duhaime – they loved him in the good times

That same board is still actively distancing itself from Ms. Vanier. This is a feeble position that only confirms SNC-Lavalin’s continued reluctance to assume any ethical responsibility for its actions. That may not last for long. The Ontario Securities Commission (OSC) recently published a Staff Notice, the result of almost a year’s work that outlines its concern related to Canadian companies active in emerging markets. That notice spoke directly to the corporate governance practices of boards. Specifically, it asked for more transparency for underwriters, better controls on foreign auditors, and enhanced disclosure of risk factors. These actions need to be understood in the context of new corporate regulations such as the UK Bribery Act and the SEC Whistle-Blower Rule, as well as last year’s watershed enforcement of Canada’s bribery statute. In that case, Niko Resources pleaded guilty under the Corruption of Foreign Public Officials Act in June, 2011, for bribing Bangladesh’s energy minister. Niko was fined C$9.5 million.

Specific to SNC-Lavalin, there could be more leaks to come with regard to fraud and bribery. These actions are rarely secret; almost always, employees other than the principal actors are aware. The problem, of course, is that there is little incentive to speak out, particularly when a lot of money is on the line.

The RCMP may have more work to do

In time, too, we will learn more about the company’s relationship with Ms. Vanier, who was paid $100,000, billed another $395,500, and had a retainer account of about $1 million with funds from SNC-Lavalin. If Ms. Vanier had no legal relationship with SNC-Lavalin, then one expects they would be charging her company, Vanier Consulting, with fraud. Odd, that hasn’t happened yet.

Incredibly, SNC-Lavalin’s behaviour has had little to no effect on its business in Canada. In fact, the company has been on a roll of late –

Some highlights:

2012: March. SNC-Lavalin is awarded the project management, engineering, procurement and construction management contract for Vale’s $2-billion Clean AER project in Sudbury.

2012: March. SNC-Lavalin, with its partner, the European-based construction group Cintra Infrastructures, lands a $1 billion contract to build and maintain Phase I of the eastern extension of the Highway 407 toll road from Pickering to Oshawa.

2012: March. As part of a joint venture with Aecon Industrial, SNC-Lavalin is given a major contract by Ontario Power Generation (OPG) to carry out the Definition Phase for the Darlington Retube and Feeder Replacement (RFR) Project. The total value of the Definition Phase is estimated at over $600 million.

2012: April. The Honourable Peter MacKay, Minister of National Defence, announces a contract award for 2.5 million to a joint venture between SNC-Lavalin and Aecon Atlantic Group for the design of a new accommodation tower and dining and messing facilities at Canadian Forces Base Halifax.

2012: May. SNC-Lavalin is awarded a contract by AltaLink LP for work on portions of transmission infrastructure projects in Alberta. Industry analysts estimate the contract to be worth about $1.6 billion

As one loyal La politica reader emailed us to say: “Is there not an honest engineering company out there our government could start sleeping with?”

Apparently not.

La politica is researching for a book on SNC-Lavalin.

SNC-LAVALIN GROUP INC. MANAGEMENT PROXY CIRCULAR and Notice of Annual Meeting of Shareholders March 26, 2012

The Hon. Hugh D. Segal, C.M., an independent Director who has served as a Director of the Corporation since August 6, 1999, will not be standing for re-election at the Meeting. In the 12 months ended December 31, 2011, Mr. Segal attended 6 of 8 Board meetings, 4 of 5 HR Committee meetings and 4 of 4 HS&E Committee meetings. … Mr. Hugh D. Segal chaired the compensation committee of a Canadian public company for more than 7 years. He currently sits on the Management Resources Committee of Sun Life Financial Inc. and on the Compensation, Human Resources, Health, Safety and Environmental Committee of Just Energy Group Inc. He is also a former member of the Compensation Committee of Holcim Canada Inc., Gulskin Sheff & Associates Inc. and CPI Plastics

Group.

…

2011 Global Issues and Acquisition, Strategies: India Australia Brazil (Consultants) Libya S.E. Asia

Gwyn Morgan

Ian A. Bourne

Pierre Duhaime

David Goldman

Patricia A. Hammick

Pierre H. Lessard

Edythe A. Marcoux

Lorna R. Marsden

Claude Mongeau

Hon. Hugh D. Segal

Lawrence N. Stevenson

Mexico formally arrests Canadian in alleged Gadhafi plot, Cyndy Vanier accused of attempted human trafficking, other offences by Dave Seglins, February 1, 2012, CBC News

Officials in Mexico say they have formally arrested Canadian Cyndy Vanier and three co-accused who have been held for months in jail on suspicion of plotting to smuggle members of Libya’s Gadhafi family to Mexico. Vanier is accused of a list of offences including attempted human trafficking, involvement in organized crime and falsification of documents. Guillermo Fonseca, a representative from Mexico’s prosecutor’s office based in Washington, D.C., told CBC News Vanier’s arrest is akin to being formally charged. A judge must review the file to decide whether the case should proceed to trial over the next few days, he said. Officials in Mexico announced more details about their probe Wednesday, saying it tied into an earlier investigation, announced in May 2009, into the theft of thousands of blank Mexican passport books. Vanier has been detained in Mexico since November. Officials said Vanier and her co-accused — Mexican citizens Gabriela Davila Huerta and Jose Luis Kennedy Prieto, as well as Pierre Christian Flensborg of Denmark — were involved in renting planes and travelling to Libya in July 2011 to extract Saadi Gadhafi, one of the sons of former Libyan dictator Moammar Gadhafi. … Vanier, a mediator from Mount Forest, Ont., has denied any involvement in a plot. She said she travelled to Mexico City in early November for business meetings to introduce a client (CBC News has confirmed it was a representative from SNC-Lavalin) to contacts in Mexico about potential water-purification projects. She said she travelled to Libya on a fact-finding mission in July to report on civilian deaths during the conflict, an effort paid for by Canadian engineering firm SNC Lavalin to determine the security situation on the ground. But Gary Peters, a private bodyguard who worked for the Gadhafi family for years, and was hired by Vanier to provide security during her mission to Libya, told CBC News that Vanier consulted on a plan to move Saadi Gadhafi and members of his family to Mexico. Peters said he was involved in viewing properties in Mexico and examining potential transfer plans, but the entire effort was abandoned in June when it was deemed to be illegal, given the UN-imposed ban on Gadhafi’s travel and the freezing of his assets.

Ottawa basically paying SNC to take AECL by Greg Weston, June 29, 2011, CBC News

The federal government’s long-awaited deal to sell off its money-losing nuclear reactor business is more like a perpetual partnership than a sale, leaving Canadian taxpayers stuck with the fiscal fall-out for years to come. The government-owned Atomic Energy of Canada Ltd. has announced it has finally reached a tentative deal to sell its commercial reactor development and repair division to Quebec-based engineering giant SNC-Lavalin. The Montreal-based company was the only suitor in the world left at the negotiating table, a fact that helps to explain why the government is effectively paying SNC-Lavalin to take over the Crown corporation. Under the deal, SNC will pay a paltry $15 million for AECL’s nuclear reactor division, plus some as yet undisclosed “royalties” on future reactor sales. In return, the government will give SNC up to $75 million toward the development of the next generation of AECL’s once internationally successful Candu reactors. In other words, Canadian taxpayers are giving the Quebec company $60 million to take AECL off their hands. … Most of AECL’s massive past liabilities and a lot of the financial risks going forward will remain exactly where they have always been — on taxpayers. For instance, SNC-Lavalin will complete the current refurbishments of four reactor projects, but only “through subcontract service agreements with the government of Canada.” Translation: SNC-Lavalin will get paid for doing the work, but taxpayers will likely be on the hook for massive cost overruns and potential lawsuits that could run into the billions of dollars. … SNC-Lavalin says it will be keeping about 1,200 of the roughly 2,000 employees currently working in AECL’s reactor division. Unless there is fine print in the deal we haven’t seen, that means taxpayers will also be stuck with the onerous costs of giving golden handshakes to 800 scientists, engineers and other relatively high-priced AECL employees, not to mention the potentially staggering expense of transferring 1,200 public service pensions to SNC-Lavalin. Perhaps the biggest ongoing cost to Canadians is what’s being left out of the AECL deal – namely, the Chalk River research division that produces isotopes for medical scans and treatments. The deal splits off Chalk River from the AECL reactor division that SNC-Lavalin is buying. Over the past two years, the government has given AECL more than $170 million in special funding for the Chalk River research reactor and other facilities that produce nuclear isotopes for medical scans. Meanwhile, AECL spent years and hundreds of millions of dollars at Chalk River building two new isotope reactors that don’t work and likely never will. Making matters worse, AECL’s commercial partner in that snafu, MDS Nordion, is now suing the federal agency for $1.6 billion in damages.

AECL sold for $15M to SNC-Lavalin by CBC News with files from The Canadian Press, June 29, 2011

Joe Oliver, the minister of natural resources, said at a news conference in Toronto that the Crown corporation’s Candu reactor business has been sold to engineering giant SNC-Lavalin Group of Montreal, ending a process that has been in the works since 2009. … The union for AECL workers condemned the sale, saying the deal will result in a “hollowed out company” and might cost thousands more jobs among the corporation’s suppliers. “It may contribute to a brain drain not seen since the Avro Arrow as engineers, scientists and others evaluate their long-term careers with the company,” Michael Ivanco, vice-president of the Society of Professional Engineers and Associates, said in a release. … “We are shocked and angry that the Harper government conducted this sale behind closed doors without any input from the Canadian public or Parliament,” Ivanco said. “They jammed legislation through the budget that gave cabinet the right to make decisions instead of Parliament, and now we see the results.” … The federal New Democratic Party critic, Nathan Cullen, and Green Party Leader Elizabeth May both said the price was too low. Each used “firesale” to describe the deal. … The announcement coincided with what turned into a lengthy shutdown of the company’s research reactor at Chalk River, Ont., which caused a worldwide shortage of the medical isotopes used to detect cancer and heart ailments. An earlier shutdown in late 2007 also strained the global isotope supply and ended only after Parliament voted to bypass the nuclear safety regulator’s closure order.

Questions over accounting cloud SNC earnings by David Milstead, March 28, 2011, Updated September 10, 2012, The Globe and Mail

SNC-Lavalin Inc. has a lucrative, growing relationship that will add millions to its sales and profits – and yet, not a dime of new cash will flow into the company. Indeed, it seems impossible – until you learn more about how the Montreal-based construction giant accounts for sales to AltaLink, an Alberta electric company. SNC-Lavalin owns 76.9 per cent of Calgary-based AltaLink and is in the process of buying the remaining chunk from Macquarie Essential Assets Partnership. In a statement, SNC chief financial officer Gilles Laramée calls AltaLink “a core investment” for his company. It is also an important customer, as SNC sells construction services to AltaLink. Typically, under Canadian generally accepted accounting principles, companies cannot book revenue and profits from sales to their own subsidiaries. But, says Michael Yerashotis of Veritas Investment Research, there’s an exception for transactions with rate-regulated subsidiaries like AltaLink.

It’s easy to understand why the rule and the exception exist. A company that makes sales to another company it controls can monkey with prices and other elements of the transaction, potentially inflating its results. But if the subsidiary has an independent regulator overseeing its economic activities, there’s much less potential for abuse. However, international financial reporting standards typically bar recognition of intracompany sales and profits and make no specific exemption for sales to rate-regulated subsidiaries, Mr. Yerashotis notes. And SNC, like all Canadian public companies, moved to those accounting rules as of Jan. 1 of this year. Yet the company says it will continue to book revenue and profits from its sales to AltaLink even as it becomes a 100-per-cent-owned subsidiary, presumably later this year. Mr. Yerashotis, who examined the relationship in a recent research report, stops short of alleging that SNC is about to violate accounting standards. But he does say his firm is “unsure what the specific rationale would be” for continuing the accounting policy under the new rules.

How big a deal is this, anyway? Well, it would help if SNC disclosed the sales and profits it derives from its AltaLink relationship, but it does not. A spokeswoman for SNC declined to comment on the matter. Mr. Yerashotis, however, has done some digging of his own, going to AltaLink’s filings with Alberta’s regulators, which contain historical data and future forecasts of purchases of construction services, which have typically been provided to AltaLink by SNC. The numbers are not insignificant now and become even more important in coming years, as AltaLink is telling Alberta regulators it intends to boost spending. In 2010, SNC reported $6.31-billion in revenue and $437-million in profit; Mr. Yerashotis estimates $263-million in sales and $36-million in profit came from AltaLink. In 2011, however, those numbers are forecast to rise to $840-million in sales and $116-million in profit to SNC-Lavalin from AltaLink; by 2013, they rise to $1.83-billion in revenue and $254-million in profit.

To be clear: If the forecasts from AltaLink’s regulatory filings materialize, the utility will provide a 2013 profit to SNC that’s more than half the company’s current bottom line. Mr. Yerashotis notes that on SNC’s fourth-quarter earnings call, management gave guidance of flat-to-declining profit in its engineering and construction (E&C) business segment for 2011. “Given AltaLink’s projected increase in required services from SNC, flat-to-declining 2011 E&C income would imply a potentially significant decrease in income from third-party E&C contracts.” “Going forward,” he adds, “we advise investors to view any reported operating income growth within SNC’s bread-and-butter E&C business with skepticism, as a great deal of reported growth may be derived from intercompany profits with AltaLink.” Mr. Yerashotis says irrespective of SNC-Lavalin’s plans to report growing revenue and profits, “it is our view that SNC’s transactions with AltaLink amount to little more than moving cash from one pocket to another.” Unfortunately, there will be another movement of cash: From the pockets of unaware buyers of SNC-Lavalin’s stock to the sellers who understand that some of the company’s profits are illusory.

G20 fence costs $9.4M, nearly double original estimate by Lauren O’Neil, July 07, 2010, The Toronto Star

The almost 10 kilometres of fencing erected around the downtown G20 security zone cost $9.4 million, nearly double the original estimate, a federal spokeswoman says. SNC Lavalin Inc, the engineering and construction group which supplied the fence, had originally valued the contract at $5.4 million, said Public Works spokeswoman Natalie Pennefather. But as the summit drew near and the security plan was more precisely developed, the RCMP determined that a number of changes were required, Pennefather said. … The 8 kilometres of high-security fence and 1.7 kilometres of additional fencing have now been dismantled, and the project will be completed by Friday, said Pennefather. City staff have been reinstalling street furniture and transit shelters. [Emphasis added]

Refer also to:

Eminently Unsuitable Nikiforuk on Gwyn Morgan

SNC-Lavalin hit with $1.65 billion class-action lawsuit

Class action proposed against SNC-Lavalin

SNC Lavalin Board of Directors SNC Lavalin

Gwyn Morgan, C.M. Chairman of the Board, Company Director

Gwyn Morgan CM Chairman and Chairman of Governance Committee

SNC-Lavalin Group Inc. Bloomberg Businessweek

Mr. Gwyn Morgan, CM founded EnCana Corporation and served as its President and Chief Executive Officer from April 2002 to December 31, 2005

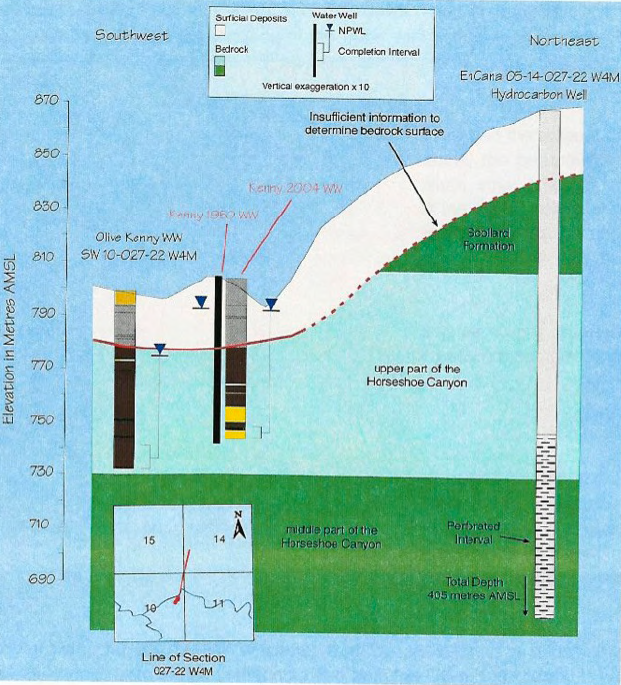

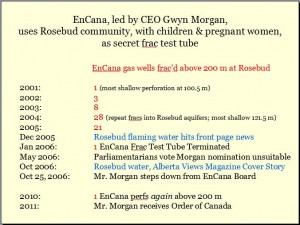

EnCana’s Multiple Shallow Fracs into Fresh Water Aquifers at Rosebud, Alberta, March 2004. Source: EnCana Corporation Site Investigation Report by Hydrogeological Consultants Ltd. File No.: 04-510, January 2005

Slide from presentation “There’s a hole in their story” by Jessica Ernst at University of Lethbridge, November 4, 2011